Global cell phone camera shipments of 4.06 billion in 2023, price wars hit Sunny, Q tech

Time: Feb 29, 2024Views:

As the most important hardware for smart image innovation, the supply quotient of optical camera module has become an important indicator to measure whether the cell phone industry is picking up.

According to Chaodian Intelligence, global cell phone camera shipments in 2023 were 4.06 billion, down only 3.3% year-on-year. However, due to the decline in volume and price, the price war in the serious volume of "hit the bone", resulting in the top two head manufacturers Sunny (02382.HK), Q tech (01478.HK), the annual results once again a big slump.

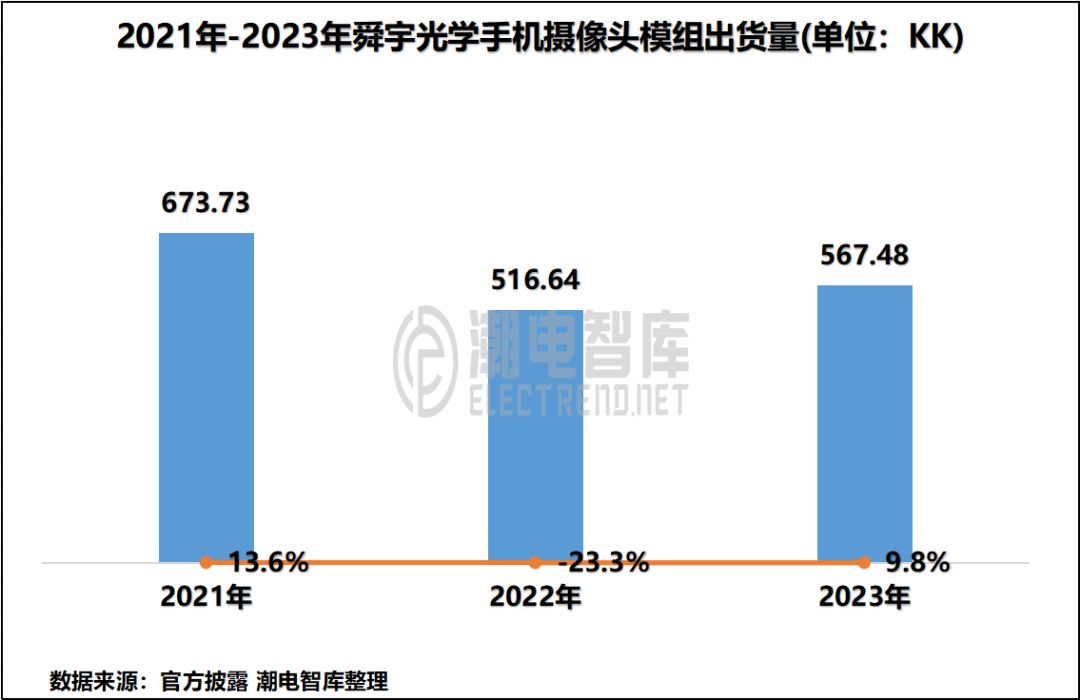

Sunny's profit warning showed that the group's net profit for 2023 will be about CNY1.08 billion to CNY1.2 billion, down 50 to 55 percent year-on-year. In terms of shipments alone, Sunny's cell phone camera modules also grew 9.8% for the whole of last year.

Q tech expects net profit to decrease by about 35% to 45% year-on-year in 2023. For the whole of last year, Quti's combined sales of cell phone camera modules amounted to about 366 million units, a year-on-year decrease of 12.3%, the largest drop among the headline companies. Not only that, its global second position is facing a strong impact of the OFILM.

Last September, benefited from the big customers Huawei to mate60 series strong return to the high-end cell phone market, another optical module manufacturers, Huawei cell phone camera module core main supply OFILM is to achieve a turnaround against the wind.

According to the performance forecast of OFILM, the net profit in 2023 is 69 million yuan to 95 million yuan. The fourth quarter is expected to realize a net profit of 230 million yuan to 394 million yuan, the highest single quarter since 2021.

In 2024, the market first welcomed a wave of "small spring", and the warming trend is gradually clear.

Driven by the Android camp stocking up, cell phone camera module market in January ushered in the peak shipments, of which Sunny and Q Tech were 62.26 million and 38.915 million, respectively, are the best single-month results in recent years. Chaodian Wisdom learned from the industry chain, OFILM, SunWin, etc. also ushered in different ranges of growth.

Although a number of organizations to give the cell phone terminal sales growth forecast, and camera modules in the last year, the positive sign of unit price correction, but a number of optical suppliers for this year's market forecasts seem very cautious, generally believe that "with the second half of last year is almost even good".

Chaodian believes that the cell phone field is still the main battlefield of the optical supply chain in the future long-term, in the consumer electronics environment is weak, "cell phone dependence" will become the business indicators of the hard and painful points. On the contrary, it is the first driving force to get back on the right track of growth.

Among them, technological innovation, delivery capacity, quality control, customer resource pool and other key indicators will form the comprehensive competitiveness of enterprises, but also a winning bullet.

recommend

Jan 10, 2024

At last years CES 2023, Sony Honda Mobility, a joint venture between Sony and Honda, was officially unveiled, with the t...

Hot