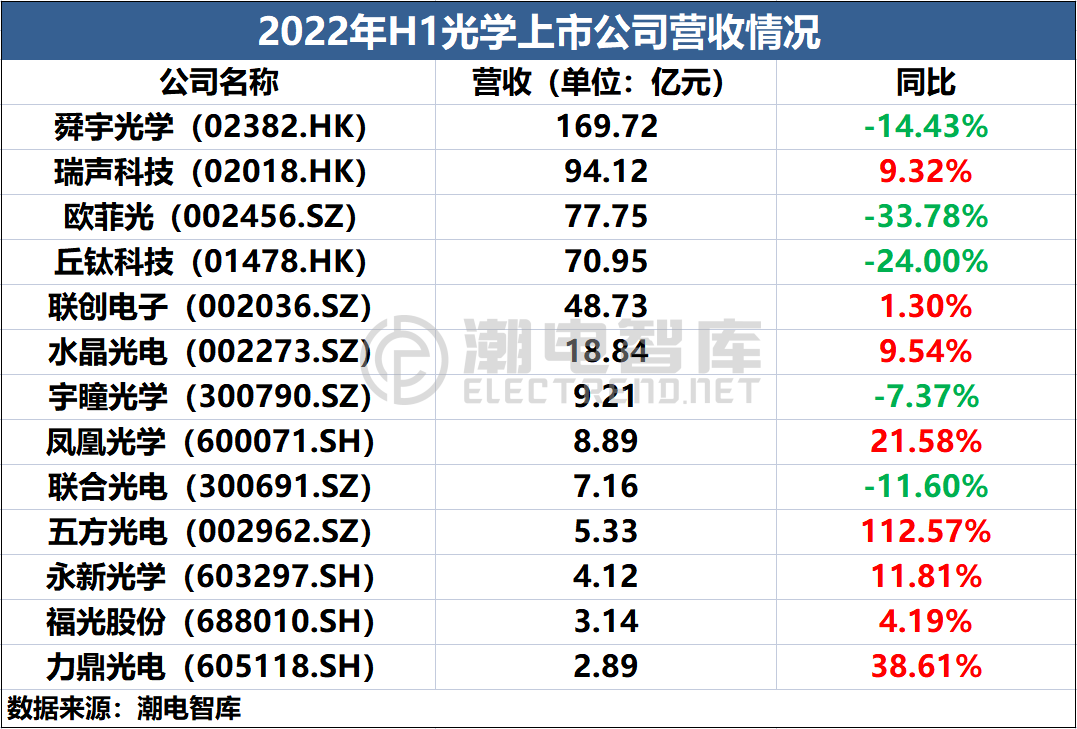

Tide TV Review|13 optical listed companies revenue PK, cell phone big players all decline

Time: Sep 19, 2022Views:

Mid-year report out, also means that the first half of the optical industry this year, the end of the race, which exploded a lot.

In order to more objective and comprehensive insight into the industry, tide electricity think tank selected a representative of the 13 optical manufacturers, from its revenue data presented to the optical market to sort out and summary.

I. Cell phone industry is indeed recession. In addition to RuiSheng technology, Sunyu, QiuTi, Ovation and several other major cell phone optical suppliers have declined in revenue year-on-year. This winter will be relatively long, possibly up to three years or more, the industry should be prepared to keep warm and cold.

II. Automotive field into the harvest period. To the car optics-based Lianchuang electronics, Lidin photoelectric and other companies in the first half of this year's revenue have achieved positive growth, and Sunwoo, Ovation, crystal photoelectric and other car business accounted for a gradual increase.

Third, XR track is the next point of contention. Late into the car has been a painful enough lesson, more than half of the manufacturers have pulled the business line to the AR / VR field, the future will be full of variables of the new battlefield. The metaverse concept is so hot that the XR market may really explode overnight.

