The market performance of global consumer electronics supply chain leader Lanshi Technology (300433.SZ), which rebounded from a rapid climb in the second quarter, heralds that the darkest moment of the consumer electronics industry has passed.

On Aug. 25, Lanshi Technology released its 2022 interim results announcement. The company achieved revenue of 19.183 billion yuan during the reporting period. Among them, the second quarter achieved revenue of 9.849 billion yuan, an increase of 5.51% from the previous quarter; the net profit attributable to the mother was 107 million yuan, achieving a turnaround.

Liang Sheng, a professional securities analyst who has been tracking Lansen Technology for years, said that under the pull of new business, Lansen Technology's revenue scale rebounded in the second quarter, quickly reversing the decline in the first quarter, and its leading position in consumer electronics will be further stabilized.

Fifteen years ago, the first generation of Apple's iPhone, which set the smartphone industry on fire, was equipped with Lanshi Technology's glass cover. At that time, the first generation iPhone sold 1.39 million units, and 10 years later Apple iPhone 6 has sold 222.4 million units, half of which are made of Lansdowne's glass cover.

At one time, 50% of the world's cell phone screens are produced by Lanshi, and its customers include Apple, Huawei, Samsung and other cell phone manufacturers. Its market value topped 200 billion yuan, which is a benchmark existence in the industry.

Today, the cell phone market downward environment, Lanshi technology in the field of consumer electronics is still pivotal.

Because the AIoT era is coming.

In addition to smart phones, smart cars, smart wear, AR/VR become the most favored consumer electronics terminals, and an important access point for the future Internet of everything. In these windfall areas, Lanshi Technology has taken the lead in completing a comprehensive ecological strategy layout, showing a long-term trend for the better.

Main business: based on consumer electronics to build a dream AIoT

According to the 2021 financial report data, Lansen Technology achieved revenue of 45.3 billion yuan last year, an increase of 23% year-on-year. Among them, revenue from Apple was 30.1 billion yuan accounted for 66.49%. There are two interpretations of this data change: one is that Lance's dependence on Apple's business is too strong and risky; the second is that Apple's frequent news of cutting orders has no impact on Lance Technology, and the cooperation between the two sides is actually increasing.

From the main business analysis, in addition to medium and high-end smart phones, smart wear, tablet PCs, laptops, all-in-one computers and other end products, Lance Technology is accelerating the expansion of smart cars, smart home appliances, photovoltaic products and other fields.

A domestic first-line ODM executive Hu S analysis that "this Lance Technology AIoT strategic map expansion performance. In addition to the traditional consumer electronics business, the hot smart cars and AR/VR and other new tracks Lance Technology can not turn a blind eye."

Annual report data show that in the first half of 2022 Lance Technology's debt ratio of 44.06%. While the production capacity is increasing, the company's long-term debt servicing capacity is increasing and the overall debt level is decreasing. In the previous four years, the company's gearing ratio has achieved "four consecutive decreases".

In the first quarter of this year, Lansen's net cash flow from operating activities was 3.597 billion yuan, up 151% year-on-year, outperforming the previous period. Tide Power Intelligence noted that for six consecutive years from 2015 to 2021, the company's net present ratio was mostly above 2 times, reflecting the company's high earnings quality.

Analyzed from the industrial layout, Lanshi Technology Liuyang Park and Taizhou Park play different business grips and perform stably.

Since its start-up in April 2009, Lanshi Technology's Liuyang Campus has grown hundreds of times in revenue and has total assets of over 70 billion RMB. The business has developed from the global smartphone protective glass field to many fields such as new energy vehicles and new photovoltaic energy.

At the end of 2020, Lanshi Technology completed the acquisition of Kesheng Taizhou and Keli Taizhou, and established a wholly-owned subsidiary, Lanshi Precision (Taizhou), to officially cut into the metal structural parts track. Lanshi Precision (Taizhou) mainly focuses on in the consumer electronics business, is an important part of the company to carry out business vertical integration. Lanshi Technology said that this year, Taizhou Park is expected to add 2-3 computer manufacturers customers.

In addition, the new parks in Huanghua and Xiangtan are still in the early stage of construction and operation, and the new parks need to receive full certification from customers, with high initial R&D costs and revenues not yet reaching scale in the short term, but it is of great significance for the company to achieve medium- and long-term strategic development.

Smart car: has cooperated with more than 20 head car companies

Lance Technology said that some of the company's smart car customers have also been affected by the epidemic fluctuations, even so, the company's smart car business sales revenue increased by fifty percent year-on-year, the customer base continues to enrich, new product development, certification smooth.

