Four key points to analyze Thailand's optical storage market, there is still a lot of space to enter the game

Time: Aug 22, 2024Views:

Thailand's optical storage industry is now in the early stages of development, with great investment potential.

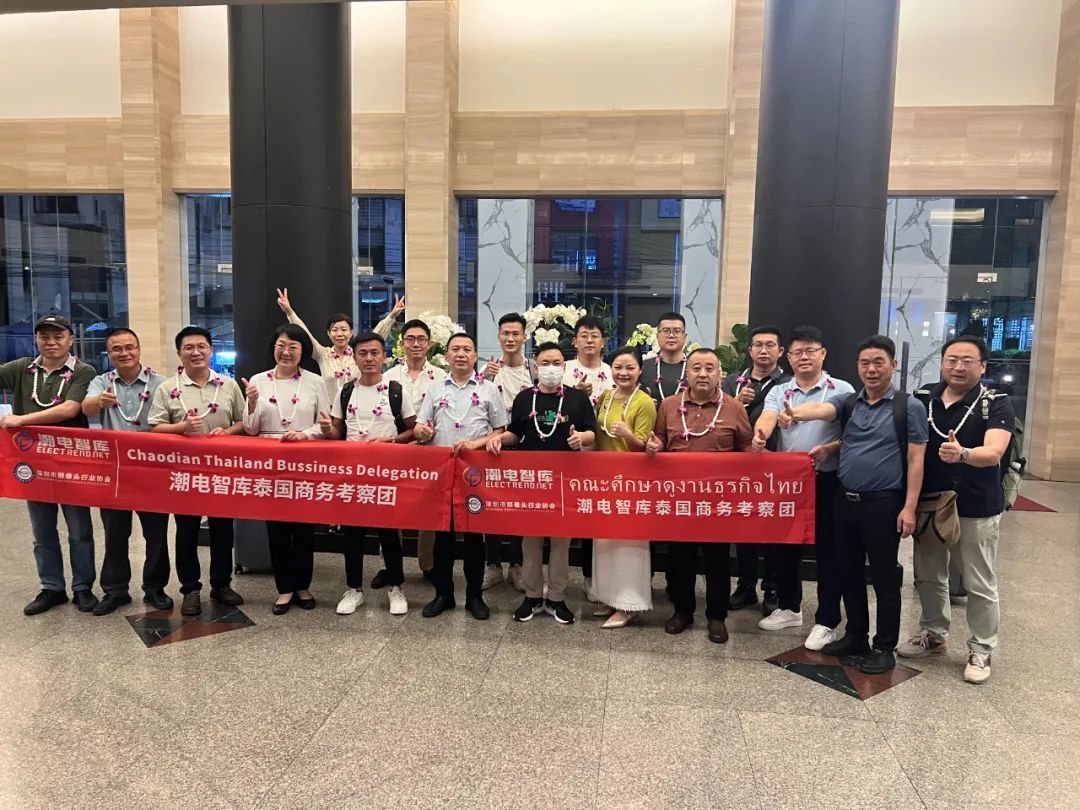

Nowadays, Thailand is mentioned in the new energy automobile industry, and in August, Chaodian organized a business mission to Thailand, and went to BYD, GAC EAN, SAIC MG, Midea, Haier, Oscan, Sihui Fushi and other listed companies that have built factories in Thailand, so as to sort out the pulse of Chinese manufacturers' large-scale seafaring in Thailand.

In the wake of the EV incentive program, the Thai government has accelerated the promotion of the country's battery manufacturing industry.

Chinese energy storage battery companies such as Hive Energy, Ningde Times, Guoxuan Gaoke, Yiwei Lithium Energy, and Xinwanda have already laid out the Thai market, and have gotten orders; in addition, inverter companies such as Aero Energy are also in the midst of intensive planning.

An energy storage enterprise surnamed Li, director of the tide of chaodian said China's energy storage battery smooth sea Thailand, it already represents that we just have a very strong price competitiveness. Thailand is now more subsidies for electric enterprises, battery manufacturing, will become the main growth of energy storage batteries and electric vehicle applications in the next few years, in recent years will certainly enact more energy storage support policies.

Chaodian Power Intelligence believes that Thailand's energy storage market will benefit from the growth of Thailand's electric vehicle market. At a time when it is increasing subsidies for battery manufacturing, it also means that the energy storage market is dawning, and is here to analyze the growth trend, policy support, demand for niche products, and direction of business expansion, with a view to providing reference for enterprises in the industry.

