Global Best Selling Smartwatches Market Analysis Briefing Q3 2023

Time: Dec 11, 2023Views:

Q3 2023 Global Best-selling Smartwatch Market Analysis Briefing by Chaodian Intelligence is based on the sales data of the TOP 20 best-selling smartwatch models in the past 6 quarters. The market is briefly analyzed in four dimensions: region, price segment, brand share, and model performance, to provide a fresh perspective on the most active, vibrant, and certainly profitable forces in the global smartwatch market.

Note: Chaodian Think Tank divides the global smartwatches into three price segments according to the product pricing of $150, and then takes the TOP 20 best-selling models in each price segment, and takes their (20X3=60 models) sales as the research basis of this report.

Global Smartwatch Market Trends

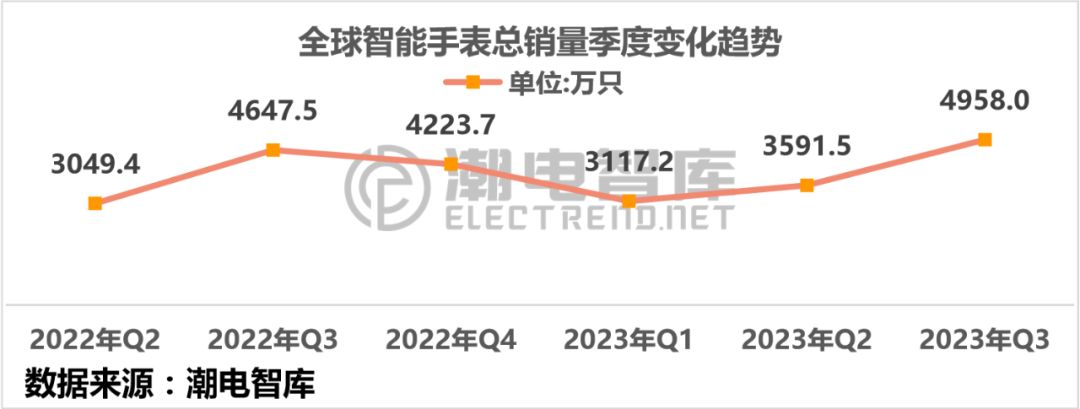

Q3 global smartwatch market realized double growth in the same ring ratio, reaching the highest value in the last six quarters.

According to Chaodian Intelligence, Q3 2023 global smartwatch shipments totaled 49.580 million units, rising for three consecutive quarters, bringing shipments close to 50 million units, up 38.0% YoY. And from the more informative year-on-year data, smartwatches grew 6.7% year-on-year in Q3 .

