In the past 8 years, the "Global Best-Selling Mobile Phone Market Analysis Report" published by TidePower Intelligence has become a trendsetter for the cell phone market. Report consultation: Mr. Yuan 16675544419

Today, the "Global Best-Selling Smartwatch Market Analysis Report" will extend the successful experience in cell phone market data analysis to create a "splendid star river" for smartwatch market data research.

Unlike the global best-selling cell phone market analysis report, the global best-selling smartwatch market analysis report focuses on the Top 20 best-selling smartwatch models in the high, mid-range and low-end price brackets, and provides a clearer picture of the market pattern of smartwatch brand manufacturers and insight into the market development trend. The real market strangulation has not started yet.

In order to more dynamically represent the advancement and retreat of smartwatch brands, some of the tables in the global best-selling smartwatch market analysis report will be extended to the Top 40 brands.

There are two points worth noting, one is that Tide Electric Intelligence defines the hardware standard of smartwatch, firstly, the round screen is larger than 1.7 inches, and the square screen is larger than 1.4 inches; secondly, with communication or with Bluetooth communication protocol, those with the above two conditions are defined as smartwatch.

Secondly, the smartwatch brands with shipments within TOP30 are called brand smartwatches in this report, and those with shipments after TOP30 are defined as white brand smartwatches.

Since several major mainstream brands have sub-brands, please understand that the global best-selling smartwatch analysis report is based on whether it is financially independent accounting to distinguish the market share of major brands.

That is, Xiaomi includes Xiaomi and Redmi and Zimmy brands, while OPPO, Realme and One Plus are counted independently.

Export overseas models are similar to similar models with different names, and the number of model models are counted by model name.

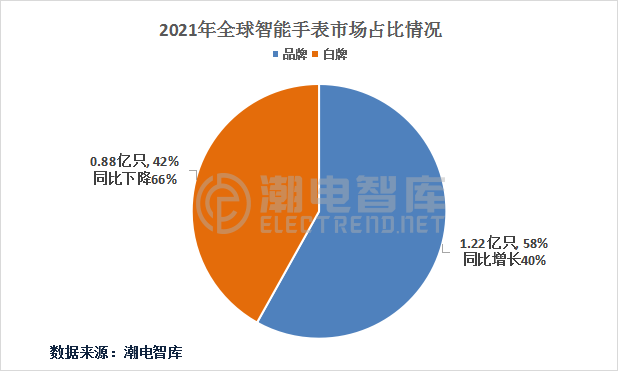

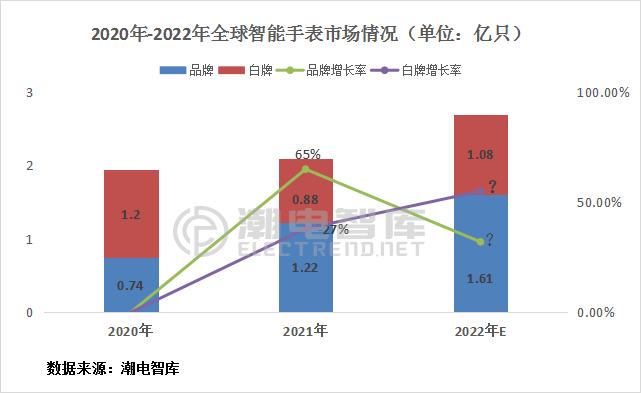

The global smartwatch market shipments reached 210 million units in 2021, up 8% year-on-year.

Among them, 122 million units were sold by smartwatch brand manufacturers, up 40% year-on-year and accounting for 58%; 88 million units were sold by white label smartwatches, down 66% year-on-year and accounting for 42%.

Tide Power Intelligence expects that the global smartwatch market shipments will grow by 20% to 250 million units in 2022.

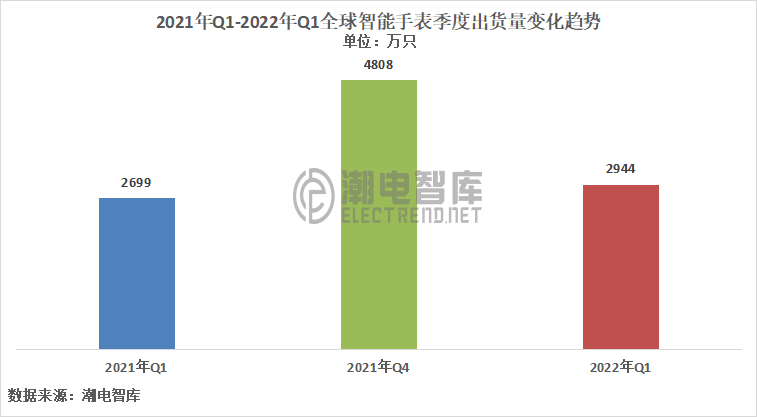

Global smartwatch brand shipments in Q1 2022 were 29.44 million units, down 38% from 48.08 million units in Q4 2021 and up 9% year-over-year.