It should be noted that the revenue indicator is used as an independent statistical item in this issue because it can most visually reflect the scale growth rate of the company, or in plain English, "how big is the business". In the next issue, the tide electricity think tank will be a comprehensive analysis of optical companies' mid-year net profit performance, that is, "how much money".

1, Sun Microelectronics: revenue of 16.97 billion yuan, down 14.43% year-on-year

Sunyu specializes in optical and optoelectronics-related product design, research and development, production and sales, the main products include three categories: first, optical components, including glass / plastic lenses, flat products, cell phone lenses, car lenses, security and surveillance lenses and other various lenses; second, optoelectronic products, including cell phone camera modules, 3D optoelectronic modules, car modules and other optoelectronic modules; third, optical instruments. Mainly including microscopes and intelligent testing equipment, etc.

Brief comment: From the first half of this year, the industry environment, whether cell phone lens or cell phone camera module, Suntech's shipments have fallen sharply, the share price is also nearly cut, facing the transformation and upgrading pressure is very big. However, in popular tracks such as AR/VR and automotive, the company has shown enough growth vitality.

"One is to strengthen the supply of high-end cell phone optical products to enhance the profitability of individual products; the other is to continue to accelerate the expansion of other segments to "100 billion revenue" target.

2, RuiSheng Technology: revenue 9.412 billion yuan, up 9.32% year-on-year

The company's main business is Chengrui optical plastic lens, WLG glass lens and glass-plastic hybrid lens, camera modules, optical transmission and other optical components of the development, manufacture and sales.

In 2020, the company's glass-plastic hybrid lens with WLG wafer-level glass lens was successfully mass produced for the first time, and the 1G6P high-end project is expected to be delivered in mass production in the second half of 2022. 2022, Chengrui Optical has set a market target of "WLG shipments exceeding 10 million pieces".

The demand for camera modules in consumer electronics, automotive, IoT and other fields is growing rapidly. Chengrui Optics is following the trend and its optical business has been extended to UAV, automotive, AR/VR and other fields.

Brief comment: If we look at the product line alone, Chengrui Optical can be considered as an alternative and has been sticking to its WLG dream.

Chengrui Optics does plastic lenses and markets a volume business model, first and foremost to enter the optical industry. The real excitement of the company's entrepreneurs must be its WLG products, because it may create a new era of optical glass lens.

3. Ovation: Revenue of 7.775 billion yuan, down 33.78% year-on-year

The company's main business is smartphone, smart car and new field business. The main business products include optical image module, optical lens, microelectronics and smart car related products, which are widely used in the consumer electronics and smart car field represented by smartphone, smart home and smart VR/AR devices, etc.

In the non-mobile phone field, Ovation has been laying out smart cars since 2015. Through the acquisition of Huadong Auto Electric and Nanjing Tianjing, Ovation has successfully become the Tier1 supplier of domestic vehicle manufacturers and has now obtained the supplier qualification of more than 20 domestic car manufacturers.

At the end of April this year, Ovation set up the meta-universe division to officially kill the VR/AR battlefield.

Brief comment: Once the world's largest optical leader, because of a series of twists and turns of the "fruit chain" event, in the past two years is experiencing the pain of transformation and upgrading. From its patent layout and new business progress, Ovation has quietly made a gorgeous turnaround and still has the background and ambition to return to the top.

4, Quti Technology: revenue 7.095 billion yuan, down 24% year-on-year

Mainly engaged in the design, development, manufacture and sales of camera modules and fingerprint recognition modules, and to the global smartphone and tablet computer brands, Internet of Things (IoT) and smart cars and other intelligent mobile terminals in the mid- to high-end camera modules and fingerprint recognition module market. Its camera module manufacturing adopts chip-on-board (COB), chip-on-film (COF), plastic-on-board (MOB) and plastic-on-chip (MOC) technologies, and is capable of mass production and sales of ultra-thin camera modules with 108 million pixels and above, dual/multi-camera modules, 3D modules and under-screen fingerprint recognition modules and other fingerprint recognition modules with different processes.