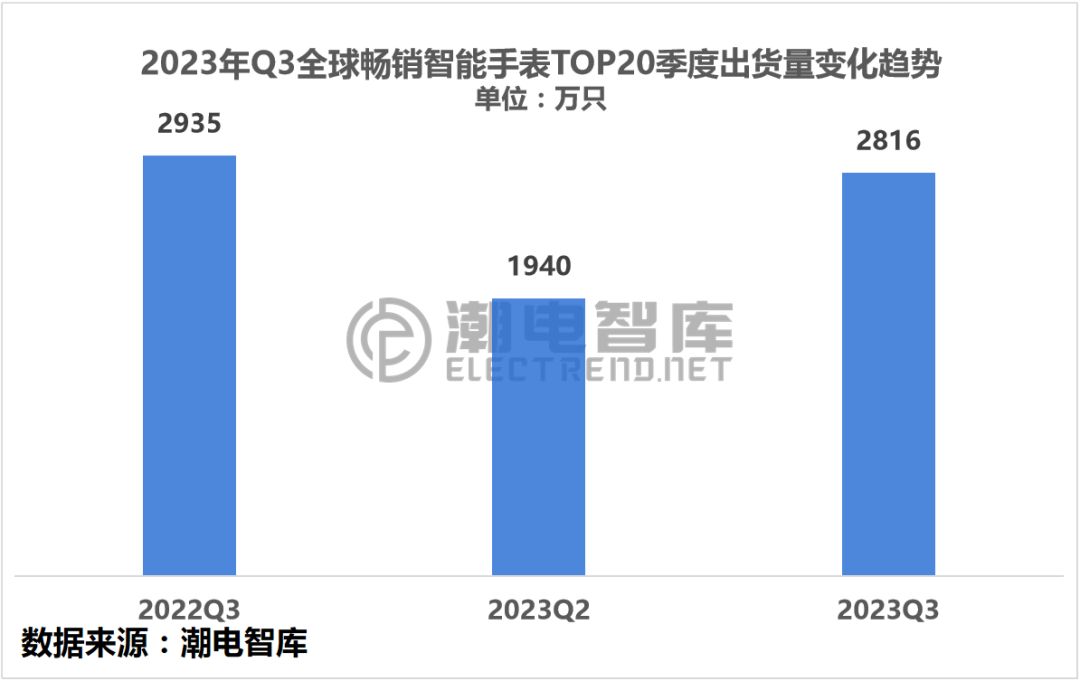

In addition, Q3 smartwatch Top 20 sales by price segment totaled about 28.16 million units, up 45.1% YoY from 19.4 million units in Q2 2023; and down 4.0% YoY from 29.35 million units in Q3 2022. This also indicates that the incremental volume of smartwatches in Q3 was mainly concentrated on non-best-selling brands.

Smartwatch sales share by price segment

According to the data from Chaodian, in terms of the total global smartwatch shipments, the price segment sales ratio of the smartwatch market in Q3 2023 showed a "dumbbell" trend: of the smartwatches sold globally in the quarter, 52.6% were priced at less than US$150, and 31.6% were priced at more than US$300.

Smartwatch Sales Share by Region

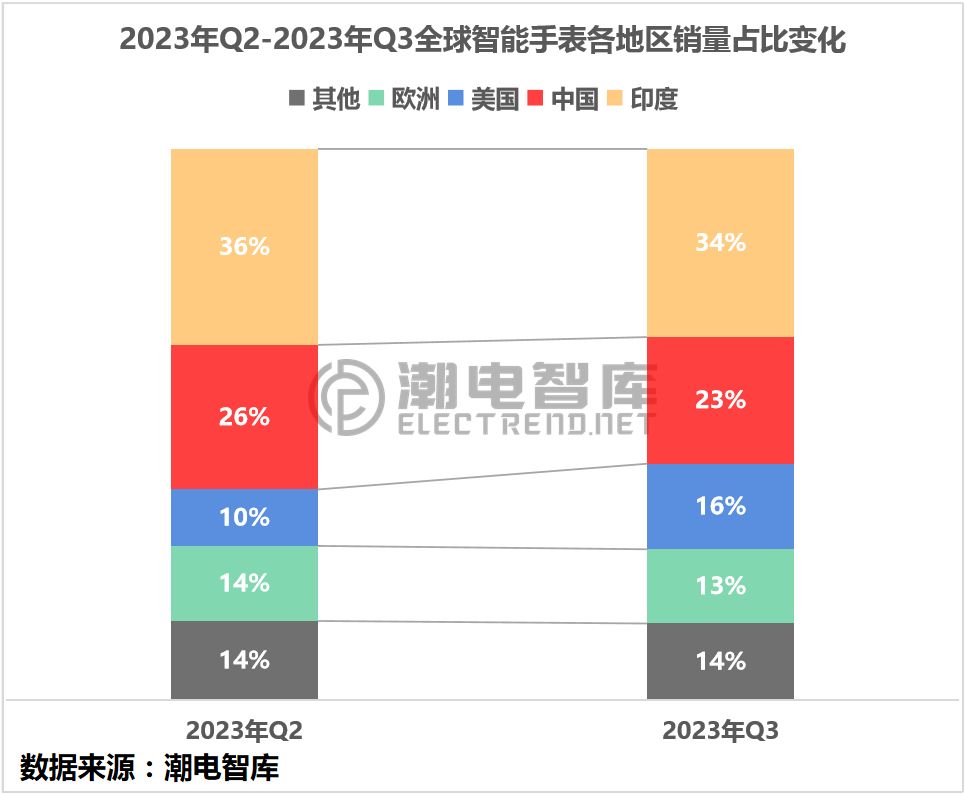

Shipments to the U.S. market surged sequentially. The shipments in China, India and Europe grew, but the ring share share shrunk.

Chaodian Think Tank data, in terms of total global smartwatch shipments, compared with last quarter's Q2, the global smartwatch market shipments in the four major regions in Q3 2023 have increased, and the market is improving across the board. Among them, the U.S. had the largest increase, from 3.678 million units in Q2, 109.3% YoY, to 7.698 million units in Q3.

Market pattern of TOP20 brands

Apple sits at the top, share back to 46%; Huawei pushes Samsung to share the top 3; Little Genius overtakes Noise, the Indian leader.

Global best-selling smartwatches shipped 28.16 million units in Q3 2023, totaling 13 brands on the list. Apple shipped 12.942 million units, up 98.8% YoY compared to 6.508 million units in Q2, with its share of the market rebounding to 46%; the market is highly concentrated, with CR3 market share of 72% and CR5 share of 87%.

