"In recent years, MiniLED technology has been focusing on resolving the shortcomings of LCD displays, particularly in terms of improving the dark-to-bright transitions and overall screen brightness. Through advancements in backlight zoning, peak brightness, and core screen technologies, the enhancements in picture quality have become increasingly apparent. When combined with robust software and hardware adjustments, MiniLED displays are now nearing the picture quality performance of OLED technology, gaining recognition and witnessing significant sales growth in both business-to-business (B2B) and business-to-consumer (B2C) markets.

Recently, Xinruida stated during institutional research that the company has developed 10.5-inch, 12.3-inch single and dual displays, as well as a 15.6-inch automotive display. The performance parameters of the 15.6-inch floating display have received recognition from potential clients. Xinruida emphasized that with the rapid development of smart electric vehicles, solutions centered around intelligent cockpits, parking, and driving have become essential. As a result, the usage and demand for automotive displays, a core hardware component of intelligent cockpits, have shown a rapid and substantial increase.

Xinruida believes that the rapid increase in demand for MiniLED backlight display modules is not only due to the company's early technological layout and accumulation but also because of the technology's superior comparable performance parameters, which have gained favor among more consumers. Moreover, the company's long-standing commitment within the industry and increased investment and effort in product layout by leading global manufacturers have also contributed to the growth of MiniLED display modules. The rapid growth of MiniLED display modules is the result of the synergistic resonance among market trends, technology advancements, and the industrial chain's cooperation.

Similarly, another backlight giant, Longli Technology, also mentioned during institutional research that with the current trend toward electrification and intelligence in the automotive industry, intelligent cockpits have raised new demands for in-car displays. Under the trends of larger displays, multi-screens, high definition, and interactive requirements, the penetration rate of MiniLED backlight displays in automotive projects is expected to continue to rise. The company's ongoing and initiated projects have provided strong validation for MiniLED backlight displays in automotive applications.

Recently, Hanbo Hi-Tech, in a similar response during investor relations activities, noted that besides the strong validation in automotive projects, MiniLED has also gradually gained recognition in IT display applications. Hanbo Hi-Tech has actively laid out various new display technologies, including MiniLED, over the years. They have independently developed the MiniLED backlight supply chain, accumulating several core technologies such as optical film materials, MiniLED light boards, adhesive groups, and structural components. They have successfully designed 15.6-inch and 12.8-inch MiniLED backlight sources, primarily applied in the consumer electronics field, including laptops, desktop monitors, tablets, and automotive screens.

The company's reserved MiniLED backlight source technologies encompass COB and POB with active or passive circuit design solutions. They can independently produce the materials, and they have applied for multiple patents related to the ultra-microstructure film used in MiniLED backlight sources. For consumer electronics MiniLED backlight products, the company has collaborated with several panel manufacturers and terminal production companies to develop and produce products for laptop computers, VR, and other fields.

Regarding the breakthrough in MiniLED mass production, Hongli Zhihui stated during investor inquiries that the company's MiniLED backlight product yield has reached 95%, with direct display product yield exceeding 90%. Additionally, the 'Mini Phase II' possesses the capability for large-scale production based on order requirements.

In terms of manufacturing equipment, according to recent investor relations activities of Lian De Equipment, the company has introduced chip sorting, chip expansion, testing, vacuum coating, chip mass transfer, and high-precision splicing equipment in the Mini/MicroLED fields. Lian De Equipment believes that Mini/MicroLED is an emerging next-generation display technology and is currently in a rapid development stage. It is expected to maintain high-speed growth in the coming years.

In terms of MiniLED technology innovation and promotion, panel manufacturers are also making significant efforts. Recently, car display giant S-Tech A unveiled three major technology platforms and seven innovative achievements at its global innovation conference, debuting a car-standard quantum dot MiniLED screen.

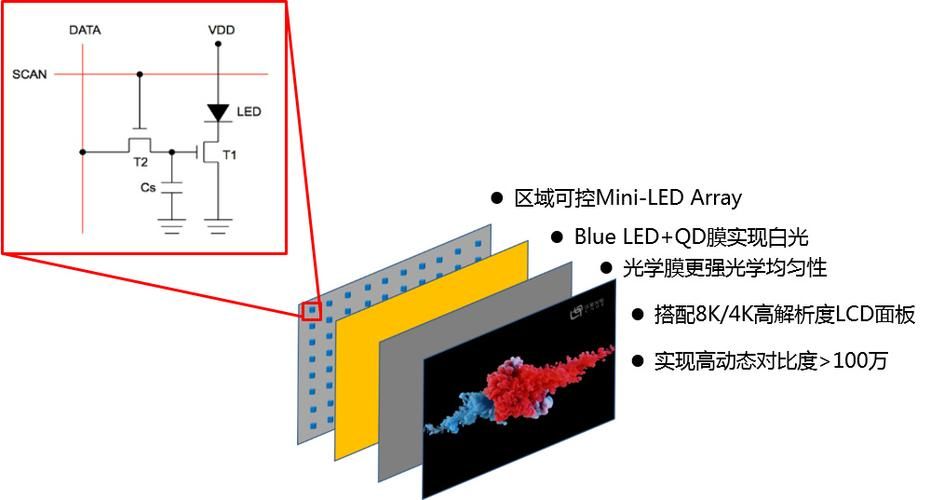

Focusing on the MiniLED technology for car cockpit displays, S-Tech A's innovative Quantum Dot film combined with a blue-light architecture for MiniLED technology achieves lower power consumption, higher color gamut (NTSC ≥ 110%), superior display picture contrast, and an improved halo effect design. This effectively fills the domestic commercial gap in the field of car quantum dot blue-light MiniLED, which has already commenced commercial cooperation with car customers utilizing the blue-light architecture for Mini-LED technology.

