If it sells 4.03 million more units in August, Quti's cell phone camera module shipments could surpass rival Sun Microelectronics Technology (02382.HK) for the first time in two consecutive months.

On September 13, Quti Technology announced on the Hong Kong Stock Exchange that it sold 34.688 million cell phone camera modules in August, down 14.6% year-over-year.

On September 14, QutiQ's stock closed at HK$4.07, down 3.55% from the previous trading day.

"The market environment is particularly bad this year, and everyone is living on a hungry stomach." Wei Liang (a pseudonym), an executive of a domestic first-line optical manufacturer, said, affected by the downstream brand cell phone manufacturers to cut orders and prices, now the industry is serious in the volume, the general order shortage, are seeking opportunities in cross-border smart cars, whole-house intelligence and other fields.

According to the tide electricity intelligence statistics, Quti cell phone camera module in the first eight months of this year, a total of 280 million units shipped, less than Sunyu's 360 million units. In the same period last year, Quti shipped 300 million cell phone camera modules, compared to Suntech's 470 million. It can be seen that both sides are on the downside of shipments, but the gap has gradually narrowed.

From Quti's August shipment announcement, three major information points are clearly visible.

First, cell phone sales "ceiling" has appeared, optical manufacturers have dived.

For the camera module product shipments decline, Quti Technology said, is affected by the macro situation, smartphone sales are still not ideal.

Wei Liang said that the macro situation refers to the lack of innovation in cell phone products, the extension of the user replacement cycle, as well as the global consumer environment downturn caused by the epidemic and other aspects.

"In the next three years, one billion units will be the 'ceiling' of global smartphone sales." said Sun Yanbiao of Tide Electric Intelligence.

Tide Electric think tank learned from the industry chain, because of the decline in orders production capacity is not saturated, some optical factories have adopted a weekly double or even three off work system. Wei Liang said, "There is no way to stabilize the workers, maintain normal operation. Otherwise, the low past, and then recruiting workers is more difficult."

Tide electricity think tank statistics of major optical manufacturers of camera module / lens product shipment data show that this year, a sharp decline year-on-year, an average of more than two percent of the margin.

In the general environment of cell phone in-volume, the camera junction module presents a situation of falling volume and price.

Second, the high-end market growth is weak and demand is weak.

The chill of cold smartphone sales filled the whole industry. Especially the high-end cell phone market, because the brand end of the innovation is not enough, the pulling power is not enough, so that the core camera module suppliers struggle.

In January this year, Quti shipped 13.338 million high-end cell phone camera modules with 32 million pixels and above, a 39.4% year-on-year jump. According to Chiu-Tech's statistics, Quti's high-end cell phone camera module product shipments from February to August were down to varying degrees year-on-year, including a 43.% year-on-year decline in April.

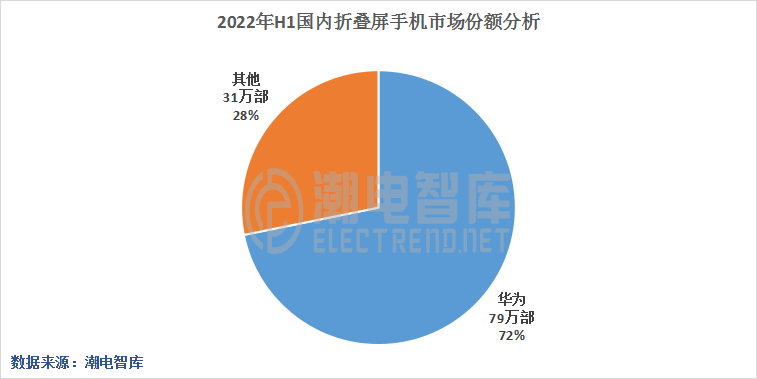

Since the second half of last year, Xiaomi, Huawei, OPPO, Vivo and glory and other major brand manufacturers set off a new wave of folding screen cell phones, trying to change the road to seize the high-end market. From the actual performance, the folding screen is not enough to replace the consumer's daily host position, sales are limited.

According to Tide Electric Intelligence statistics, China's smartphone sales in the first half of this year was 141 million, down 14.5% year-on-year; folding screen phones, despite the exaggerated growth rate, but absolute sales of only 1.1 million, accounting for less than 1% of total smartphone sales.

It should be noted that China's folding screen cell phone market is basically monopolized by Huawei, its market share of more than 70% in the first half of this year.

Three is the non-mobile phone field to take off, car and IoT run the fastest.

Starting from this year, Quti has differentiated its monthly results by mobile and non-mobile The business is differentiated.

Quti related executives explained to Tide Electric Intelligence, "separately monitor the progress of non-mobile phone growth, this is the future trend." With the weak performance of the cell phone industry in recent years, Quti has also started to cross borders and layouts in automotive, Internet of Things smart terminals (IoT) and other fields.

Quti's announcement data shows that the company sold 512,000 non-cell phone camera modules in August, up 287.1% year-on-year. Both the shipment volume and the growth ratio are the highest value this year.

"Quti's pace of entering the automotive field is relatively lagging, and it will take a time period for the scale shipments to manifest." According to industry chain sources very close to Quti, the significant growth of non-cell phone camera module sales in August mainly came from the IoT business.

From January to August this year, Quti's non-mobile phone business camera module shipments reached 2.421 million units. Wei Liang believes that although the scale of shipments is small, but for Quti to achieve "from 0 to 1" strategic significance is more significant.