Brief comment: With the module products, Quti has vividly interpreted what is called "one trick to eat all over the world". In the first half of this year, Quti's cell phone camera module products maintain a good shipment volume, down 5% year-on-year, much lower than the industry average decline of 20%.

The "big one in the runt" is obviously not worth celebrating. For Quti, to get rid of "cell phone dependence" and accelerate the expansion of non-mobile phone field is the king. Although the IoT business is gradually taking off, it is not enough to change the company's current product mix. Compared with market competitors, Quti's entry into the automotive field has lagged behind the point, the pace needs to be accelerated.

5. Unitech Electronics: Revenue of 4.873 billion yuan, up 1.3% year-on-year

Strongly driven by the automotive business, UniCreative Electronics' revenue has maintained high growth and crossed the 10 billion mark for the first time in 2021.

CCTF focuses on developing new optical and optoelectronic industries such as optical lenses and image modules, touch display devices, and investing and cultivating electro-acoustic and chip industries. The company's products are widely used in smart terminals, smart cars, smart homes, smart cities and other fields.

During the reporting period, the company carried out strategic cooperation with internationally renowned intelligent driving solution platform providers Mobileye, Nvidia, Aurora Huawei, etc., and continued to make efforts in the development of advanced assisted safety driving and intelligent cockpit lens for automobiles. The self-driving car series lenses developed in cooperation with Valeo, Magna, Aptiv, Mcnex and other internationally renowned automotive electronics factories are being released.

Brief comment: In 2018, Lianchuang Electronics cooperated with head algorithm solution companies such as Nvidia and Mobileye to develop 8M pixel high-end vehicle lenses and obtained certification, becoming the first company in the industry to successfully develop 8M lenses for vehicles, and has now landed in mass production.

Many optical companies now take LMC as a technology learning benchmark, which has fully illustrated its important position in the industry. In the past, the industry's labeling of CCTF was "first-class technology, second-class production capacity". With the landing of the expansion projects of Hefei CCTF and Tongcheng CCTF, under the guidance of the "high lift and high hit" strategy, CCTF is expected to become a double-class enterprise in the field of vehicle technology and production capacity.

6, crystal photoelectric: revenue 1.884 billion yuan, up 9.54% year-on-year

Specializing in the development, production and sales of optical imaging, thin film optical panels, automotive electronics (AR+), reflective materials and other related products, the main products include precision thin film optical components, thin film optical panels, semiconductor optical components, automotive head-up displays, new display components, reflective materials, etc., and applied to smart phones, digital cameras, tablet PCs, notebook computers, intelligent wearable It is used in downstream end products such as smart phones, digital cameras, tablets, notebooks, smart wearable devices, drones, smart homes, security and surveillance, and automotive electronics.

The company focuses on the optical track, with smart phones, smart homes, smart cars, etc. as application scenarios.

Brief comment: At present, Crystal Photoelectric AR-HUD has been mass-produced and equipped with Red Flag, Changan and other complete models, and is expected to ship new models in BYD and Great Wall Motor. In VR level, the company said it has technology layout in diffractive light waveguide, reflective light waveguide, birdbath and other solutions, and is cooperating with brand VR headset in development.

The global smartphone market continues to be weak, and the breakout of the industry chain has become a foregone conclusion. As a global camera filter leader, these years crystal photoelectric choose intelligent cars and XR field as a cross-border track, is undoubtedly a very forward-looking strategic choice.

7, Yushin Optical: revenue of 920 million yuan, down 7.37% year-on-year

No cell phone business to support the U Pupil Optics is the king of the global security lens industry.