In other high-end product areas, panel manufacturer Longteng Optoelectronics, during recent investor inquiries, mentioned that the company sees a promising application prospect for MiniLED in the high-end market. They consider it a crucial core technology and have successfully launched products such as MiniLED car displays, notebook screens, and gaming monitors, while continuously advancing MiniLED backlight technology development and display effect optimization. They have developed their assessment and quantification methods for halos and are actively researching new technical architectures to further optimize costs.

The company has deeply collaborated with globally renowned semiconductor manufacturers, focusing on advancing the mass production of MiniLED in car and laptop products. They are exploring the applications of MiniLED in various high-end scenarios like gaming and healthcare, planning to integrate oxide backplanes with MicroLED, jointly researching relevant technologies for MicroLED industrialization, laying a solid foundation for providing customers with more diverse and high-value products for the metaverse's application.

MiniLED is also demonstrating significant potential in terminal products. For instance, TV giant Hisense has not only introduced a 40,000-zone MiniLED backlight TV product but also developed and produced the 8KAI image quality chip X specifically for it. This chip integrates scene perception, deep neural network learning functions, and powerful computing power, housing a dedicated NPU unit to support high-precision AI operations. This breakthrough has enabled MiniLED to enter the era of 100,000-zone displays. Through the integration of 'optical systems,' the 'X-core' image processing technology, and the 'black crystal screen,' along with innovative fusion with ambient light sensing, the MiniLED industry has achieved several groundbreaking innovations, laying a solid foundation for the upgrade of high-end LCD displays.

Hisense has also made breakthroughs in innovative products and applications in the field of 4K MiniLED medical endoscope displays. They developed high-performance self-made MiniLED modules to enhance dark field performance, increase display brightness, and improve color effects. This enhancement significantly improves clinical picture quality experiences. Additionally, achieving a super high contrast ratio of 200,000:1, equivalent to 100 times that of traditional endoscope displays, means a stronger depth perception of narrow cavity images, presenting more deep tissue details in minimally invasive surgery. Furthermore, covering an ultra-wide color gamut of 85% and meeting the BT2020 standard for red color gamut 100% coverage addresses the pain points of brownish bleedings and poor layering in dark field conditions during surgeries. The product supports the industry's most advanced 12G-SDI 4K signal interface, accurately restoring 4K endoscopic ultra-clear video signals, addressing the long-distance transmission pain points in digitized operating rooms, ushering in a new era of high dynamic display in the medical industry. This series of products' expansion satisfies various usage needs in different minimally invasive surgery scenarios.

Hisense's Endosmart product equipped with intelligent brain AI technology for digestive endoscopy enriches minimally invasive surgery usage scenarios. It has been adapted and used in dozens of mainstream equipment companies in China's hospitals, receiving acknowledgment from endoscope enterprises and clinical hospitals. It has broken the industry monopoly of international brands, accelerating the innovative development of high-end domestic medical equipment.

On the other hand, TV panel and whole machine giant TCL Technology showcased significant innovation achievements and representative products from the forefront of the photovoltaic and panel supply chains at the first Chain Expo. They debuted the world's largest 115-inch QD-MiniLED TV in China, not only boasting an incomparable ultra-large screen but also utilizing an improved six-crystal square-core MiniLED display technology. This enhancement has increased TV brightness by 27.5% and improved energy efficiency by 30.2%, significantly enhancing the halo control ability and brightness. Combined with the Pro2023 technology featuring over 20,000 zones, the color gamut reaches 157% of BT.709, showing exceptional color accuracy (ΔE < 0.99). This allows the TV to achieve a peak brightness of XDR5000nits, a contrast ratio of 50 million:1, and a broader dynamic range. Equipped with an A++ butterfly-wing star screen, all-channel 4K144Hz true high refresh rate, and four HDMI2.1 interfaces (including two full-featured), supporting VRR variable refresh rate, ALLM automatic low latency, and Dolby Vision support, the TV excels in color reproduction, precise light control, and offers support for details previously unseen on low-brightness televisions.

Furthermore, with the addition of the M2 butterfly chip and the TXR MiniLED picture enhancement chip, this 115-inch QD-MiniLED TV possesses intelligent perceptual capabilities. It improves picture quality from multiple dimensions, such as intelligent contrast optimization, intelligent color optimization, intelligent clarity optimization, and intelligent scene optimization. It provides pixel-level tuning for picture quality, achieving unprecedented heights in size, picture quality, sound quality, and other configurations.

To enhance competitiveness, vertical integration in the industry has already begun. Panel giant BOE acquired a controlling stake in MiniLED chip manufacturer Huacan Optoelectronics for 2.1 billion yuan, while TV giant Hisense Vision gained control of Qianzhao Optoelectronics, representing the simultaneous choice of equity by panel and terminal manufacturers to secure production capacity.

In terms of the industry competition pattern, the global display industry is primarily distributed in four regions: Mainland China, South Korea, Taiwan, and Japan. As new technologies like LTPS-TFTLCD and AMOLED mature, the investment threshold for related industries has risen. South Korea and Mainland China have begun to lead industry development. South Korea is exiting the TFTLCD field and shifting focus to OLED. Domestic panel companies in China have gradually gained market dominance in the LCD industry. MiniLED backlight is one of the upgrade solutions for TFTLCD displays and complements existing mainstream LCD production technologies.

The increasing consumer recognition of large-screen MiniLED display technology has led to more and more terminal brands joining the MiniLED market, ushering domestic manufacturers into a period of harvest. Data related to TV sales in the first half of 2023 indicated that MiniLED TV sales increased nearly fourfold compared to the previous year, with a market share nearly eight times that of OLED TVs in the high-end segment. This signifies that an increasing number of high-end TV consumers are choosing the rapidly growing MiniLED TVs."