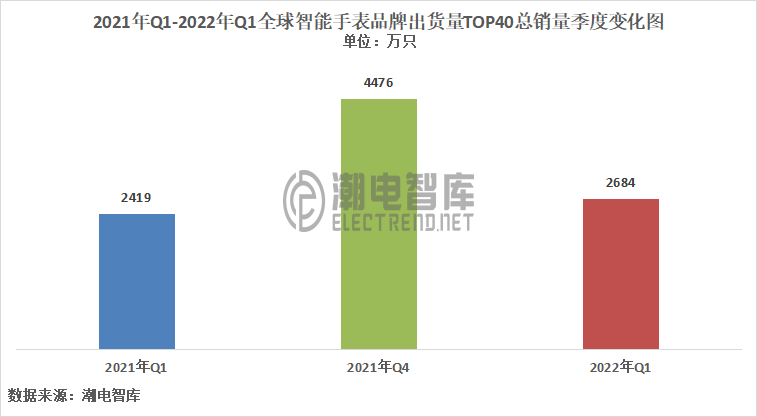

1. Top 40 global smartwatch brands shipped in Q1 2022

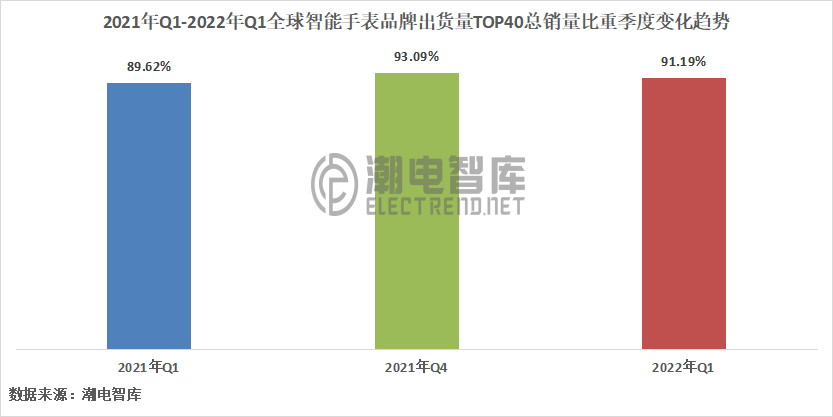

The TOP40 global smartwatch brands shipped a total of 26.84 million units in Q1 2022, down 40% from 44.76 million units in Q4 2021 and up 10% from 24.19 million units in Q1 2021.

In terms of market share, the shipments of the TOP40 global smartwatch brands accounted for 94% of the total number of brands in the entire market in Q1 2022, a decrease of 2% YoY and an increase of 1.5% YoY.

From the above data, the global smartwatch brand TOP40 has steadily accounted for 90% of the total, the first quarter belongs to the off-season, and the proportion is likely to rise further into the peak season, and the big brand focus effect will be more obvious.

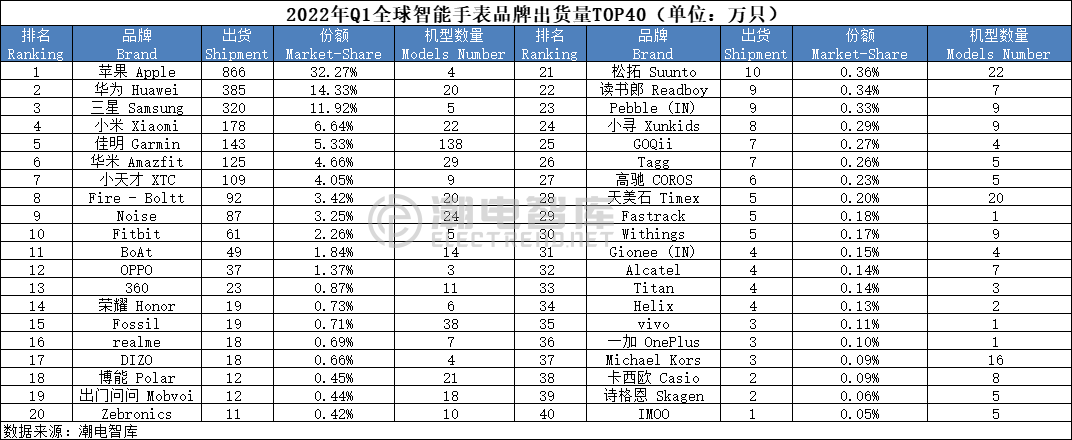

Compared with Q4 of 2021, the overall fluctuation of global smartwatch brand shipments TOP40 in Q1 of 2022 is not big, but there are still bright brands.

Only one seat from TOP1 to TOP20 changed hands, with Songto dropping out and DIZO re-entering the TOP20 camp; there were also new changes in the TOP21 to TOP40 rankings, with the exception of DIZO entering the TOP20 from the TOP40, Sugar Cat and Celes dropping out of the list, and the new entrants being Titan and Fastrack (a subsidiary of Titan), both of which are local Indian brands. The new entrants are Titan and Fastrack (Titan's subsidiary), both of which are local brands in India. This once again shows that the global smartwatch brand market is in a fierce turmoil and the market pattern is not yet stable, so there are plenty of opportunities to strive for upstream.

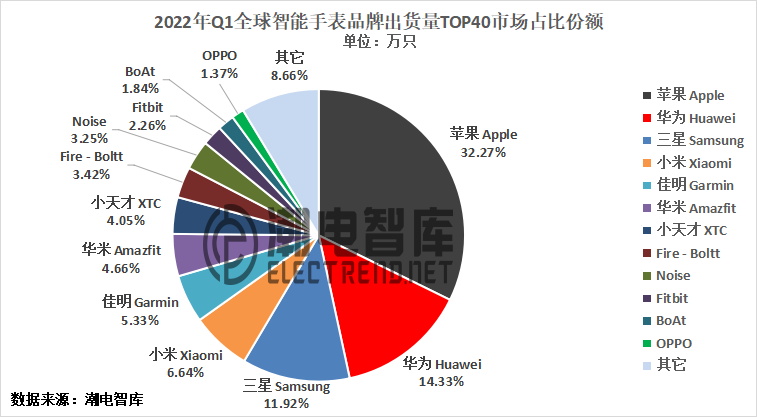

In terms of specific brands, compared to Q4 2021, there is no change in the Top3 ranking, but Apple's market share shrank from 38% in Q4 2021 to 32%, with a large decline in market share, but year-on-year, Apple grew 27% and is still the leader.