Yuyu optical is specialized in optical lens and other product design, research and development, production and sales of high-tech enterprises, products are mainly used in security monitoring equipment, car cameras, machine vision and other high-precision optical systems. Its core technologies are reflected in the lens design capability, structural design capability, product technology capability, product processing technology level, quality control level and many other aspects, including: glass-plastic hybrid optical system design and development technology, ghost and flare control technology, high precision detection technology, optical lens defect simulation and feedback technology, automatic detection technology for visual resolution, zoom lens non-linear CAM slot design technology, plastic bonded lens technology, etc. design technology, plastic bonded lens technology, etc.

Brief comment: At present, Pupil Optics has a complete range of products in security and other segments, and will focus on developing pure optical products, especially automotive optical products, including LIDAR optical accessories, head-up display (HUD) optical components and intelligent headlights.

This is of great significance to Apollo Optics. First, it can fully unleash its optical technology advantages, and second, it can achieve rapid scale growth. The strategic industrial layout allows it to adapt to future market changes and gradually complete the transformation and upgrading of the optical industry structure.

8, Phoenix Optical: revenue of 889 million yuan, up 21.58% year-on-year

Mainly engaged in the production and sales of optical components, optical lenses, optoelectronic modules, intelligent controllers, lithium batteries, optical instrument spare parts and other products, with optical, mechanical, electronic, plastic and other multi-professional integrated research and development and production and management capabilities.

The company's optical lenses and optical lenses are mainly used in security video surveillance, automotive equipment, etc.; precision metal parts are mainly used in camera, projector, automotive equipment and other product fields; optical microscopes are mainly used in general education, higher education, industry, research institutes and other fields.

Brief comment: One of the oldest optical manufacturers in China, recognized as the "Whampoa Military Academy" of the optical industry. Unfortunately, its performance is also like a late old man, continuous losses for many years.

At the business level, Phoenix Optical originally intended to transform the semiconductor industry through acquisitions, but in the end did not succeed. In the face of intelligent security lens, car lens, smart home, industrial machine vision and other fields such as forest strong hand, can't help but ask "liangpo old carry on, still can rice?"

9, United Optoelectronics: revenue of 716 million yuan, down 11.6% year-on-year

In August 2005 in the Torch Development Zone Venture Center was established, many years of development has formed a set of optoelectronic product design and development, ultra-precision processing and intelligent manufacturing as one of the complete business system. In the field of optical anti-shake, ultra-high magnification zoom lens, ultra-high definition 4K laser display is the only domestic independent development and mass production of enterprises, high-frequency HD security zoom lens market share of the world's first.

Brief comment: In the first half of this year, United Optoelectronics inventory increased significantly, the company said the main reason is based on customer orders demand and the company's sales forecast, strategic inventory stocking.

Risk concealed. The first half of last year, the security camera industry growth rate is unusually fast, mainly downstream worry about the shortage and raw material price increases triggered by panic hoarding. From the second half of the year, to inventory has become the industry theme. In May this year, rumors that their largest customer Hikvision will be the United States to take stricter sanctions, which is also not good news for the United Optoelectronics.

10, five-party photoelectric: revenue of 533 million yuan, up 112.57% year-on-year

Specializing in the development, production and sales of precision optoelectronic thin film components, the main products are infrared cut-off filters (IRCF) and biometric filters, which are used in digital imaging fields such as camera-ready cell phone cameras, computer built-in cameras, car cameras and security cameras. The company's core technologies include: precision optical coating technology, cleaning technology, screen printing technology, laser cutting technology and assembly technology, etc.

Brief comment: Five-sided photoelectric is the only optical companies to achieve a doubling of revenue growth, but also indicates that the industry order resources more concentrated. Tide electricity think tank from the industry chain was informed that the cell phone is still the most important application carrier of infrared filters, the current industry's degree of involution beyond imagination, generally to the most primitive price war savage grab single, so many filter companies have been unsustainable.

Innovation as the driving force, cross-border to seek new growth points, is the future of China's filter industry.

