Depth|Mobile phone track into the best "litmus test", CMOS staged the battle of kings

Time: Sep 26, 2022Views:

According to Tide TV Sense and Perception, the global smartphone shipments in the first half of this year were 601 million units, down 8.7% year-on-year. The Chinese market Android camp has had a greater impact, with only 142 million smartphone shipments in the first half of the year, down 14.5%.

Narrow road to the brave win. Global shipments of more than 70% of the cell phone track, the best CMOS manufacturers "litmus test".

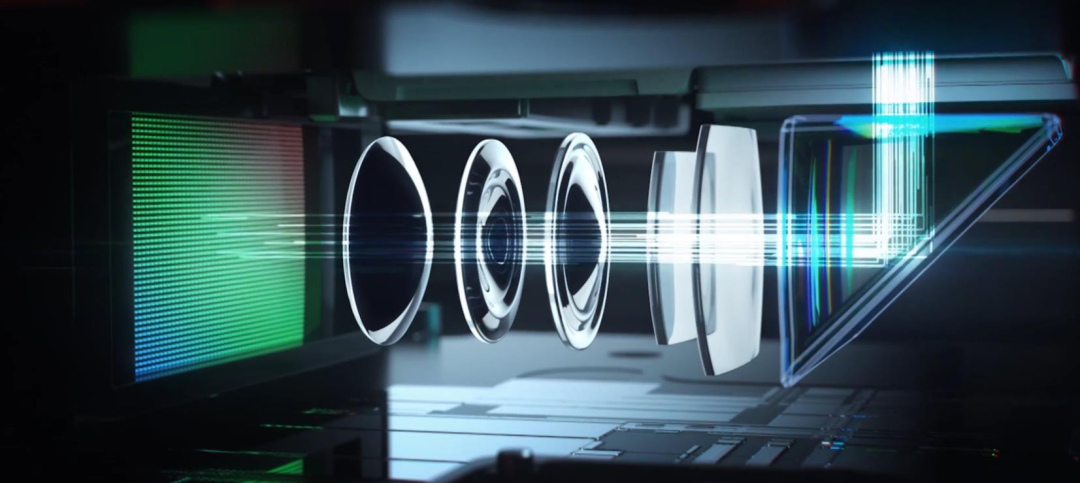

Cell phone camera manufacturing costs are mainly composed of CMOS image sensor, module package, optical lens, voice coil motor, infrared filter and other parts. Among them, CMOS image sensor is the core of the camera composition, is also the most critical technology, occupying about 60% of the cost of cell phone camera.

Tide Electric think, although now the smart car gradually take off, AR/VR meta-universe concept is hot, the Internet of everything has given rise to more forms of access terminals, but in the next five years or even longer, the cell phone terminal is still the largest demand market for CMOS, but also the major manufacturers to compete for the high ground.

Trapped cell phone, CMOS market decline for the first time in 13 years

According to the statistical analysis of Tide Electric Intelligence, the global CMOS market sales are expected to decline by 6.5% to $17.7 billion this year, facing the first decline in 13 years.

The root cause is the global consumer economy weakness caused by the epidemic, as well as the lack of innovation in cell phone products, longer replacement cycle and other factors, resulting in the decline in global smartphone sales.

Affected by the downturn in the downstream cell phone market, the growth rate of CMOS image sensor demand has decreased, and the sales of CMOS image sensors for smartphones are expected to be $16.9 billion by 2025, with a compound growth rate of around 3%.

In the first half of this year, Sony's CMOS image sensor sales to leading Chinese system manufacturers were lower due to the U.S. trade ban. Still, Sony believes that excess inventory of cell phones and image sensors will be reduced by early 2023, with market conditions ending and getting back on track in March next year.

In addition to weak demand for mainstream consumer smartphones, CMOS image sensors have been negatively impacted by high inflation and soaring energy costs due to the Russia-Ukraine war, as well as deteriorating global economic conditions caused by the U.S. trade ban on China.

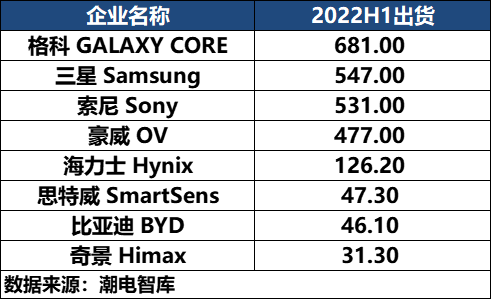

Clearly divided, the top four shipments accounted for 90% of

Data show that the average number of cameras carried by each phone worldwide will average about 4.1 in 2021, twice as many as in 2017. To improve the camera capacity of smartphones, cell phone manufacturers in addition to the main camera continue to add ultra-wide angle, macro, telephoto, ultra-telephoto and other different functions of the camera, 3-5 cameras become the current market mainstream configuration.

