Recently Torchlight Technology (SH:688167) announced that it intends to pay RMB 349,736,500.00 (the "Base Purchase Price") in cash to acquire 100% of the shares of the Korean panel equipment company COWINDSTCO.,LTD.

This is another Korean panel laser equipment company acquired after Yawei (002559.SZ) acquired LIS Korea, and it is a complete acquisition. 2019 Yawei acquired 21.96% shares of LIS through its wholly-owned Korean subsidiary Yawei Precision Laser Korea, which was established to become the largest shareholder of LIS.

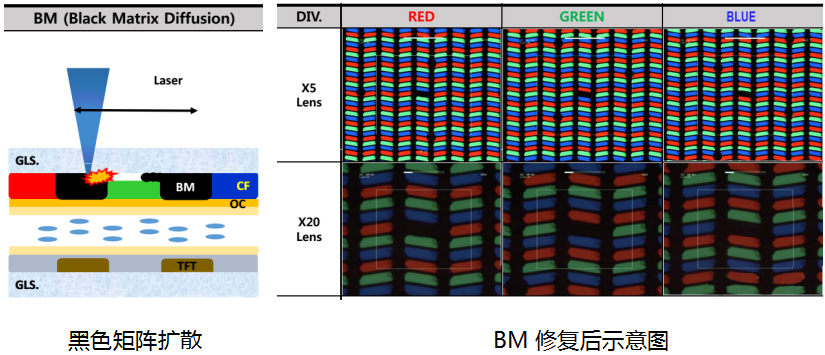

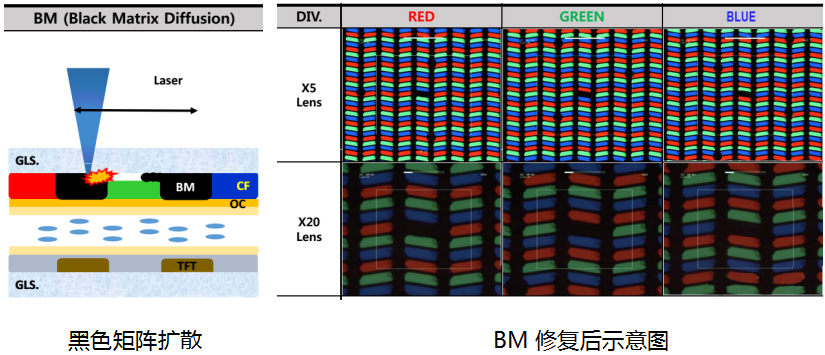

Unlike LIS, which focuses on laser cutting process, COWINDST is the world's leading provider of display panel repair equipment, photomask (mask version) repair equipment and pan-semiconductor optical inspection equipment.COWINDST's DisplayRepair equipment includes repair equipment in the whole manufacturing process of flat panel display (Array-Cell-Module) COWINDST is the first company in the world to successfully deliver G8Halftone mask repair equipment, and its products have already covered Photronics, DNP, Newway and other global mainstream mask companies, and are widely used in flat panel display and other pan-semiconductor fields. technology has been recognized by global mask plate leaders such as Photronics and Toppan, and will provide the impetus for future sales growth.

In terms of industry position in the market, COWINDS' newly developed optical inspection equipment belongs to the pan-semiconductor inspection field equipment, and has the following competitive advantages over other equipment in the market: 1) the first color image inspection: color image inspection of the surface using high precision optical inspection technology, which has a higher detection rate compared to the traditional black and white gray scale inspection method; 2) lower error rate; 3) faster processing speed faster. The subject company has formed a prototype and passed the test of the Korean customer, which is recognized by the customer and has a large market demand.

Torchlight Technology said that since its establishment, it has been focusing on the basic science research and development of photonics technology, and constantly expanding the potential innovative application areas, forming a "components and raw materials", "application modules, modules and subsystems" and "specific We have formed a three-ring development strategy of "components and raw materials", "application modules, modules and subsystems" and "application-specific systems and total solutions". Torchlight has become a technology leader and core component provider in the "necked" niche industries, promoting the high-quality development of national and regional economies.