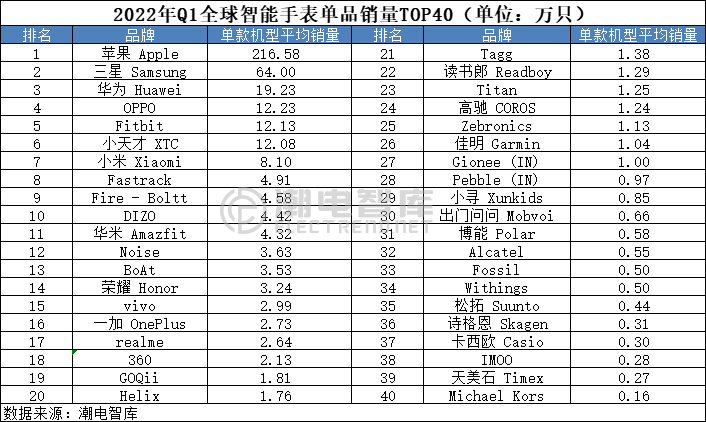

Compared with the TOP40 global smartwatch unit sales in Q4 2021, there is a general decline in Q1 2022, with Apple, Huawei, Samsung and Fitbit all falling sharply, and only Fire- Boltt, vivo and Tagg growing.

2. Top 20 global best-selling smartwatches in Q1 2022: High-end market increased greatly year-on-year, low-end market shrank year-on-year

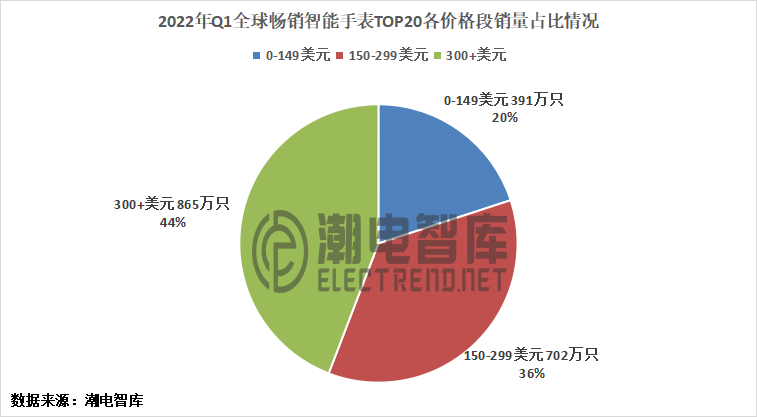

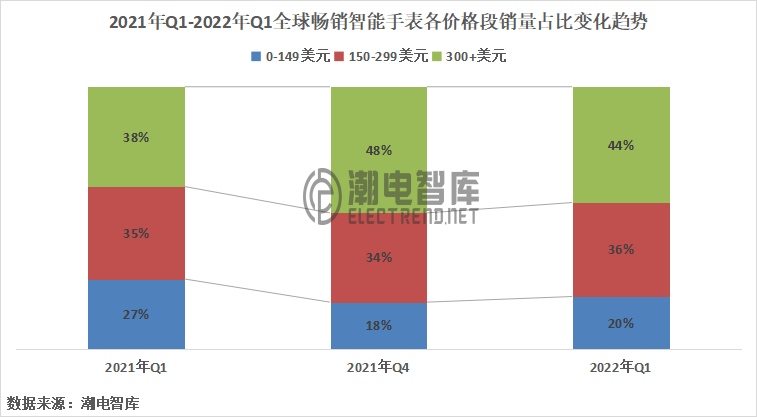

The smartwatch market is divided into high, medium and low-end markets by price point. 8.65 million units were shipped at the $300+ price point, accounting for 44% of the total, a 4% decrease from 48% in Q4 2021, and a 6% increase year-on-year. This indicates that the market share of the high-end market has steadily increased to more than 40% of the total market, despite a decline in the year-over-year rate.

The $150-299 price point shipped 7.02 million units, or 36% of the total, up 2% YoY from 34% in Q4 2021 and up 1% YoY from Q1 2021. The mid-range market achieved double growth year-over-year and year-over-year, with a clear trend of expansion in this market.

3.91 million units, or 20% of the total, were shipped in the $0-$149 price point, up 2% YoY from 18% in Q4 2021 and down 7% YoY from Q1 2021. From the trend, the low-end market has been hovering below 20% market share, with small market volume.

Overall, in 2022 Q1 compared with 2021 Q4, the high-end market slightly decreased drop while the low-end market slightly increased, but year-on-year with 2021 Q1, the low-end market to the mid- to high-end market is very obvious, which indicates that the low-end market survival space is increasingly difficult.