The Passenger Association recently said it would raise its forecast for new energy passenger vehicle sales in China to 6 million units in 2022, which is nearly 10 percent higher than the 5.5 million units expected at the end of last year. Keep in mind that the auto industry also suffered a major supply chain impact caused by the epidemic in the first half of this year.

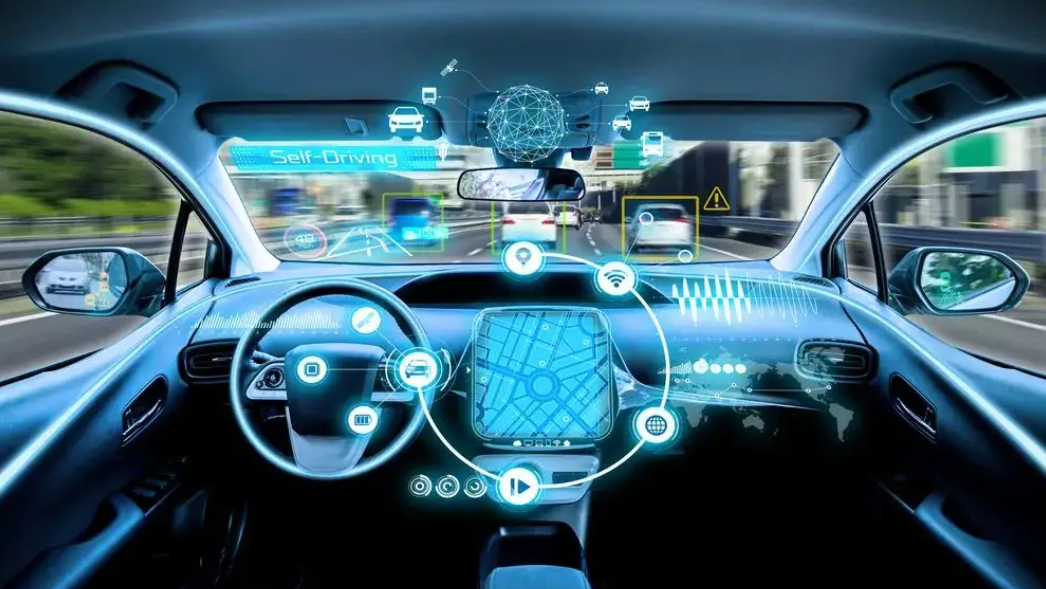

Smart driving technology has facilitated the emergence of a third era of the automotive industry. According to the Tide Electric Intelligence prediction, the $15 trillion market size makes smart cars the biggest windfall in the next decade.

As a national important, the automotive industry ushers in the inflection point of the era of smart car technology iteration, and China stands at the peak of the global smart car development and market.

Data from the China Association of Automobile Manufacturers (CAAM) shows that China will produce and sell more than 3.5 million new energy vehicles in 2021, accounting for more than 50% of the global total and ranking first in the world for seven consecutive years.

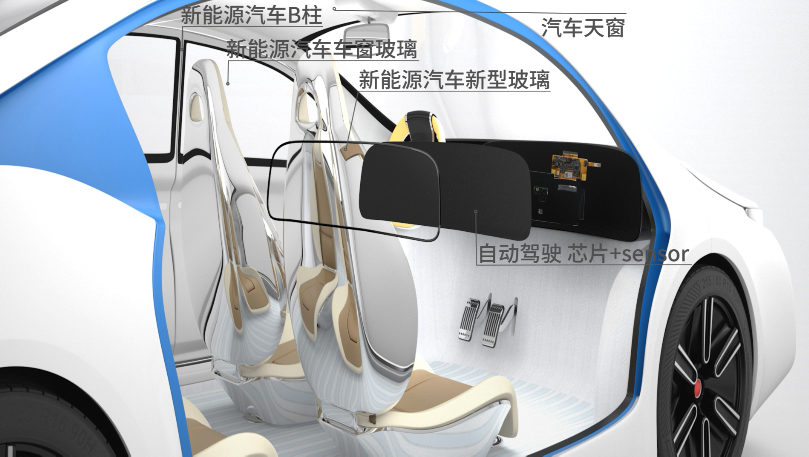

In the field of intelligent vehicles, electrification, new energy and light weight have become the industry's development trend. Modules such as intelligent driving systems and new energy management systems have become the heart of the car, giving rise to new markets such as in-car touch display panels, new B-pillars and new auto glass.

With the growth of electrification and intelligent demand, electronic components will account for 60%-70% of the cost of the whole vehicle. Take the core composition of the car panel of the central control screen, for example, the global scale of the central control screen to maintain an annual growth rate of more than 6%, the market size in 2022 is expected to reach $ 46.1 billion.

