Headset ODM manufacturer SkyKey IPO, large customer orders dive in the first half of the year, future growth worrisome

Time: Oct 22, 2022Views:

Headphone ODM manufacturer Tiankey Electroacoustic is trying to achieve relief for its own business through IPO.

Information on the official website of the Shenzhen Stock Exchange GEM issuance and listing audit information shows that SkyKey Electro-Voice recently disclosed a second inquiry response letter and updated the prospectus.

In the letter of inquiry, the Shenzhen Stock Exchange also asked the company to explain the performance sustainability. In this regard, SkyKey replied that under prudent assumptions, it is expected to achieve annual revenue of 1.251 billion yuan, down 11.34% year-on-year, and is expected to achieve net profit after deduction of non-pareil attributable net profit of 70,082,400 yuan, down 26.17% year-on-year; under optimistic assumptions, it is expected to achieve annual revenue of 1.353 billion yuan, down 4.11% year-on-year, and is expected to achieve net profit after deduction of non-pareil attributable net profit of 80.2293 million yuan, down 15.48% year-on-year.

However, that's just what the numbers say. In fact, as the global cell phone market suffered an unprecedented winter, including headphones, cell phone peripherals market conditions are also a chicken, the next two years of market development are extremely optimistic.

The dilemma is that its main business around the traditional electro-acoustic brand, and is becoming the main force of the electro-acoustic cell phone brand, and did not become a key to the electro-acoustic customers.

The trouble is that the cell phone ODM manufacturers represented by Wintel, Huaqin and Longqi, in the cell phone business decline juncture, coincidentally also headphone ODM as the focus of its future development. From this point of view, even after three years, the market recovery, the sky key electroacoustic market growth space is very limited.

Backed by Harman

The prospectus shows that the past three years, SkyKey electro-acoustic customers are extremely stable, Harman, Sennheiser, TonePoint, TPV Group, Corsair and other traditional electro-acoustic giants are its major customers.

The largest customer is Harman, accounting for 60% of its revenue in the past three years, while other major customers account for less than 10%. 2019 to the first half of this year, the company's sales revenue to Harman Group accounted for 26.75%, 62.47%, 58.71% and 62.07%, respectively, in 2020 accompanied by sales revenue to Harman Group from 148 million in 2019 to 785 million. billion to 785 million yuan, the company's operating income for the period reached 1.256 billion yuan, an increase of 126.71% compared with 2019.

However, in the first half of this year, the risk of SkyKey Electroacoustic's high dependence on Harman Group gradually emerged.

Information in response to the inquiry letter shows that Russia is one of the main export regions of Harman Group's products, and the sales revenue of products exported to Russia in 2021 is 130 million yuan, with a sales revenue of 9.21%. The war between Russia and Ukraine broke out at the end of February this year, and Harman Group did not place any order to the company for shipment to Russia after the war broke out. The sales revenue of the company's products exported to Russia in the first half of this year dropped 69.03% year-on-year.

At the same time, SkyKeys said that due to the delay in R&D progress, the company's new project of TWS headphones of Harman Group, which is expected to have a large sales volume, did not achieve mass production in the first quarter of this year, and failed to make up the sales gap of two main models in time. In this context, the company's TWS headset sales revenue in the first quarter fell 45.99% year-on-year.

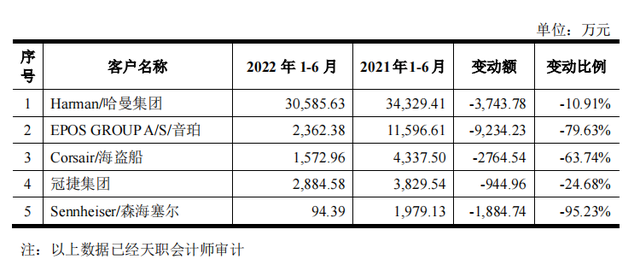

The company's dependence on Harman Group further increased in the first half of the year, along with the decline in sales from other top five customers. Information in response to the letter of inquiry shows that in the first half of this year, the company's second to fifth largest customer sales declined 79.63%, 63.74%, 24.68% and 95.23% year-on-year, respectively, while the sales revenue of Harman Group further increased to 62.07% from 52.21% in the first half of 2021.

However, according to the forecast of SkyKeys, the revenue share of Harman Group will be reduced to 50.9% for the whole year of this year under prudent assumptions.

For the second half of this year's performance, TECS is pinning its hopes on new customers such as Anchor Innovation and Nothing. But from the data report of Tide Electric Intelligence, Anker Innovation and Nothing in the headphone market position, still in the third camp. It is difficult to create growth momentum in the next three years for Tide Key's electroacoustic business, at best, to fill.

Homogenization of headphone products

The performance problem of SkyKey Electroacoustic, on the one hand, is unable to quickly harvest the headphone orders from cell phone manufacturers, on the other hand, the headphone product technology innovation is now in a bottleneck, the market product homogenization is serious, coupled with the global economic weakness and other reasons, the market is extremely depressed.

The main products of SkyKey Electroacoustic are all kinds of headphone products, including headphones, TWS headphones, in-ear headphones, and also operate walkie-talkie accessories and car accessories, acoustic parts, etc. From 2019 to the first half of this year, the revenue of headphone products accounted for more than 86% year-round, of which headphones and TWS headphones are the main source of revenue.

In the three years of 2019, 2020 and 2021, benefiting from the outbreak of demand for TWS headphones, SkyKey Electroacoustic's operating revenue grew at a CAGR of 59.56%. However, in the first half of this year, this growth momentum has suddenly disappeared.

For the first half of the performance decline, the sky key electric claim, the first half of the war in Russia and Ukraine, the new crown epidemic and other external factors, the macroeconomic situation and consumer electronics market demand uncertainty continues to increase, the company itself also entered a period of new and old project product switching, part of the sales revenue accounted for a relatively large number of TWS and headset project in 2022 has ceased production or gradually enter the life cycle At the same time, the company's product revenue concentration is high, and the gradual withdrawal of a single major product from the market has a greater impact on the company's overall operating income.

It can be seen that the key to the sound through the IPO fund-raising 600 million yuan, but also want to electroacoustic technology innovation level, dig a deep well, continue to serve its large customers. But the difficulty at hand is that the market is changing too fast, the past glory instantly into a piece of rubble.

recommend

Feb 03, 2024

Recently, overseas institutions have downgraded Apples rating. For a time, Apple from being bearish in mainland China du...

Hot