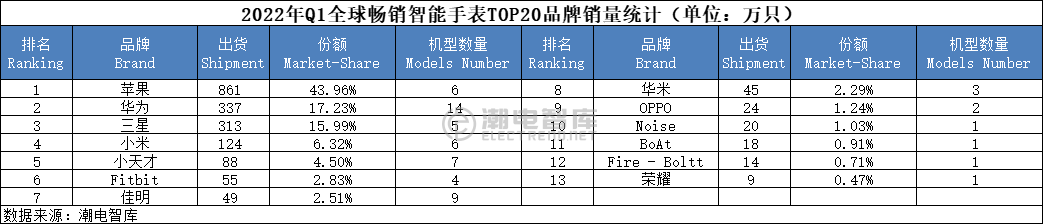

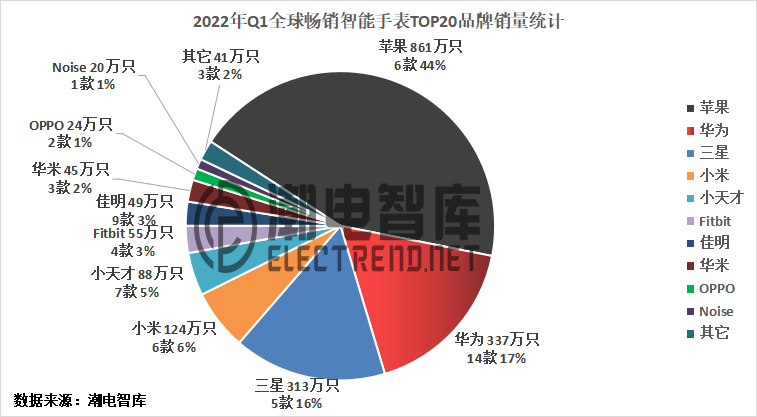

3、Q1 2022 global best-selling smartwatch TOP20 brand sales statistics: bottleneck in the advantage of big brands

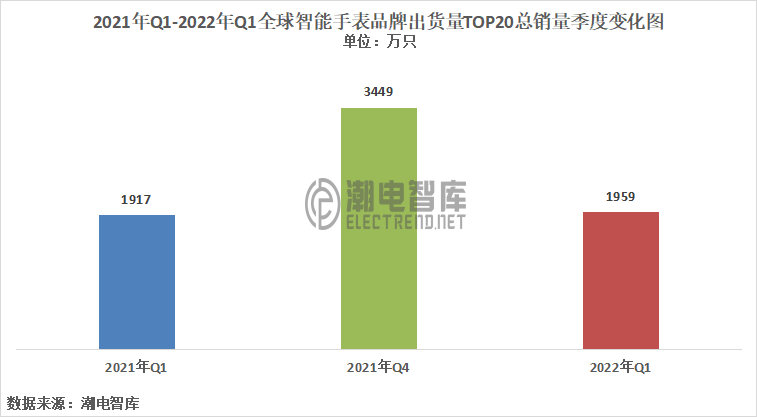

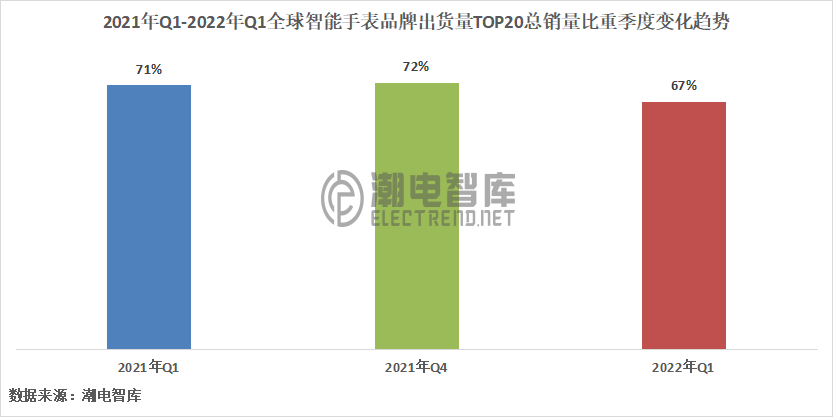

The total sales of Top 20 global best-selling smartwatch brands in Q1 2022 was 19.59 million units, accounting for 67% of the total sales of global smartwatch brands in Q1; down 43% from 34.49 million units in Q4 2021 and up 2% from 19.17 million units in Q1 2021; in terms of proportion, down 5% and 4% year-on-year respectively.

The above figures show that the bottleneck phenomenon of the advantage of big brand focus has emerged, and the proportion of TOP20 to the total market has fallen below 70% for the first time.

Relative to Q4 2021, Q1 2022 Apple smartwatch sales declined more, with a 5% share drop, but still continued to sit firmly as the market leader in terms of 27% year-on-year growth.

Other points to note should be that among the Top 20 global best-selling smartwatch brands in Q1, Huawei and Samsung's market share rose to 17% and 16% respectively from 13.74% and 12.18% in Q4 2021, and both seats remained unchanged; meanwhile, Xiaomi came to Top 4 from Top 6, and Little Genius rose to Top 5 from Top 10.

The overall performance of Chinese smartwatch brands is also remarkable, with Chinese smartwatch brands occupying five seats in the TOP10 of the world's best-selling smartwatches. Huawei, Xiaomi, Genius, Huami and OPPO all ranked second, fourth, fifth, eighth and ninth respectively.

