Global TWS Market Development Trends

The global TWS market and the market for top-selling brands achieved growth in Q3 2023 compared to the previous quarter, indicating a significant market recovery. However, most of the growth came from non-top-selling brands and white-label products.

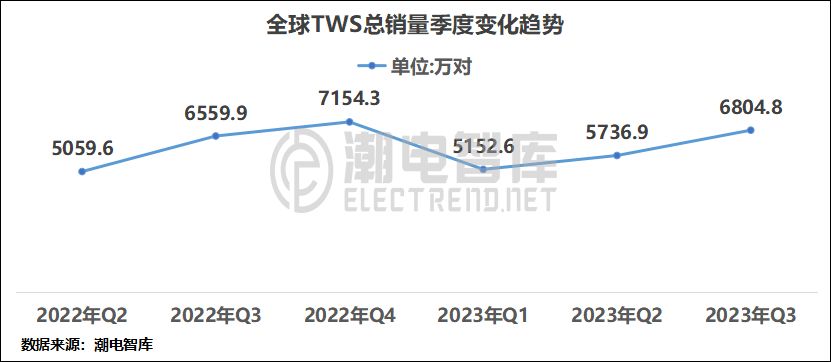

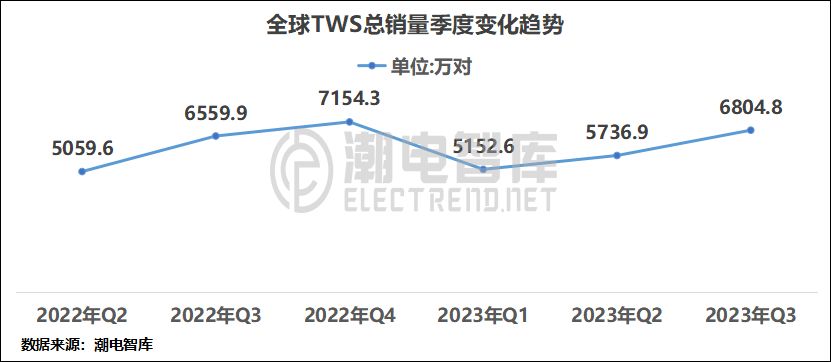

According to Chao Dian Think Tank statistics, the total global shipment volume of TWS in Q3 2023 reached 68.048 million pairs, showing an 18.6% increase from the previous quarter. Comparing year-on-year data, there was a 4% growth in Q3, indicating a visible market recovery.

Additionally, the top 20 best-selling models in various price ranges saw a total sales volume of approximately 35.09 million pairs in Q3 2023, showing a 3.0% increase from Q2 2023 and a notable 22.3% increase from Q3 2022.

Sales Volume by Region

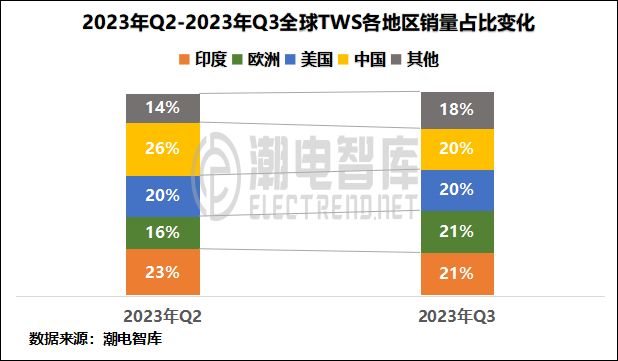

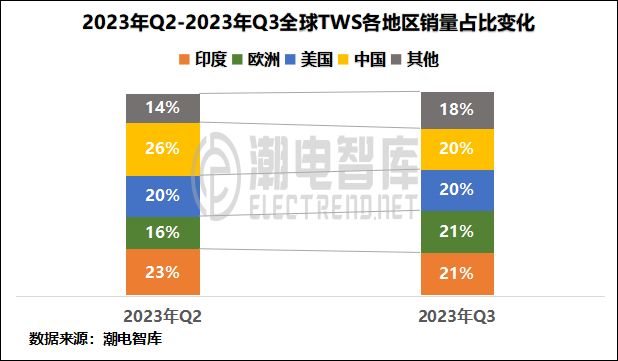

Europe experienced rapid growth, while the market in China and India saw a decline. Europe's market share in the global TWS shipment increased to 21% in Q3 2023, shipping approximately 14.031 million pairs, indicating a 31% quarter-on-quarter growth. However, both China and India experienced a downturn. China's shipments dropped below 15 million pairs, declining by 23% compared to the previous quarter.

