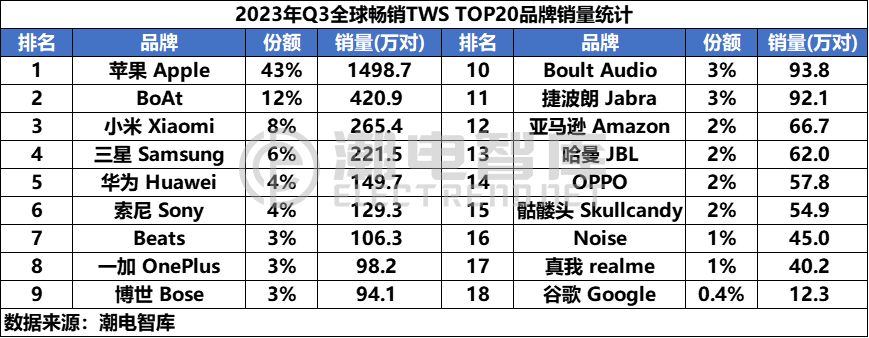

Market Landscape of Top 20 Brands

In Q3 2023, the global TWS market recorded a total shipment of 35.089 million units, with 18 brands making the list. Apple dominated with shipments of 14.987 million units, securing a 43% market share. BoAt, an Indian brand, stood at second place with a 12% market share. Other manufacturers didn't reach the 10% mark, indicating ongoing restructuring within the TWS headphone market.

Top 20 Best-Selling Models Above $150

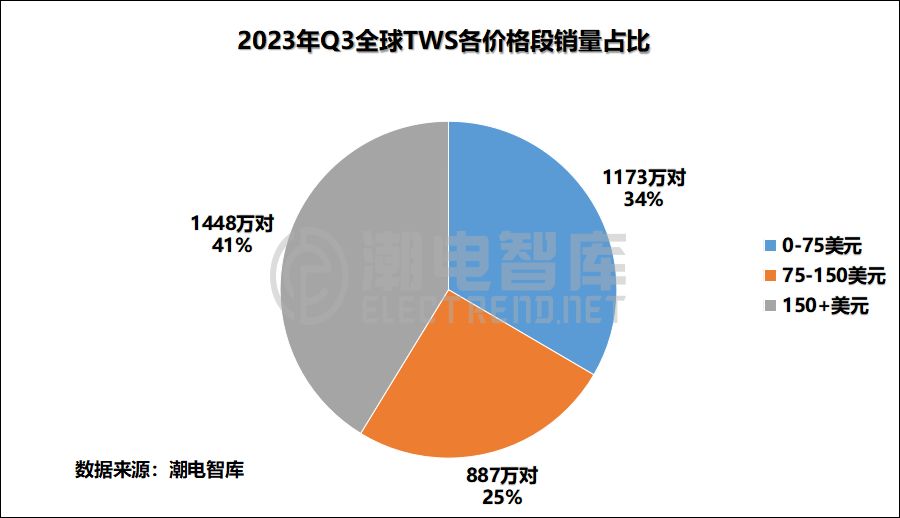

The top-selling TWS models priced above $150 in Q3 2023 totaled shipments of 14.483 million pairs, involving 8 brands. Apple dominated with two models, capturing 70% of the market share. AirPods Pro 2 alone accounted for 7.609 million pairs sold. Following closely were Samsung, BOSE, and Sony, each holding an average share of 6%. Google ranked lowest among the brands. In the high-end TWS market, Chinese brands were in an exceptionally weak position.

Top 20 Best-Selling Models Between $75 and $149

The global best-selling TWS models priced between $75 and $149 in Q3 2023 totaled shipments of 8.877 million pairs, involving 9 brands. Apple's AirPods 2 led this price range, surpassing all models. JBL had the highest number of models in this price segment, with a total of 5 models.

Top 20 Best-Selling Models Below $75

The best-selling TWS models priced below $75 globally in Q3 2023 totaled shipments of 11.73 million pairs, dominated by BoAt and Xiaomi. Ten brands made the list, with BoAt featuring 6 models and Xiaomi 4. BoAt emerged as the best-performing brand in this price range, with 4.208 million pairs sold, capturing a share of 35.9%. The most popular TWS model was BoAt Airdopes 131."

-

Top 10 Global Smart Ring Brands by 2023 Jan 10, 2024

-

Top 25 Global TWS ODM/OEM by 2022 Aug 31, 2022