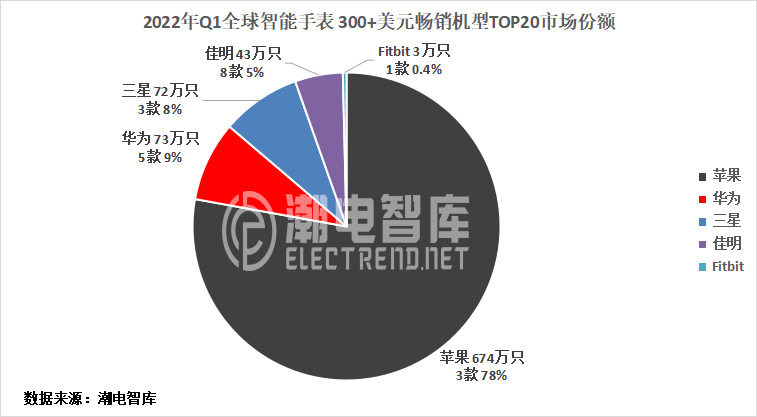

4, 2022 Q1 global smartwatch $ 300 + best-selling models TOP 20.

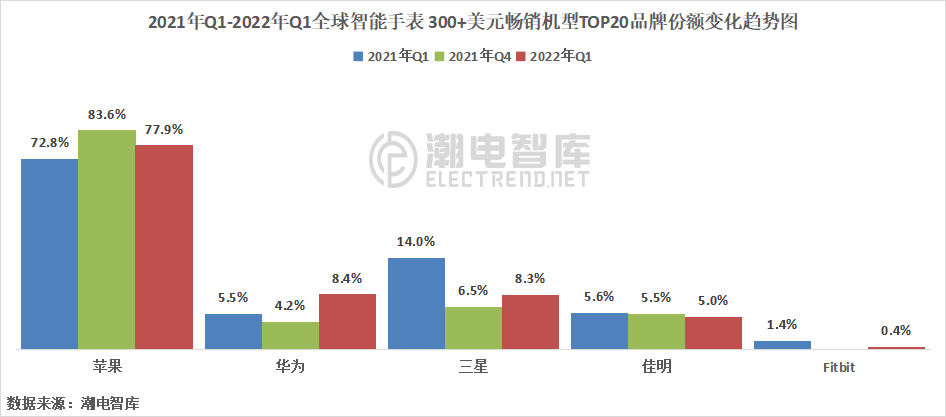

In the chart of the TOP20 market share of global smartwatch 300+ USD best-selling models in Q1 2022.

Apple sold 17.28 million units, 3 models, 83% share

Apple sold 6.74 million units, 3 models, accounting for 77.85%

Huawei sold 730,000 units, 5 models, accounting for 8.39%

Samsung sales of 720,000, 3 models, accounting for 8.35%

Goodman sales 430,000, 8 models, accounting for 5.02%

Fitbit sales of 30,000, 1, accounting for 0.38%

Domestic brands, only five models of Huawei on the list, it can be seen that the domestic brands in the high-end market still has to be developed, the high-end market is the most important directional mark of a market.

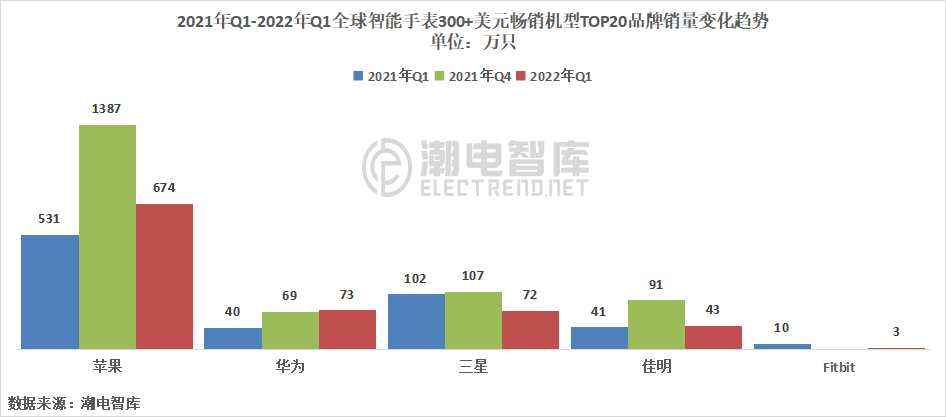

The total shipments of Top 20 best-selling models of global smartwatches with $300+ in Q1 2022 was 8.65 million. It is 47% down from 16.6 million units in Q4 2021 and 18% up from 7.3 million units in Q1 2021.

Brand sales change, Apple smartwatch sales of 6.74 million, an increase of 1.4 million year-on-year, continue to sit in the high-end first; the rest of the year-on-year growth is Huawei and Jia Ming, of which Huawei is to achieve year-on-year ring double growth; in addition, the most serious drop is Samsung, year-on-year and ring drop of more than 300,000.

Market share change, Apple's market share of 77.9%, down 6%, but the market share is still the first of the fault; ring than the growth is Huawei, Samsung, Huawei's market share is doubled.

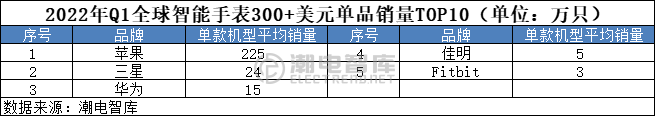

Looking at the sales of single products of each brand above $300, Apple ranks first with 2.25 million, and the sales of single products of the rest of the brands are lower than 300,000. In the short term, Apple's position in the high-end market is still difficult to shake.

In the comparison chart of the best-selling single products, the only brand with a year-on-year increase is Fitbit, which is back on the Top 20 list of high-end best-selling models; the brands with a year-on-year increase are Apple and Garmin, of which Apple's single product growth is nearly 500,000. It is worth noting that Huawei has seen a year-on-year ringgit double decline, indicating that Huawei's ability to create a single explosive product is declining.