From the perspective of the competitive landscape, the cell phone CMOS image sensor market belongs to a high degree of monopoly market.

In the first half of this year, the total shipments of 8 cell phone CMOS manufacturers were close to 2.5 billion units, and the top four manufacturers in terms of shipments were Gecko Micro (681KK), Samsung (547KK), Sony (531KK) and Howell (477KK), accounting for 89% of the total.

In the head camp, genetically only Gekomicro is considered a true representative of domestic CMOS. According to global shipments, Gekomicro will ship 1.9 billion CMOS image sensors in 2021, accounting for 26.8% of the total, making it the "ten champions" of the global cell phone CMOS market share. If you take the sales caliber statistics, last year, Geke micro CMOS image sensor sales revenue reached 900 million U.S. dollars, ranking fourth in the world.

It can be seen that domestic CMOS has steadily occupied the industry's head position, but the space for market substitution is still huge.

Return to experience, high-end is not the only choice

In August this year, Motorola released its first 200 million pixel flagship phone motoX30 Pro. The gimmick was sufficient, but the evaluation from the industry chain and the market response were relatively general, and there was no obvious role in promoting the change of cell phone camera industry.

From a purely technical point of view, 100 million or even 200 million pixel CMOS has already appeared, but it is more of a concept than an application, and is regarded as the performance of manufacturers' "muscle show".

Unlike the gradual upgrade of cell phone chips, screens and other structural components, the camera is being reduced in the last two years. Cell phone supply chain experts Chen Yu said, this indicates that cell phone brands and CMOS chip supply has entered a new stage of more pragmatic, rational return to the user experience.

Without the support of product experience, high-end will be a pavilion in the air.

According to the tide electricity intelligence statistics, from last year to date, Xiaomi, Huawei, OPPO, vivo, glory and other first-line brands released nearly 20 flagship analysis, 50M main camera accounted for 87%, becoming the most mainstream configuration.

In September, Apple iPhone 14 equipped with 48 megapixels, sitting 50M is the optimal solution under the existing technology "imaging effect, size, cost" program, and will be used in the future for a long time by the cell phone terminal.

In this most competitive CMOS battlefield, Sony, Samsung and Howell currently dominate. Sony still leads, but compared to the peak of the dominant power has been greatly weakened. Data show that Sony CMOS revenue of $8.2 billion in 2021, is its seven major business modules is the only business unit to see a decline in both revenue and profit.

Domestic manufacturers, represented by Gekomicro, are trying to burst into the high-end.

On August 10, Gecko Micro officially released the world's first single-chip 32-megapixel CMOS image sensor GC32E1.

In fact, in the CMOS track of cell phones, GK Micro has become an "open secret" to enter the high-end. In July this year, Gecko micro self-research 0.7um process 32M, 50M CMOS sensor has been suspected of exposure. Tide Electric Intelligence learned from the industry chain that its GC50E (50M) and GC32E (32M), like the 0.7um process route, is about to enter the promotion phase.

This indicates that Gecko Micro has opened up all the domestic industry chain resources and will encounter Sony, Samsung, Howell and other traditional strong players head-on.

Industry experts predict that 2023 is expected to be a big year for high pixel further popularization of cell phones, and various CMOS manufacturers are grasping to enter this main track.

Cross-border action, domestic more advantageous

A research firm predicts that the CMOS industry will recover moderately next year with market sales to $19.3 billion, then reach a new high of $21.7 billion in 2024.

"The proportion of CMOS in the cell phone market will decline rapidly in the next three years, at around fifty percent or even less." Sun Yanbiao, a tidal power think tank, believes that in the AIoT era, as an important visual perception system, cameras will be widely adopted by smart cars, smart security, smart glasses, whole house intelligence and other multi-terminal products.

In other words, CMOS will see rapid growth in the non-cell phone field. According to Tide Electric Intelligence, Chinese manufacturers are significantly faster than overseas in cross-border expansion in emerging markets.

In the first half of this year, Gekomicro achieved revenue of 3.29 billion yuan and net profit of 510 million yuan. Gecko Micro said that non-mobile CMOS fields such as smart city, automotive electronics, notebook computer and Internet of Things are very important components, and the company has continuously launched 3 new products of smart city/automotive electronics series based on its own intellectual property 65nm+ CIS process platform and patented FPPI technology.

The automotive market is the fastest growing market for CMOS image sensors. Advances in autonomous driving technology have seen the number of in-vehicle cameras mounted on a single vehicle skyrocket. The camera configuration of new powerhouse models such as Azure ET7, Xiaopeng P7, and Polar Fox Alpha S has exceeded 10.