This is an opportunity for China's automotive supply chain.

According to Lanshi Technology's 2021 annual report, the research and development project "large size 3D glass product development" has been mass production, expanding the company's technical advantage in the field of automotive curved display and customer orders.

At present, Lanshi Technology has become the core supplier of many smart car brand customers, and has established long-term and stable strategic partnerships with more than 20 automotive customers, including Tesla, Bentley, Porsche, Mercedes-Benz, BMW, Hyundai, and Azera.

Lanshi Technology started to layout the new energy vehicle field as early as 2015. At present, Lanshi Technology's products in the field of automotive electronics mainly include center control panels, instrument panel components, B-pillar components, new auto glass, charging piles, etc.

Lanshi Technology's automotive fund-raising project located in Huanghua Park will also be completed at the end of 2022.

It can be predicted that in the field of automotive glass and large-size functional panels, Lanshi Technology is still the most powerful competitor.

Smart wear: AR/VR future beyond imagination

On April 7, Lanshi Technology released the "announcement on changing the use of part of the funds raised", the company intends to "Changsha (II) Park smart wear and touch function panel construction project" to increase the total investment from the original 1.515 billion yuan to 5.406 billion yuan.

This is regarded by the industry as Lanshi Technology's major attack on AR/VR, smart watches and other wearable market.

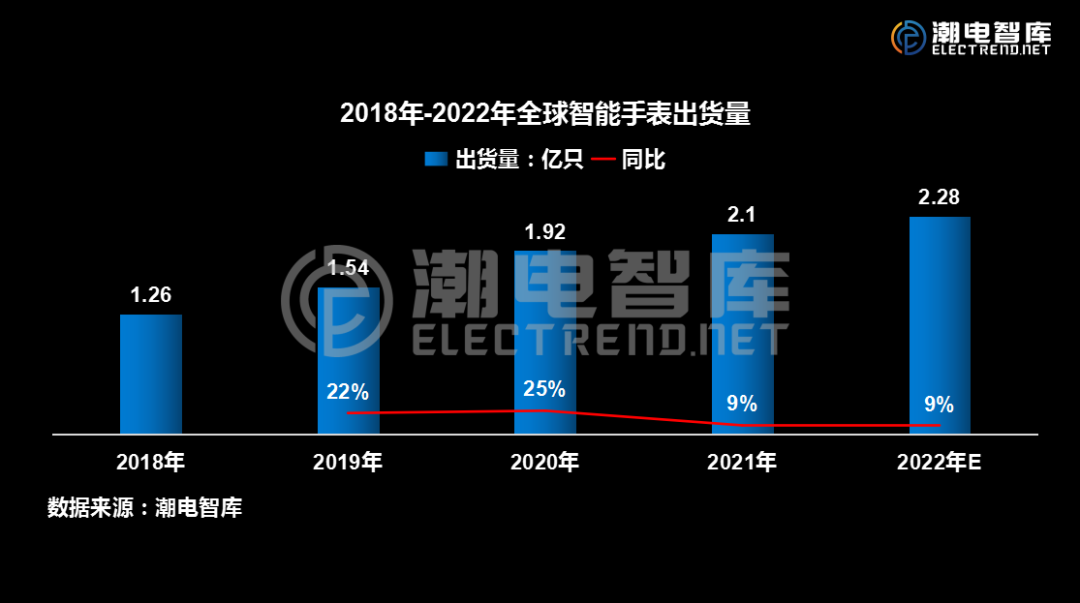

According to Tide Electric Intelligence, the global smartwatch brand shipments in Q1 this year were 29.44 million units, up 9% year-on-year. TidePower Intelligence estimates that the global smartwatch market shipments will grow by 20% year-on-year in 2022, with a total cumulative shipment of over 500 million units.

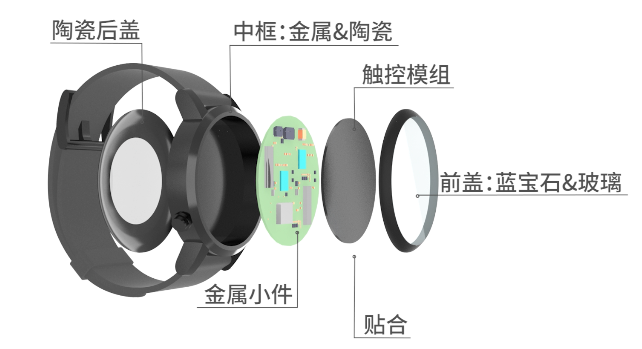

Currently, Lansen Technology's main products for wearable devices include glass protective covers, sapphire protective covers, sapphire and ceramic sensor components, ceramic cases and components, touch display modules and metal components, and can provide supporting value-added services such as component lamination and assembly.