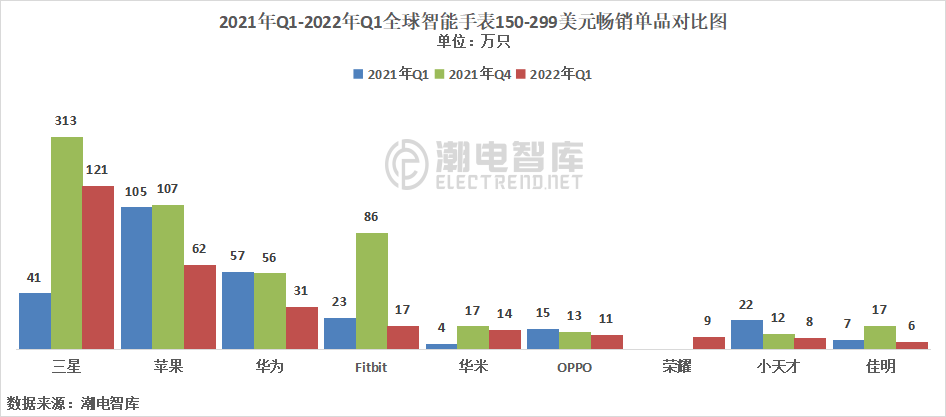

5, 2022 Q1 global smart watch $ 150-299 best-selling models TOP20: Samsung defeated Apple to top the list, Apple single product sales fell below one million for the first time

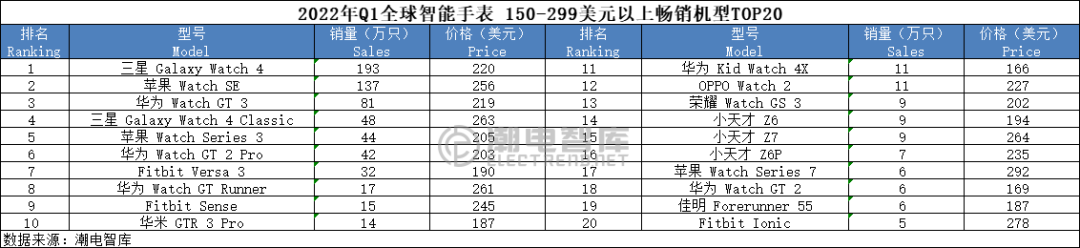

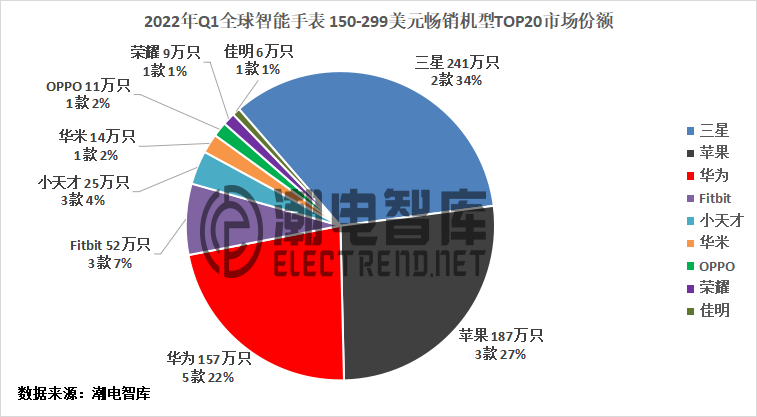

In the chart of Q1 2022 global smartwatch $150-299 best-selling models TOP20 market share.