11, Yongxin Optical: Revenue of 412 million yuan, up 11.81% year-on-year

Yongxin Optics is a supplier of optical precision instruments and core optical components in China, covering two business systems of optical microscopes and optical components, with main products including optical microscopes, barcode scanner lenses, liquid lenses, automotive lens front lenses, LIDAR optical components and parts, etc., with "Jiangnan", "NEXCOPE", "NOVEL" and other independent brands, products are mainly exported to Europe, America, Japan, Singapore and other countries and regions.

Brief comment: Although there are Japan Nikon, Leica microscope system, United Scope and other international customers, microscope market share of the world's first identity, but the industry is not a big cake, the market value of 7 billion in the optical industry is only a "lightweight".

The technical strength of Yongxin Optics is evidenced by the aerospace applications and ASP, but the car camera is not laid out in advance like Sunwing United Scope, but chose to focus on the layout of LIDAR lenses. In the face of the LIDAR has not yet scale on board the status quo, the style of conservative Yongxin optical short-term explosive growth is difficult to achieve.

12. Fugong: Revenue of RMB314 million, up 4.19% year-on-year

Specializing in the research and production of special and civilian optical lenses, optoelectronic systems, optical components and other products, including laser, ultraviolet, visible, infrared series of full-spectrum lenses and optoelectronic systems, mainly divided into "customized products", "non-customized products" two major series. The "customized products" series mainly include special optical lenses and optoelectronic systems; "non-customized products" mainly include security lenses, vehicle lenses, infrared lenses, machine vision lenses, projection light machines, etc., which are widely used in safe city, smart city, Internet of Things, Internet of Vehicles, intelligent manufacturing and other fields. They are widely used in safe city, smart city, Internet of things, Internet of vehicles, intelligent manufacturing and other fields.

Brief comment: The announcement shows that the core customers of the custom products of the Fuguang shares are mainly the Chinese Academy of Sciences and major military industrial groups affiliated research institutes, enterprises, etc., the products are mainly used in the Shenzhou series, Chang'e moon, Mars exploration, etc., the gross margin of up to about 60%.

Feel very high, but unfortunately the amount is too small. From 2016 to 2021 custom products revenue no year more than 100 million, and last year even fell 15% year-on-year.

Therefore, the civilian market has a decisive significance for the growth of the scale of Fugong shares. However, in the main security lens monitoring field, the industry's boom in the past two years is not high, the company and the head rival Yuyu optical gap is further widening, the urgent need to find more growth points at the moment.

13, Lidin photoelectric: revenue of 289 million yuan, up 38.61% year-on-year

Focusing on optical lens industry, with a complete business system of design, production and sales, we are able to provide professional optical imaging solutions and optical lens products for customers in downstream applications such as security video surveillance, vehicle lenses, machine vision, smart home, video conferencing, drones, VR/AR devices, motion DV, motion capture, 3D Sensing, and computer vision.

Our optical lens products are mainly exported to Hong Kong, Taiwan, Japan, Korea, EU, USA, Canada, Thailand and other countries and regions, and our main customers include Jabil Group, Huan Yong Technology, Group Light Electronics, Porsche Group, Panasonic, Flextronics, Yuan Sheng Technology, SVI and other famous manufacturers.

Brief comment: Liding Optoelectronics seems to be small in volume, but its performance has been very solid and high quality, the first half of the revenue is to achieve counter-trend growth. The company has a 50% gross margin and 30% net profit performance, which is closely related to its business layout overseas, with overseas revenue accounting for 72%.

In addition, the company has begun to enjoy the car industry dividends. In-vehicle products are mainly sold overseas, including automotive projection lights, driving monitoring and blind area measurement products, etc. The company's ADAS is officially sold in the domestic market from 2020. 2021, the company's in-vehicle application revenue accounted for about 12%.

Therefore, going abroad is where many optical companies need to rise to a strategic level of consideration.

recommend

Feb 03, 2024

Recently, overseas institutions have downgraded Apples rating. For a time, Apple from being bearish in mainland China du...

Hot