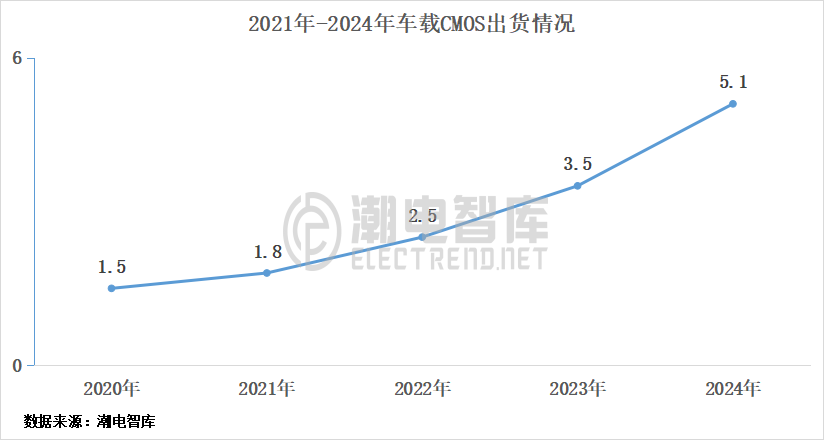

Tide Electric Intelligence estimates that global shipments of in-vehicle CMOS will exceed 250 million units this year, up 39% from 180 million units in 2021. Tide Electric Intelligence predicts that the car CMOS market will maintain a compound growth rate of about 40% in the next three years, and the global car camera shipments will exceed 700 million units in 2025.

ON Semiconductor currently occupies the high-end global in-vehicle CMOS market, with a 45% market share in 2021, and Weir shares 29% of the market, ranking second. In addition, domestic companies including Gecko Micro, BYD Semiconductor, and Sitewell are also laying out the field.

"After Europe, America and Japan and South Korea, the third automotive era belongs to intelligence, chemistry belongs to China, and the most powerful automotive supply chain is bound to appear in China." Sun Yanbiao said, compared to the technical specifications of automotive CMOS is not as high as the cell phone side, but because of the long validation cycle of automotive-grade electronics, so the next three years will be an explosive year for domestic CMOS manufacturers.

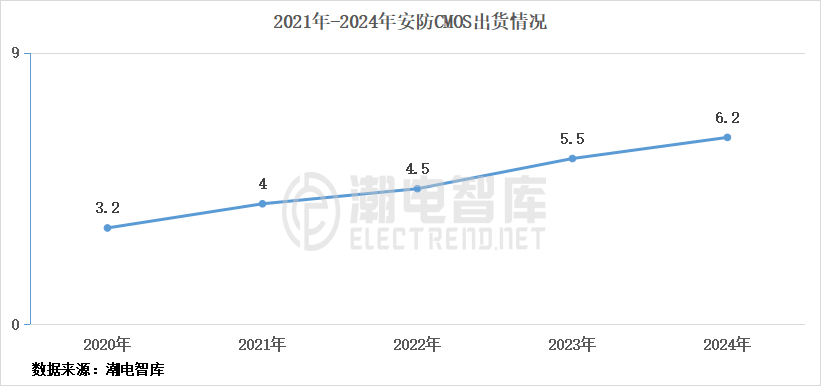

In the field of security, smart cities and smart life, the rapid advancement of the security camera industry to bring huge pulling power. According to the Tide Electric Intelligence statistics, the security CMOS market shipments reached 400 million units in 2021, an increase of 28% year-on-year.

Compared to cell phones and automotive track, 2022 security CMOS market will show a steady rise, especially the consumer security market will have greater room for improvement. According to Tide Electric Intelligence estimates, in 2021 the global consumer security CMOS chip market shipments in about 70 million, this year is expected to exceed 100 million mark.

Summary

Domestic alternative is the trend, the competitiveness of the need for strong polishing

Since 1873, scientists Joseph Mei and Willoughby Smith first discovered that selenium junction crystals can generate current after sensing light, CMOS development has been 149 years of history.

Driven by the development of smart phones, CMOS has found a good application in the last 10 years. However, due to multiple factors such as the downturn in the consumer environment and the lack of product innovation, the cell phone market is gradually falling back rationally, and the related CMOS shipments are directly testing the "gold" of manufacturers.

Cross-border new areas is the main theme of the CMOS industry today, smart cars, notebooks, security, AR / VR is the most promising non-cell phone track.

It must be admitted that the domestic CMOS industry started late and is generally in a backward position. But compared to overseas powerhouses such as ON Semiconductor, Sony and Samsung, Gecko Micro, BYD Semiconductor and Weir have outstanding local combat capabilities and are more able to closely follow the needs of industry customers, gradually expanding market share and penetrating into the mid- to high-end market.

In this arduous attack, Chinese CMOS manufacturers need to continue to consolidate their technical and product strength. Because the market is always the application is king, cost-effective to win.

Translated with www.DeepL.com/Translator (free version)

recommend

Feb 03, 2024

Recently, overseas institutions have downgraded Apples rating. For a time, Apple from being bearish in mainland China du...

Hot