Energy structure adjustment contributes to the immediate need for optical storage

Thailand's energy structure is dependent, and fuel, natural gas shortages, poor coal quality, long-term power supply gap, growing demand for renewable energy.

The country is located in the southeast subtropical region, very close to the equator, solar energy resources, photovoltaic power generation potential. Thanks to the continuous decline in the cost of solar photovoltaic systems and government policy support, renewable energy installed capacity ranked first in Southeast Asia.

Statistics from relevant professional organizations show that Thailand's solar energy market is expected to grow from 3.9GW in 2024 to 5.52GW in 2029.

Against this backdrop, in recent years, the Thai authority government has accelerated the implementation of renewable energy power generation projects and the construction process of upgrading grid infrastructure. For example, the Electricity Generating Authority of Thailand is developing a 778MW Bhumibol Dam solar PV park, which is expected to be commercially operational in two years.

Photovoltaic products have entered the era of parity, and upstream raw materials such as lithium batteries have realized rapid cost reductions in the past year, which is very attractive to Thailand, where there is a rigid need for energy storage and is relatively price-sensitive.

Preferences for factory construction plus tax breaks

Thailand has a perfect infrastructure, including deep-water ports, industrial parks, etc., and also introduced a large number of foreign investors to Thailand to invest in preferential policies to build factories, has attracted China's battery energy storage companies to open subsidiaries and build factories.

The local government supports the PV and battery storage market through fiscal incentives, tax incentives, feed-in tariffs, and other policies, and also provides a series of investment subsidies and tax breaks, such as the Alternative Energy Development Program and the Energy Efficiency Development Program, to reduce system costs for companies.

In October 2022, Thailand's Investment Promotion Board approved a five-year (2023-2027) New Investment Promotion Strategic Framework, which provides up to 13 years of corporate income tax exemptions for projects related to upstream industries and advanced technologies.

Thailand's photovoltaic (PV) storage development comes mainly from the need to integrate renewable energy sources, covering segments such as photovoltaic (PV), battery storage, large-scale energy storage, and distributed energy storage. The country's government encourages the development of PV floating projects and plans to build eight floating solar power plants over the next 16 years, with an expected total capacity of 2,725 MW.

Customized design and stick to price competitiveness

According to Chaodian, smart grids, PV energy storage power supplies, grid-connected inverters, and other products that optimize the allocation of power resources and improve the reliability of energy utilization are expected to see greater demand in Thailand.

Distributed and portable energy storage products for camping and self-driving tours are highly sought after in Thailand. These products use high-density solid-state lithium batteries, which can be recharged by utility power, solar power, vehicle charging and other means, which is conducive to matching the needs of the Thai public more quickly.

Chaodian believes that the products should meet the needs of pure off-grid and on-off-grid switching, and just as DEI has launched exclusive products for the South American market, it is best to customize the design of products and solutions to enter the Thai market as well.

Thailand is investing heavily in solar energy, and providing energy storage systems that seamlessly integrate with solar installations can be a major advantage. Small-scale energy storage products, for example, not only need to be competitively priced, but also have the flexibility to meet different project sizes and needs, which, taken together, can be a strong selling point.

Strive for exhibition and local channel resources

If you want to enter the Thai market, you first need to be clear about what local and foreign competitors are in the country.

Local companies already operating solar PV projects in Thailand include SPCG Public Company Limited, Bangkok Solar, Blue Solar, Thai Solar Energy PLC, etc., with significant market share.

In addition to the above companies, Chinese companies are another major player in the Thai market and have been rapidly increasing their market share. For example, the first battery packs from Hive Energy's Thailand factory started to be supplied in bulk in the first quarter of this year. So the powerful Chinese companies are the number one “threat” to capture the market.

As with all new markets, if you are ready to enter the Thai market, you can actively contact solar cell and renewable energy installation companies, related PV power plant operators and investors to find a cooperation plan to accelerate access to project resources.

Chaodian suggests that companies pay attention to the relevant information released by the Thailand Investment Promotion Board to promote brand awareness in Thailand, and participate in more local chambers of commerce in Thailand to obtain relevant contacts and resources.

recommend

Aug 22, 2024

Germany as the first large European balcony PV market, the leading trend is stable. On August 9, the relevant statistica...

Hot