Samsung sold 2.41 million units, 2 models, accounting for 34.33%

Apple sold 1.87 million units, 3 models, accounting for 26.69%

Huawei sold 1.57 million units, 5 models, accounting for 22.34%

Fitbit sales of 520,000, 3 models, accounting for 7.42%

Little genius sales of 250,000, 3 models, accounting for 3.54%

Huami sales of 140,000, 1 model, accounting for 2.02%

OPPO sales of 110,000, 1, accounting for 1.54%

Glory sales of 90,000, 1 model, accounting for 1.31%

Jiamin sold 60,000, 1 model, accounting for 0.81%

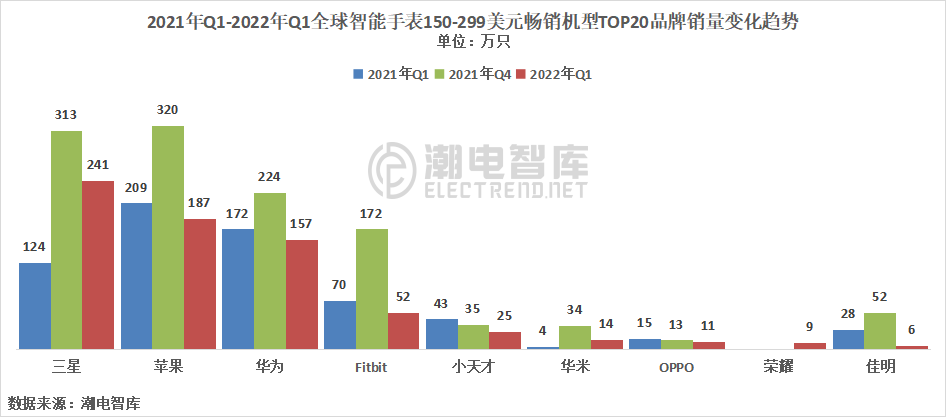

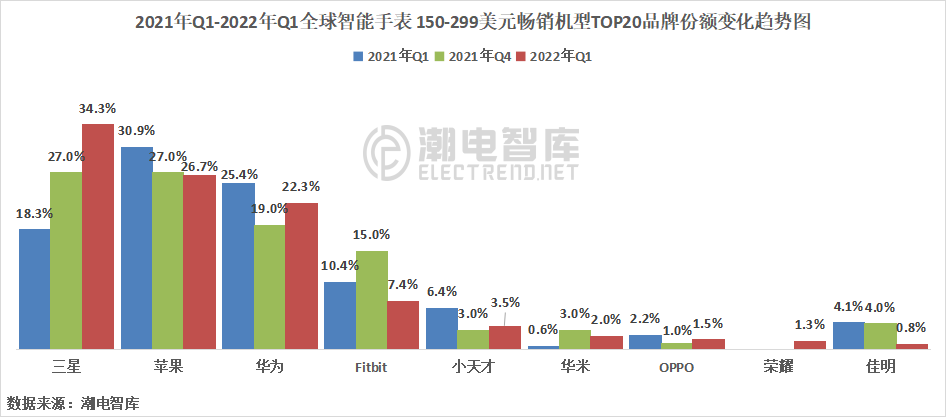

Total shipments of Top 20 best-selling models of smartwatches $150-299 worldwide in Q1 2022 were 7.02 million units. It is 40% down from 11.74 million units in Q4 2021 and 4% up from 6.76 million units in Q1 2021.

Brand sales change, Samsung smartwatch sales of 2.41 million, an increase of 1.17 million year-on-year, overtaking Apple to top the first; glory also returned to the list, its smartwatch sales of 90,000; the rest of the brand year-on-year decline in general.

In terms of market share change, Samsung's market share rose year-on-year and year-over-year, with a year-on-year increase of 16%, overtaking Apple to rank first, while the rest of the brands saw a year-on-year decline.

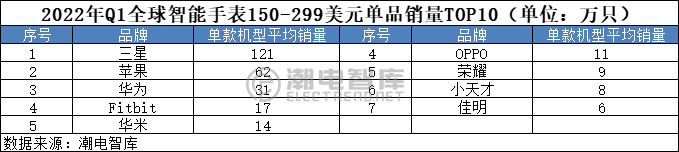

150-299 U.S. dollars of each brand single product sales, Samsung ranked first with 1.21 million, the rest of the brand single product sales are less than 1 million, especially Apple single product sales is the first time to fall below one million.

The best-selling single product comparison chart, ringgit growth only glory, back to the list is not easy; other points to watch is Samsung and Fitbit single product sales fell sharply ringgit, Samsung is down nearly 2 million.

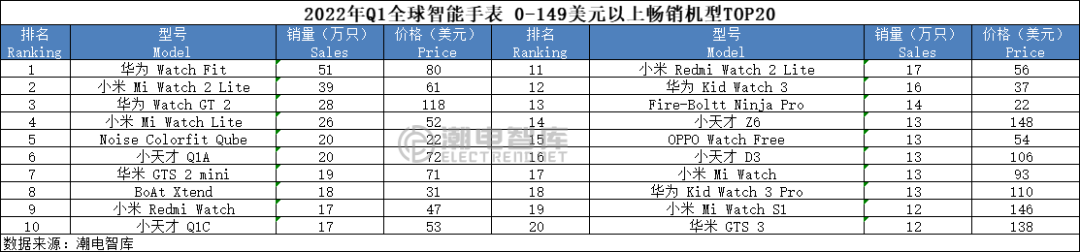

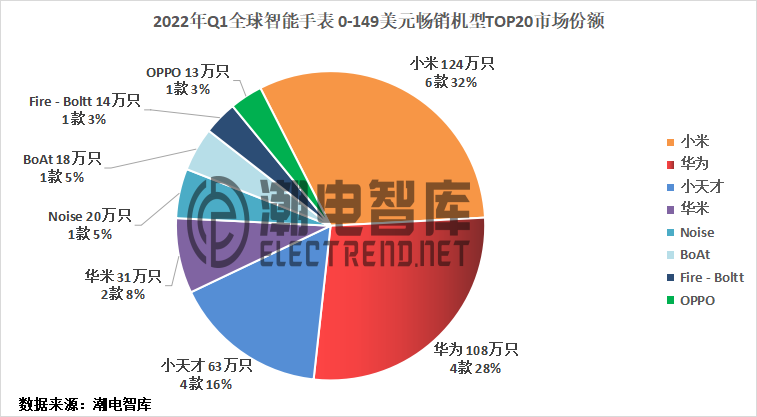

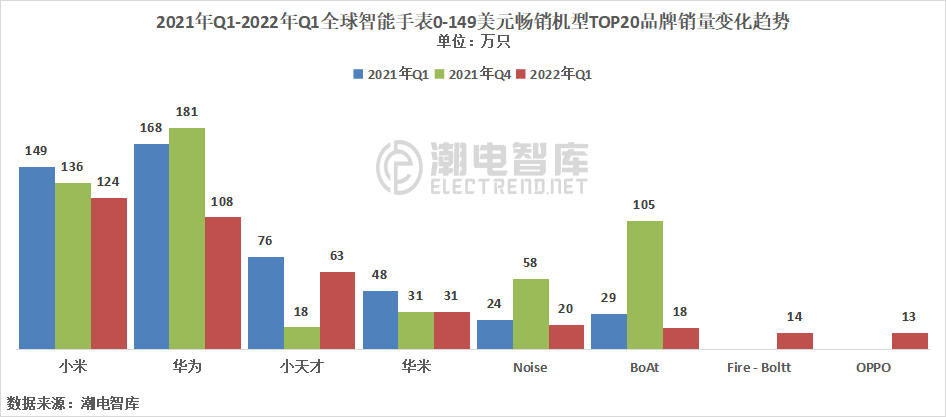

6, 2022 Q1 global smart watch 0-149 dollars below the best-selling models TOP20.