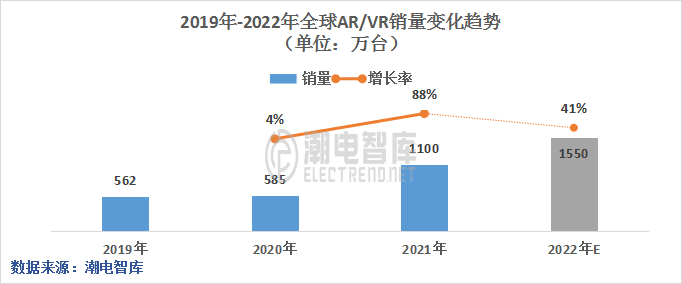

Leveraging on the concept of metaverse, AR/VR track is a hot scene, is expected to become the largest potential driver of growth in the consumer electronics industry. In addition to the early layout of Goer, at present, Lance Technology, Sunwoo, Ovation, Longqi and other head enterprises in various fields have entered the game.

According to the statistical forecast of Tide Electric Intelligence, the global AR/VR market shipments reached 3.5 million units in Q1 2022, an increase of 230% year-on-year; the annual shipments will exceed 15.5 million units; and the shipments will exceed 50 million units in 2026.

There is news that Lanshi Technology will become the core supplier of glass and metal for Apple's AR/VR headset. Lanshi Technology has also repeatedly said in the interactive platform that the company has worked with core customers to develop AR/VR products, and provide customers with one-stop product solutions and services including acoustic, optical, structural and functional parts modules.

This "core customer" is understood by the outside world as Apple.

It is understood that Bluestar Technology started the expansion of AR/VR products 5 years ago, and was one of the first companies in the industry to start the R&D and innovation of optical, structural and functional components modules.

From the current trend, VR will become a new generation of hardware terminals in the future, carrying a variety of consumer life and entertainment needs. At present, the main scenes of AR/VR are in games, video, live broadcast and car, etc. In the future, breakthroughs will be made in improving work efficiency and quality of life, medical education, military engineering, etc. The application scenes will continue to expand and there is huge room for imaginative development in the future.

Professional analysis believes that AR/VR is expected to become the hardware entrance to the virtual world, and even the next generation of mobile computing platform.

Stirring 20 years: what is the core of Lance

Affected by the macro situation, the epidemic environment, industry cycles, etc., the first half of the consumer electronics industry companies generally depressed performance.

In the words of Sun Yanbiao, a tidal power think tank, "the first half of the tidal power industry environment is a cruel double test for companies. One is to test the innovation and blood-making ability, the second is to test the ability to withstand the cold and anti-risk."

Top "National Electronic Information Industry Leader", "China Electronic Information Top 100 Enterprises", "National Intellectual Property Demonstration Enterprise" and many other honors and halo, in fact, each transformation Upgrade is crucial to Lanshi Technology.

Public information shows that Lanshi Technology R & D staff has more than 10,000 people, since the listing of R & D investment of more than 10 billion yuan, with national enterprise technology center. This year's mid-year performance report shows: the first half of the company invested 1.32 billion yuan in R & D expenses, an increase of 30.4%. By the end of the reporting period, Lanshi Technology has obtained 2094 patents, including 345 invention patents, 1610 utility model patents and 139 design patents, covering processing technology, product testing, equipment development, new materials, industrial Internet, production data, intelligent park, enterprise resource management and other fields.

This is the result of nearly 20 years of cultivation in the consumer electronics industry since Lanshi Technology was established in 2003, and is also a microcosm of the development of China and even the global tide electricity industry.

It is worth noting that Lansen Technology's R&D expenditure in 2021 reached a record high of RMB 2.134 billion, an increase of 47.97% year-on-year.

In terms of key projects, Lanshi's R&D investment related to new smart wearable products such as watches and VR/AR, new automotive products such as center control screens, B-pillars, new auto glass and charging piles, metal alloy products such as smartphone mid-frames, and new non-metallic materials such as sapphire and ceramics, and automation equipment has increased.

Tenacity and vision, innovation to see the future. This, is the real kernel of Lanshi Technology.

Ups and downs, perhaps Lanshi Technology has long been accustomed to the various changes in the market environment. Just uphold the original intention, Lanshi technology company still has excellent texture and good fundamentals, with the marginal improvement of the company's performance situation, the earnings inflection point is expected to come, a new round of long-cycle starting point is worth looking forward to.