Torchlight Technology, with its technological barriers in the upstream of the photonics industry in "photon generation" and "photon regulation", has clearly identified the pan-semiconductor process as one of the three key strategic directions for application. After years of technology accumulation, we have developed technology-leading photonic application solutions and corresponding modules or sub-systems for market demand, which can achieve import substitution or even import elimination, such as IC logic chip wafer annealing system, which has been recognized and ordered by industry head customers, realizing the rapid growth of the company's pan-semiconductor process business.

Torchlight believes that on the other hand, certain of the Company's innovative technologies and products, such as the solid-state laser annealing system for low-temperature polysilicon preparation, are designed to replace the traditional excimer laser annealing technology, which is dominated by foreign companies with absolute market position. Due to the advanced nature of this technology and Torchlight's temporary inability to provide complete solutions to the market and customers in the past, it has also been more difficult to find integrators with strong technical capabilities and process development capabilities to collaborate and thus achieve rapid commercialization on the ground.

In order to further promote the commercialization of the pan-semiconductor process business and mass production of related products, the Company has started to invest in the construction of the "Torchlight Technology Pan-Semiconductor Process Photonic Application Solution Industrial Base" project in Hefei, Anhui Province, to develop, produce and sell pan-semiconductor process application related products, and to integrate the Company's The company will also transfer the company's current mature pan-semiconductor process business and ongoing pan-semiconductor process-related R&D projects to Hefei for industrialization.

Through this acquisition, the company intends to acquire system integration capability and process development capability in the field of pan-semiconductor process, as well as the understanding of the advanced pan-semiconductor equipment market and the accumulation of high-quality customer resources, so as to enhance the third ring of the company's "three rings" business strategy, i.e., to provide complete systems and total solutions for specific applications, thereby completing its business in the field of pan-semiconductor process, from core components to the development and production of products. In this way, the company will complete its comprehensive layout in the pan-semiconductor process field, from core components and raw materials, to application modules, modules and subsystems, to application-specific systems and total solutions.

This acquisition is a key step in the implementation of the company's development strategy, which will facilitate the company to further establish its advantages in photonic application technology in the field of pan-semiconductor process, promote the company to connect with the industry and industry more deeply, and realize the commercialization of the company's innovative technology. Through this acquisition, the company will grasp the golden window of the development of the pan-semiconductor industry, quickly realize the implementation of the strategic layout, seize the opportunity to break through the localization of key core equipment of pan-semiconductor in the context of the huge market demand, and achieve import substitution or even import elimination.

In recent years, with the display industry's high-definition technology upgrade, the product began to integrate the direction of development, some of the original semiconductor field of basic functions, using similar TFT pixel drive unit semiconductor design and mass production method, added to the panel process process, pan-semiconductor industrial transformation. Therefore many panel equipment companies, are required to use some semiconductor technology to plan, research and development, design, manufacturing their own products.

In the field of semiconductor mass production technology, Japan, South Korea occupies the world's most significant industrial resources, has long dominated the development direction of mass production technology. At the same time panel display technology is also from Japan and South Korea highly mature before migrating to mainland China, so in the panel production capacity transfer to mainland China, the related industry chain resources are also slowly losing the local market.

And the Chinese mainland in the process of undertaking the transfer of panel production capacity, but also the related industry chain resources put forward a huge demand, so some Japanese and South Korean industry chain resources enterprises, also began to turn their attention to the Chinese mainland market, its off to seek cooperation with the Chinese mainland industry chain, as well as the related industry chain resources sold and transferred to the Chinese mainland industrial capital, is an important initiative of these enterprises in the coming period.

Laser-induced processing and laser repair, due to non-contact processing, are the main tools for the semiconductor and display panel industries to enhance mass production efficiency and mass production yields, and occupy an important position in mass production. For the industry, in addition to the stability of the light source and actuator, the main point is that it directly affects the production cost of the production line, so the industry certification threshold is high, and it is difficult for companies without mass production data support to have the opportunity to cut into the market.

Torchlight Technology is a well-known domestic manufacturer of laser light source devices and control products, while COWINDST is a solution integrator that has obtained certification from a large number of terminal panel equipment and panel companies in Japan and South Korea, so after the completion of the acquisition and restructuring, Torchlight Technology has opened up the whole industry chain layout in the field of panel equipment from the upstream core devices to the final equipment market applications, and become an independent pan-semiconductor equipment R&D manufacturer.