Sales Volume by Price Segments

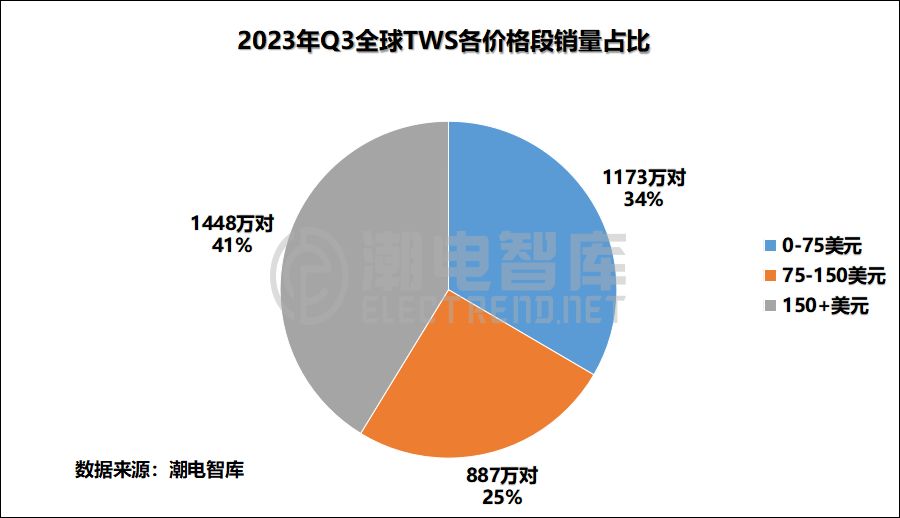

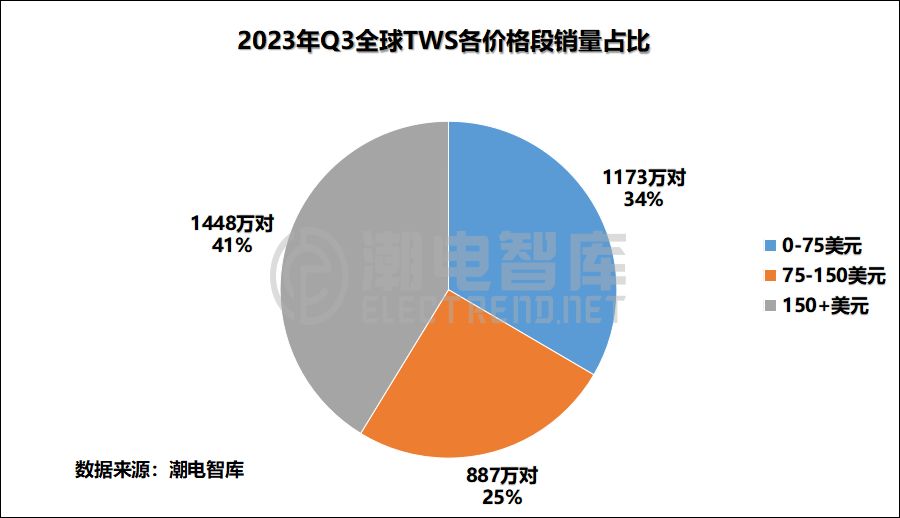

The distribution of sales volume across price segments in the global TWS market exhibited a 'dumbbell-shaped' trend in Q3 2023. Approximately 41% of the sold TWS were priced above $150, while those priced below $75 accounted for only 34%. The price range between $75 and $150 represented 25% of the sales volume.

