Following Europe, many global inverter companies are extending their tentacles to the United States.

Industry research report said that from January to July this year, China's exports of inverters totaled 47.8 billion yuan, of which exports to Europe amounted to 29.5 billion yuan, accounting for 62% of China's total exports of inverters. Although Europe is still the "treasure bowl" of the inverter industry, the inventory problem is becoming more and more prominent, and it takes time to continue to digest.

In this context, the U.S. inverter market has become a new target and is expected to maintain high growth.

Combined with the recent energy storage special market research in the U.S. for nearly a month, Wang Huan of Chao Dian Think Tank believes that "China's new energy storage and inverter enterprises in the U.S. to establish a local team, assembly plants and warehousing resources, is the current way to minimize the return on investment is the highest, but also to win the competition of the key winners and losers."

According to the tide of electricity think tank understanding, the current active manufacturers of the U.S. standard inverters are mainly Megger energy, Shuozhi, Oxford, etc., but Siemens, Wo Mai and other strong enterprises have gradually entered the market. If the current European mainstay such as sunlight power, jinwang technology, huawei and other more head players strategic shift to the United States, the new center of the global inverter battlefield will be a touch.

European stage demand slowdown

According to the relevant data disclosed by the General Administration of Customs recently, China's exports of inverters in August continued to reduce the number and amount of year-on-year.

In August, China's PV inverter export quantity of 4,020,900 units, a year-on-year decline of 4.79%; the corresponding export amount of 690 million U.S. dollars, a year-on-year decline of 28.32%.

The main reason is that the overseas market stage demand slowdown, export weakness is expected to be related to the high base of the same period last year, the European market inventory digestion as well as the lack of overseas installation efforts. The research organization pointed out that the decline in energy prices in Europe and the influx of a large number of enterprises into the energy storage market and other factors have triggered a decline in demand in the European household energy storage market, and the channel inventory has gradually risen.

