As the core component of the energy storage system that realizes bidirectional energy conversion and adapts to the power grid, PCS plays a very important role.

PCS can smoothly switch between grid-connected and off-grid, control the charging and discharging process, improve the quality of output power, and ensure the safe operation and service life of the energy storage battery pack.

Relevant organizations predict that the global installed capacity of energy storage will grow by 56% in the next five years, and will reach about 270GW by 2026, and the global energy storage market size will be more than 100 billion U.S. dollars.

The United States, as a large country with energy storage demand, has a huge PCS market and attaches great importance to the research and development of PCS technology.

In 2023, the U.S. annual energy storage installation is expected to reach 8.36GW, a year-on-year growth of 103%; in 2024, the U.S. plans to install 14.91GW of energy storage, a year-on-year growth of 78.4%.

PCS technology innovation will promote the performance of the entire energy storage system to improve, will more reduce the unit cost and loss of the U.S. energy storage installation, to expand more application scenarios.

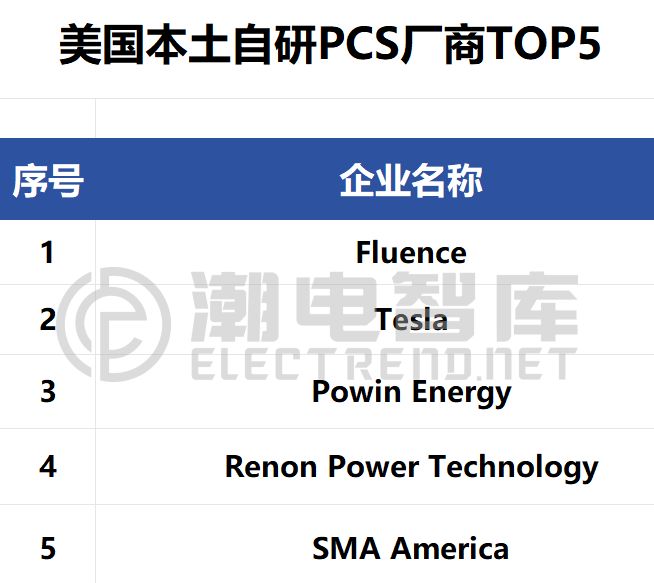

Tide Power Intelligence summarizes the top 5 U.S. local self-developed PCS vendors here.

Founded in 2018, Fluence was established by electrical industry giant Siemens and energy storage industry pioneer American AES Power (AES).

Although the company has not been established for a long time, its business has grown rapidly and it has become a leading global provider of energy storage products and services as well as renewable energy optimization software. By 2023, its customers will cover over 225 projects in 47 regions, with a shipment scale of 7GWh.

Fluence is the world's second-largest battery energy storage system integrator in terms of project numbers, after Sunny Power, which has installed and contracted the largest number of projects. Among the world's top five battery energy storage system integrators in 2022, Fluence is on par with Tesla, ranking second with a 14% market share.

Fluence is also the No. 1 system integrator in Europe, with a 19 percent market share in Europe.

Fluence recently reported its fourth fiscal quarter 2023 results, reporting net income of approximately $4.8 million for the period, making it profitable for the first time.

Tesla.

Founded in 2003, Tesla's business mainly covers electric vehicles and renewable energy, and the company currently offers energy storage products including Powerwall, Powerpack, and Megapack, a large commercial and industrial energy storage battery.

This year, the U.S. installation of residential batteries in about half of the Tesla Powerwall, Tesla has become the U.S. household storage market share of the highest brand.

Data show that Tesla's energy storage business in the third quarter generated 1.56 billion U.S. dollars in revenue, accounting for 7% of total revenue, and its gross profit margin reached 24.4%, higher than the automotive business of 15.9%.

On December 22nd of this year, Tesla's Shanghai energy storage super factory has been officially launched.

Powin Energy

Founded in 2010, Powin Energy is a supplier specializing in battery energy storage systems. Its headquarters is located in Portland, Oregon, the United States, in the field of energy storage has nearly 10 years of development history, is the head of the United States, one of the energy storage integration enterprises.

Data show that Powin Energy has been ranked among the top three global energy storage system integrators in recent years. According to incomplete statistics, Powin Energy has successively reached relevant cooperation with Chinese enterprises such as Ningde Times, Yiwei Energy Storage, Ruipu Lanjun, Haichen Energy Storage, Vision Power, GCL and CIMC.

Powin Energy has more than 2,500 MWh of energy storage projects worldwide, covering power generation, transmission and distribution, solar, microgrid, commercial and industrial sectors. The company is not only strengthening its competitiveness in the U.S. market, but also expanding its applications in other markets around the world.

In March, Powin Energy announced that it will build its first battery storage system facility in the U.S., and is also working to enter other energy storage markets, including the U.K.

Renon Power Technology

Renon Power Technology specializes in energy storage batteries and fast charging solutions, primarily using lithium iron phosphate battery technology.

Its PCS product line includes EStation, Xtreme, Xcellent and EBrick, all of which are based on a bi-directional DC/DC modular design that allows for parallel expansion of DC bus power and a wider range of application scenarios.

The company mainly provides energy storage products for residential and commercial use, including high voltage and low voltage energy storage systems. The company's smart charging pile is the AC Coupling Smart Pile. 207 kWh On/Off-Grid Integrated Solution and EStation Series are all-in-one solutions developed by the company that integrate energy storage systems, inverters, transformers, switchgear and monitoring systems.

SMA America

SMA America offers solar inverters, storage inverters, medium-voltage box transformers, DC technology, system monitoring solutions, applications and digital products.

The company's Sunny Central UP is a centralized PCS product. It has a maximum output of 4,400 kVA (1,500 V DC) and utilizes IGBT technology with a meter of 2,400 V. The product is designed for use in a wide range of applications.

SMA Solar Technology has announced plans to expand its production capacity in the US, which is expected to start in 2025, with an annual capacity of 3.5GW.