Market Landscape of Top 20 Brands

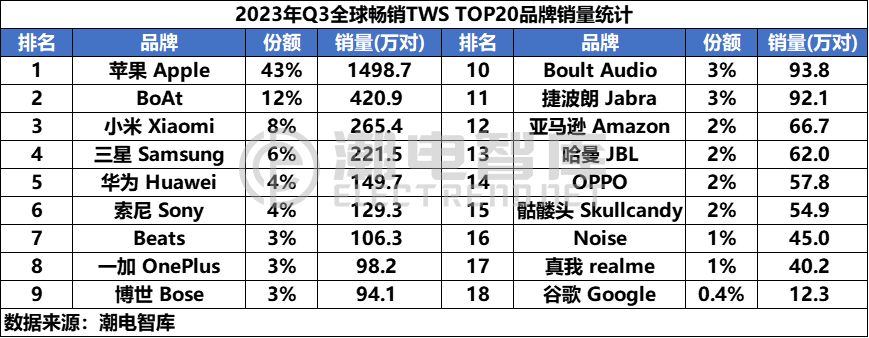

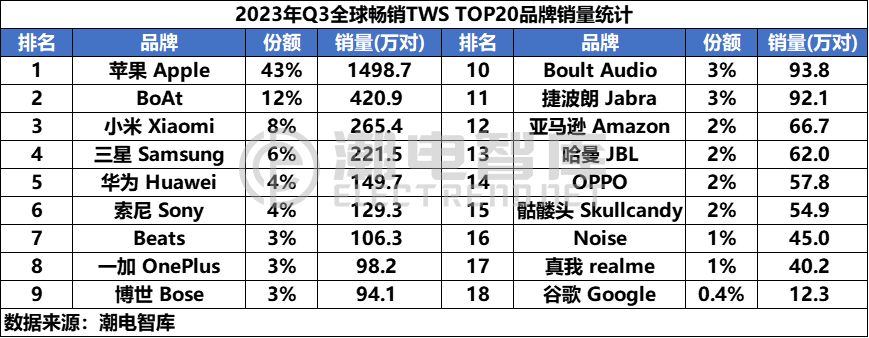

In Q3 2023, the global TWS market recorded a total shipment of 35.089 million units, with 18 brands making the list. Apple dominated with shipments of 14.987 million units, securing a 43% market share. BoAt, an Indian brand, stood at second place with a 12% market share. Other manufacturers didn't reach the 10% mark, indicating ongoing restructuring within the TWS headphone market.

Top 20 Best-Selling Models Above $150

The top-selling TWS models priced above $150 in Q3 2023 totaled shipments of 14.483 million pairs, involving 8 brands. Apple dominated with two models, capturing 70% of the market share. AirPods Pro 2 alone accounted for 7.609 million pairs sold. Following closely were Samsung, BOSE, and Sony, each holding an average share of 6%. Google ranked lowest among the brands. In the high-end TWS market, Chinese brands were in an exceptionally weak position.

Top 20 Best-Selling Models Between $75 and $149

The global best-selling TWS models priced between $75 and $149 in Q3 2023 totaled shipments of 8.877 million pairs, involving 9 brands. Apple's AirPods 2 led this price range, surpassing all models. JBL had the highest number of models in this price segment, with a total of 5 models.

Top 20 Best-Selling Models Below $75

The best-selling TWS models priced below $75 globally in Q3 2023 totaled shipments of 11.73 million pairs, dominated by BoAt and Xiaomi. Ten brands made the list, with BoAt featuring 6 models and Xiaomi 4. BoAt emerged as the best-performing brand in this price range, with 4.208 million pairs sold, capturing a share of 35.9%. The most popular TWS model was BoAt Airdopes 131."

Our Authors

We have experienced employees who choose the services we provide, and our services are all professional. If you contact us, we may receive a commission.

Why You Can Trust ELECTREND

15

Years of service experience

580+

Brand Customer Choice

1000+

The choice of corporate customers