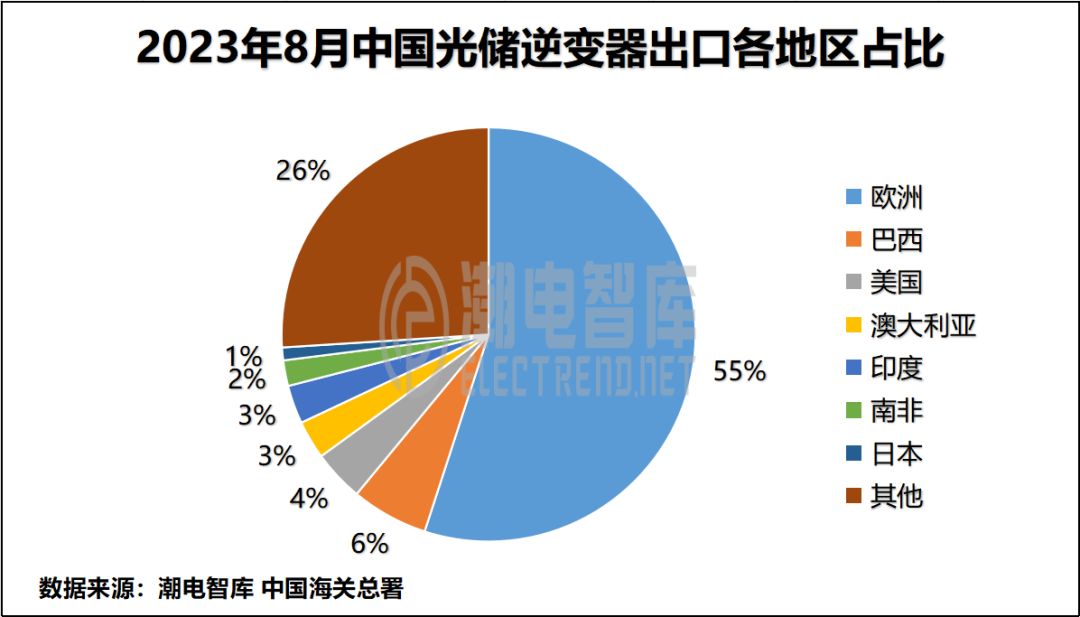

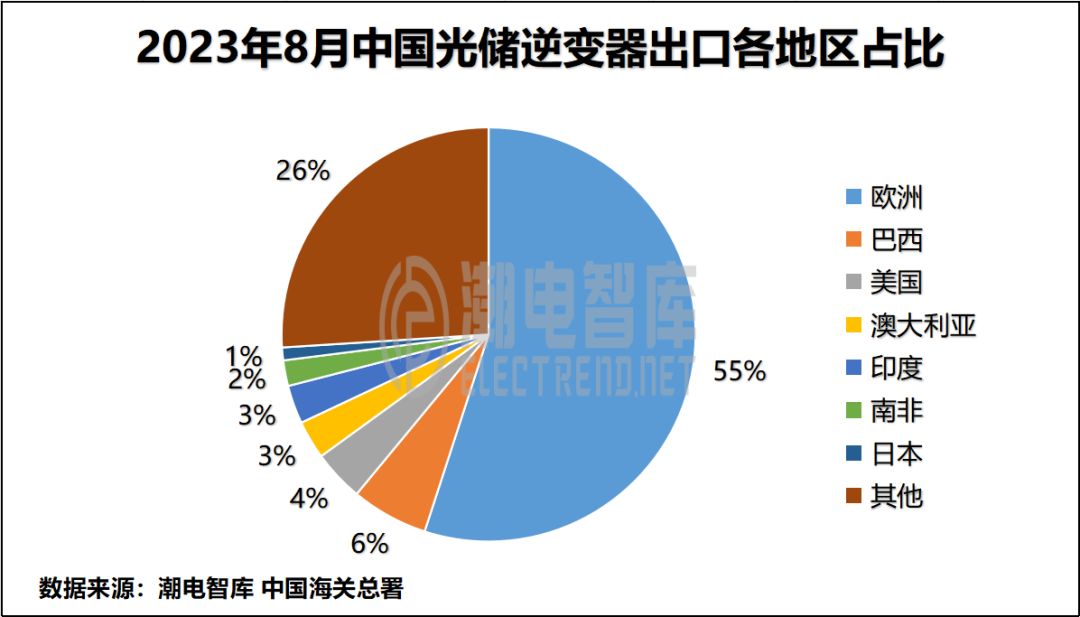

Sub-region, China's exports of European optical storage inverter amounted to 382 million U.S. dollars in August, a year-on-year decrease of 32.8%, a year-on-year decrease of 13.7%, accounting for 55% of the export value; exports of U.S. optical storage inverter amounted to 0.026 billion U.S. dollars, a year-on-year decrease of 41.2%, a year-on-year increase of 2.5%, accounting for 4% of the export value. Australia / India / Japan in August export amount accounted for 3% / 3% / 1%.

From the data analysis, the European region export amount is a declining trend, the Netherlands, Germany and other major European PV market export volume also continued to decline, is expected to Europe still exists a certain amount of inventory pressure. July-August by the impact of the European holiday demand slowdown, PV installed end demand is in the off-season, the inventory to go slower.

Also according to the General Administration of Customs data, from January-August 2023, the total export country data, Europe is 4.65 billion U.S. dollars, accounting for 61%; South Africa/Brazil/U.S. /Australia accounted for 6%/5%/3%/2%, respectively.

It takes at least half a year for American Standard certification

At present, many inverter enterprises in China have taken the United States as a key market to develop, but face the reality of American Standard certification problems.

According to the industry chain, it takes at least half a year to certify inverter products exported to the U.S., and the cost is more than RMB 700,000 yuan. Currently, inverter manufacturers such as Meggergy, Shuozhi and Oxford, which have already obtained the American Standard Certification, are seizing the time to seize the local market share.

Data show that MAGRENE is a professional energy storage inverter supplier, providing customers with standardized energy storage inverter products, customized solutions and ODM services. For household storage and industrial and commercial areas, the company launched this year G2 and two series of products of energy storage inverters and PM modules.

Shenzhen Shuo Ri New Energy Technology Co., Ltd. was founded in 2009, headquartered in Shenzhen, China, its products include household PV energy storage system, household PV energy storage inverter, and solar charge and discharge controller. It is reported that Shuori is new inverter product development investment from 2017, officially cut into this track.

Comparatively speaking, Oxford's business field is broader, mainly providing a variety of emerging products for total solutions, home automation and green energy market, covering solar energy systems to air-source heat pumps, double-glazing, energy-saving LED lamps, smart door locks, electric blinds, electric vehicle charging, utility poles, and electric bicycles. Its European headquarters is in the UK and it has a branch in Australia.

Wang Huan said that there are actually very few local inverter manufacturers in the United States that really have the strength, so it seems very crucial for Chinese companies to build assembly plants in the United States. If this step is missing, the whole market layout will not be able to form a perfect business closed loop.

Siemens, Womai and other giants enter the market

Some media reported in August that as a representative of German technology giants, Siemens plans to build a factory in Wisconsin in the United States in early 2024 to start production of string inverters suitable for solar modules. The manufacturing plant will be managed by Sanmina, a Siemens partner and U.S.-based manufacturing company.

Ruth Gratzke, president of Siemens Smart Infrastructure USA, publicly stated, "This new production line demonstrates Siemens' strategic focus, which is to provide the best possible service to our U.S. customers while being a key partner in the U.S. transition to a more sustainable future."

Siemens is certainly not alone in recognizing the strategic position of the U.S. market.

At the FY2022 and Q1 2023 earnings presentation held on May 10 this year, Yang Bo, director and general manager of Womai, told investors that the company's current sales and certification of energy storage products are in line with the expected progress, and that its products in the U.S. market are mainly energy storage inverters, which are mainly involved in the household market.

At the same time, Womai stock financial director Li Xinyuan mentioned that the company's products are currently exported to the United States tariffs of 25%, export tariffs in the European region is relatively small.

Chaodian Think Tank believes that for inverter companies that have already obtained the American Standard Certification and successfully entered the U.S. market, it is imperative for them to take the first-mover advantage and strive to stabilize their position with more market share, because with the growth of the market scale, when industry leaders such as Sunny Power, Jinlang Technology and so on come out of the woodwork, it will bring a very strong shockwave.