BoAt, one of India's leading local wearable, did not enter the list of best-selling model brands this quarter, replaced by Fastrack, another Indian brand.

However, in terms of total shipments, BoAt shipped 2.384 million smartwatches in the third quarter, far better than Fastrack's 815,000 units. Due to the fact that the former smartwatch model has 114 models on sale, the sales of its best-selling model BoAt Storm Call were diluted to 180,000 units, which was not as good as the 244,000 units of Fastrack's best-selling model Revoltt FS1.

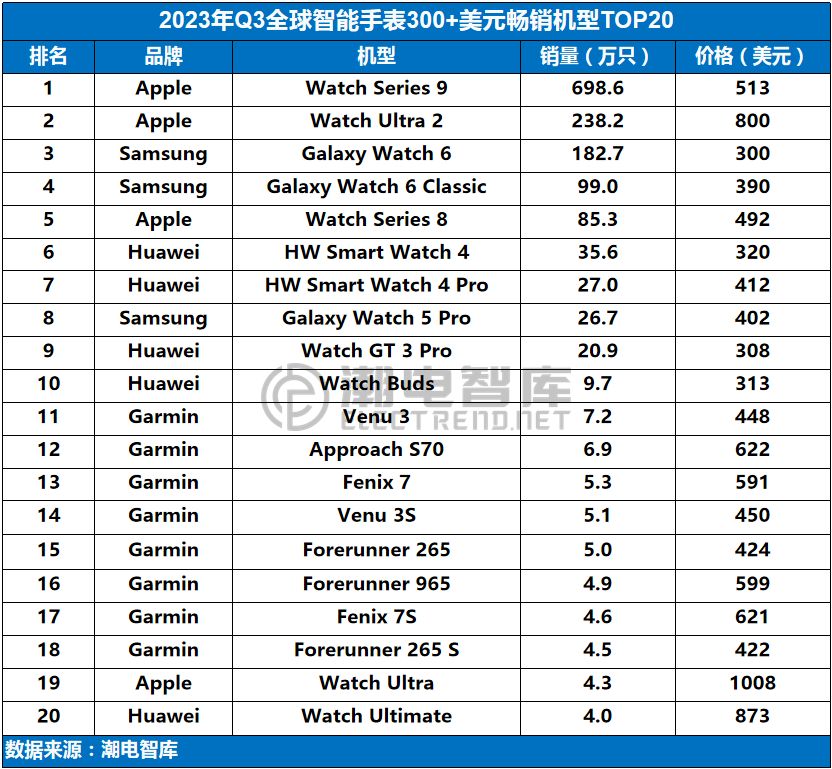

Top 20 best-selling $300+ models

Apple Watch Series 9 triggered the global market, Samsung Galaxy Watch 6 helped Samsung to sit at the second place.

Q3 2023 Global Best Selling Smartwatches $300 + Best Selling Models TOP20 totaled 14.75 million units shipped, with 4 brands making the cut. Apple carved out 70% of the market with 4 models, of which the new Watch Series 9 alone sold 6.986 million units;

Next is the Samsung Galaxy Watch 6 to help Samsung sit in second place. Huawei and Jiaming followed, of which Jiaming entered 8 models.

Top 20 best-selling models from 150-299 dollars

The competition in the mid-range market is the most intense, with 9 major brands shortlisted, and Apple, Huawei, and Little Genius in the top three.

2023 Q3 global best-selling smartwatches $150-299 best-selling models TOP20 totaled 6.84 million shipments, 9 brands were shortlisted. Huawei Watch GT 4 does not beat Apple Watch SE 2022, the latter became the emperor of the price range, but the former Huawei has the most shortlisted models in this price range, totaling 5 models.

Top 20 best-selling models from $0-$149

Little Genius leads the low-end market, China and India are equally divided, and the king of the machine is also Little Genius Q2A.

2023 Q3 global best-selling smartwatches under $150 best-selling models TOP20 total shipments of 6.56 million units, the price range was abandoned by Apple Samsung, but Huawei is still participating, six brands were shortlisted (three brands each in China and India). India's top three wearable brands Noise, Fastrack and Fire-Boltt all performed well. The No.1 selling brand in this price segment was Little Genius, and the best-selling model was also the Little Genius Q2A, with 689,000 units sold;

After Noise, India's leading brand, Xiaomi and Huawei ranked 3rd and 4th respectively.

recommend

Jan 10, 2024

Smart ring with the successive layout of Samsung, Apple and other head brands into the game, or will usher in a big outb...

Hot

-

Top 10 Global Smart Ring Brands by 2023 Jan 10, 2024

-

Top 25 Global TWS ODM/OEM by 2022 Aug 31, 2022