Torchlight Technology also said that the company and the subject company technology synergy effect is obvious, the company in the pan-semiconductor process field, as a mature supplier of semiconductor laser light source components, optical components for many years, has developed a technology-leading optical system and laser light source system solutions. COWINDST has over 17 years of technology accumulation in the pan-semiconductor industry and has global leading technology advantages in laser repair equipment related to advanced display field (including LCD, OLED, emerging display technologies such as silicon-based OLED, MicroLED, etc.) and mask plate field (including display 17 lithography mask plate, organic light-emitting material evaporation mask plate, etc.), and in automatic It has 56 licensed patents and related technology reserves in the core technology fields of automatic optical inspection (AOI) algorithm, high-precision motion control, software development for pan-semiconductor equipment, laser application process, etc. It is one of the few equipment companies in the world that have mastered all LCD/OLED laser repair technologies, and the related equipment has been applied in mass production by mainstream panel manufacturers in China, Japan and Korea.

In the future after the integration is completed, the two sides will have huge industry opportunities in the following areas of business synergy. First of all, with the development of display technology, silicon-based OLED, Mini/MicroLED panel repair for laser beam shaping put forward higher requirements, Torchlight Technology will use advanced optical shaping technology to help display panel laser repair, display mask version repair technology upgrade. Torchlight has many years of experience in optical inspection of semiconductor wafers and optical devices and modules with mainstream equipment manufacturers. After the completion of this acquisition, Torchlight will be able to provide high uniformity and high resolution optical systems to enhance its inspection equipment inspection capabilities and accelerate the development process of related products.

Torchlight Technology has mastered the solid-state laser stripping UV spot technology and products for flexible OLED stripping, which has matured after years of technology accumulation and mass production applications, and has basically replaced the excimer technology route in the Korean market, becoming the mainstream technology route for flexible OLED stripping with lower operating costs, with a cumulative global shipment of 22 sets. After the completion of this acquisition, it will quickly form the integration capability of flexible OLED solid-state laser stripping equipment and provide customers with a complete set of solutions, which is expected to break the monopoly of excimer laser stripping in the domestic market and help customers reduce comprehensive operating costs.

Torchlight is developing UV solid-state laser annealing line spot system for realizing low temperature polysilicon 18 annealing process in the display industry, and has delivered the first prototype in 2020, which is expected to break the global dominance of excimer laser annealing by US companies in this field for the past decade and become a new solution with extremely low operating cost and high equipment utilization. With the completion of this acquisition, the commercial implementation of solid-state laser annealing (SLA) systems will be achieved more quickly as the SLA project advances.

Torchlight has already launched a laser system for Mini/MicroLED mass welding, and has started research on laser systems for MicroLED stripping with related customers. After the completion of this acquisition, laser repair technology is also expected to migrate to Mini/MicroLED repair applications, and its equipment integration and process development capabilities can also help the company further strengthen its rapid layout in the entire Mini/MicroLED industry.

In addition, the semiconductor laser annealing system provided by Torchlight Technology has been verified by downstream equipment manufacturers in two of the world's top five wafer foundries, breaking the long-term monopoly of foreign companies in this field, not only to achieve import substitution, but also to achieve import elimination, after the merger, with the subject company's technical advantages in the field of system integration and process development, the company can accelerate the semiconductor IC wafer annealing equipment to The company can accelerate the development of semiconductor IC wafer annealing equipment to a deeper level, provide high-end equipment for related processes, and promote the development of the domestic semiconductor industry chain.

At the same time, COWINDST's mature laser repair technology in the panel field can quickly extend from display to high-precision mask repair of semiconductor ICs. The mask optical inspection technology in the panel field can also be quickly extended to the high precision mask inspection in the IC field, providing customers with comprehensive solutions. This field is currently monopolized by Japanese companies, but with the subject company's rich technology reserve and based on the urgent localization demand of the Chinese market, the high-precision mask plate repair business for semiconductor integrated circuits will also become a new business growth point for the company in the future.

Torchlight Technology indicated that it has formed a set of international management system and process by successfully acquiring LIMO of Germany, a technology leader in the global micro-optics field, in 2017, and after the completion of this transaction, the Company will continue to implement the overall management strategy of centralized functional departments, unified processes and systems, and shared service centers in the head office, and further develop synergies with the subject company through strategic resource sharing and business operation integration. Further synergistic effects will be achieved to reduce operating costs and enhance the Company's sustainable profitability.