The smart car track is accelerating, allowing the camera industry to usher in the second growth curve after cell phones.

On August 11, at the first "Smart Car Camera Series Technical Seminar" held by Tide TV Intelligence, industry chain strength companies such as Xuan Yuan Zhi Driving, Howie and Ling Yu Micro actively participated and made a wonderful theme sharing.

"Car thermal imaging is about to enter the thousand-dollar era." Xuan Yuan Zhi driving Liu Tao believes that compared to visible light, near infrared and micro-light night vision and other sensing technologies, thermal imaging application advantages are more obvious. After the future rise in awareness of thermal imaging and the decline in mass production costs, the market will rapidly scale up.

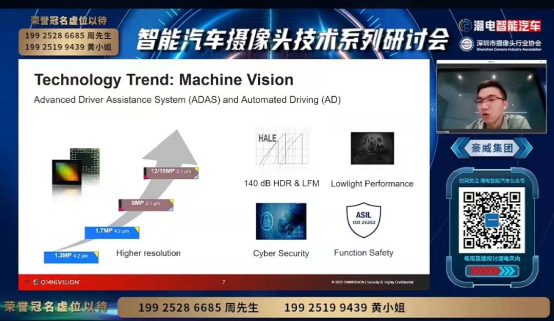

Wang Haiwei from Howell, a leading global in-vehicle CMOS company, said that the company now has a wide range of in-vehicle product lines from low to high pixels, and has formed extensive partnerships with head chip algorithm companies, which are two key advantages to help build its own "moat" in the smart car track.

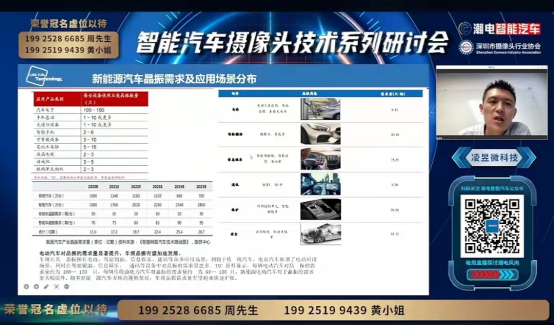

In terms of market performance, new car makers such as Azure, Ideal and Xiaopeng are more aggressive in terms of camera installation, such as the Xiaopeng P7/P5, Azure ET7, and the new HI version of the Polar Fox Alpha S. The number of cameras is above 10. BYD and Tesla have also followed, pulling the car camera usage rising, the corresponding car gauge crystal demand has accelerated. According to Ling Yu micro Xie Xian Ling Yu micro technology Xie Xian predicted that in 2025 the car field is expected to account for 20% of the global crystal market.

Camera is the core sensor of ADAS perception layer. Compared with millimeter wave radar and LIDAR, in-vehicle cameras are the first to get on board because of their low cost, relatively mature hardware technology and core advantage of being able to identify object content.

Especially benefiting from the ADAS penetration rate and the improvement of intelligent driving level, the number of single vehicle cameras mounted is rapidly increasing, especially the car-making new force brands are more aggressive in the assembly of full vehicle perception hardware, the number of cameras in Xiaopeng P7/P5, Weilai ET7, Pole Fox Alpha S new HI version are above 10.

Tide Electric Intelligence predicts that as the level of autonomous driving progresses, the global in-vehicle camera mount is expected to exceed 280 million in 2025, and the market size will exceed the 100 billion mark. China is the largest producer and consumer of smart cars, and it is expected that by 2025 the number of in-vehicle cameras will exceed 100 million, with a market size of nearly $50 billion.

The purpose of "Smart Car Camera Technology Seminar Series" is to unite the strength of brand car companies, head optical manufacturers, global automotive Tier1 and other parties to analyze the case application of car camera in smart driving, new materials, CMOS chips, FPGA image acquisition display system, etc., and to find the strength for the 100 billion car market application to find the focus point.

Our Authors

We have experienced employees who choose the services we provide, and our services are all professional. If you contact us, we may receive a commission.

Why You Can Trust ELECTREND

15

Years of service experience

580+

Brand Customer Choice

1000+

The choice of corporate customers