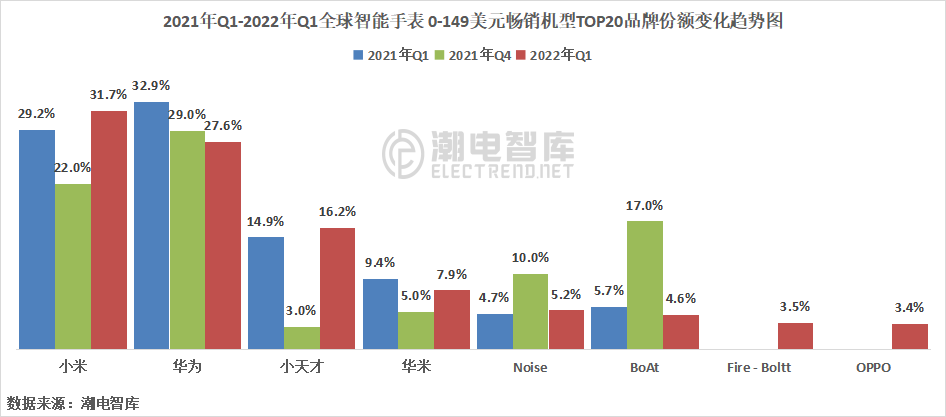

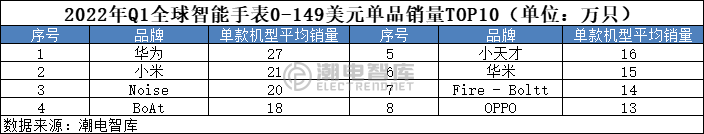

In the chart of the TOP20 market share of the best-selling models of smartwatches under $0-$149 worldwide in Q1 2022.

Xiaomi sold 4.15 million units, 8 models, or 55% of the total

Xiaomi sold 1.24 million units, 6 models, accounting for 31.66%

Huawei sold 1.08 million units, 4 models, accounting for 27.59%

The sales of Xiaoyi is 630,000, 4 models, accounting for 16.18%

Huami sales of 310,000, 2 models, accounting for 7.86%

Noise sold 200,000 units, 1 model, accounting for 5.18%

BoAt sold 180,000 units, 1 model, or 4.58%

Fire-Bolt sold 140,000 units, 1 model, or 3.54%

OPPO sold 130,000 units, 1 model, or 3.42%

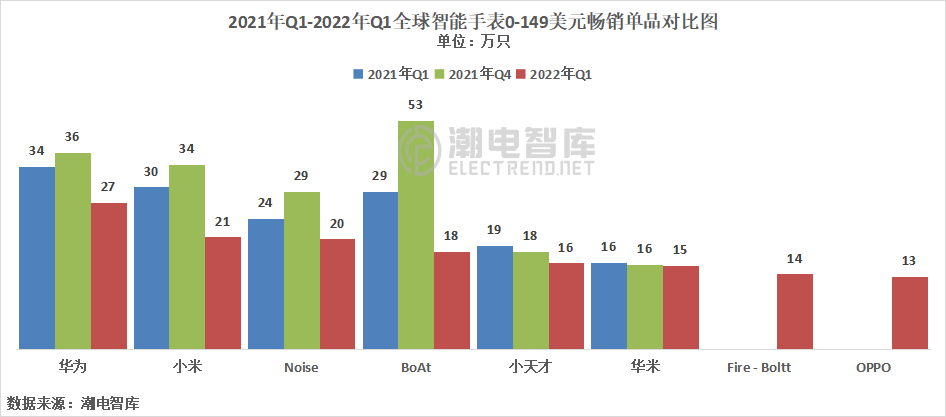

Total shipments of Top 20 best-selling models of smartwatches from $0-$149 worldwide in Q1 2022 were 3.91 million units, down 34% YoY from 13.1 million units in Q4 2021 and down 23% YoY from 7.18 million units in Q1 2021. The decline in both ringgit and year-over-year shows that the low-end market has seen a decline in brand focus and fierce competition, a situation that could lead to low-end brands moving closer to the mid-range or directly lead to withdrawal from the stage.

In terms of changes in brand sales, Xiaomi and Huawei smartwatch sales fell year-over-year and year-over-year, but they still ranked first and second in the low-end market; Xiao Genius, Fire-Bolt and OPPO grew year-over-year and performed well, with Fire-Bolt and OPPO returning to the list.

In terms of market share change, Xiaomi's sales declined, but the overall market decline was even greater, resulting in a 9% increase in market share; Genius also performed very well, with a 13% increase in market share to 16.2%.

Looking at the single product sales of each brand from $0-149, Huawei ranked first with 270,000, Xiaomi and Noise ranked second and third with 210,000 and 200,000, while the rest of the brands sold less than 200,000 single products. The overall look of the low-end market is low single product sales, with a small gap and high competition.

Year-on-year and year-over-year, the single product sales of each brand showed a general decline, and it is difficult to build explosive products. Also worth noting is that Fire-Bolt and OPPO are back on the list, which is not easy.

Translated with www.DeepL.com/Translator (free version)