Recently Dongshan Precision released an announcement that in order to further integrate the industry's high-quality resources, optimize the allocation of resources, play a synergistic effect, enhance the core competitiveness and enhance corporate profitability. According to the "Equity Transfer Intention Agreement" signed by the parties to the transaction, the company intends to transfer 60% equity interest in Yancheng Dongshan to Guoxing, after the completion of this transaction, the company holds 40% equity interest in Yancheng Dongshan, and Yancheng Dongshan will no longer be included in the scope of the company's consolidated statements. Yancheng Dongshan, a wholly-owned subsidiary of the Company, belongs to the LED business segment of the Company and is mainly engaged in the research and development, production and sales of LED display devices and other products.

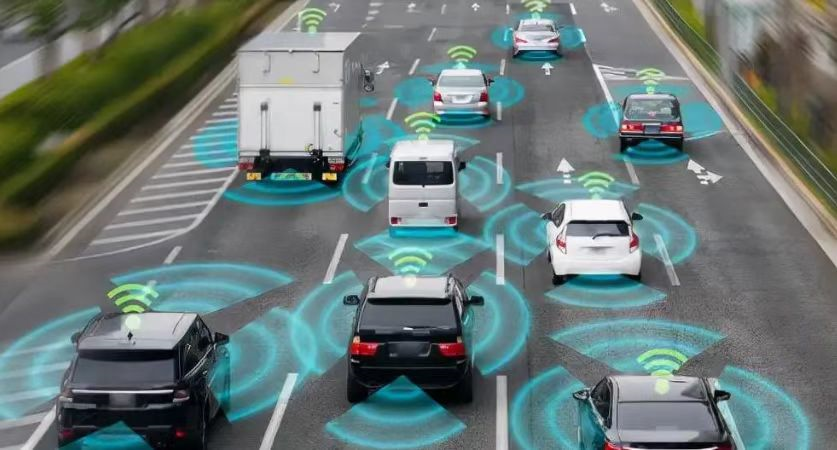

Previously, Dongshan Precision has expressed its strategic goal of embracing new energy and grasping the opportunities of electrification and intelligence of automobiles, in which the precision manufacturing segment provides functional structural parts such as body-in-white, heat dissipation, housing and electric core for new energy vehicle customers, and gradually completes the transformation from communication to new energy vehicles; the FPC segment accelerates the expansion of automotive soft board production capacity and actively explores new customers; the PCB hard board focuses on The FPC segment accelerates the expansion of automotive soft board capacity and actively explores new customers; the PCB hard board focuses on the incremental market of new energy vehicles such as automatic driving, intelligent cockpit and domain controller.

Dongshan Precision recently accepted investor research, said the company changed a project to automotive soft board business at the beginning of this year by factors such as 5G development does not meet expectations, and the project is now actively advancing. The company expects to have about 3 million units of soft board capacity plan by the end of this year. At this stage of the energy storage business is shipped with SMT soft board, automotive soft board is still mainly optical board, loaded with SMT as a supplement, but the future loaded with SMT is the trend, so the product unit price will be improved.

In the field of optoelectronic display, Dongshan Precision is a well-known manufacturer of touch display modules and LED display parts in the industry. Among them, touch products are mainly used in large and medium-sized display field, including notebook computers, tablet PCs, smart homes, car screens and other products; LCD display module products are mainly used in small and medium-sized display field, including tablet PCs, cell phones and other products; LED display parts products are widely used in indoor and outdoor small-pitch high-definition displays and other fields.

For the LED business, Dongshan Precision previously said that the production capacity of the LED segment is currently at the head level, and there is no need to make large investments in the past three years. The company believes that the future demand of the industry is still in, but need time to slowly release.

And Guoxing and Dongshan precision in the LED business volume difference is not too big, the two LED packaging capacity accounted for more than 15% of the market, the annual revenue is in the 3 billion yuan. After the acquisition and merger, Guoxing is expected to become the number one LED packaging company.

In recent years the global due to repeated epidemic, trade friction under the global industry chain restructuring, the economy is in the down cycle and other factors disturbing, display industry in the enjoyment of a short period of capacity mismatch and epidemic market market, back to the normal downward track of resonance with the economic cycle.

Only display enterprises by enhancing product display area and carry out new technology additive, promote the product unit price price upward, but display line overall market sales still than the peak at the end of 17 early 18 fell by about 30%, some areas of demand even appeared to cut or even disappear, to the third quarter of this year, some enterprises business hit a new low in more than a decade.

Some display companies in mainland China still insist on believing in the logic of investment against the market, including LCD panel companies TCL Huaxing and Shenzhen Tianma are in production and investment in the construction of new 8.6 generation production line, Guoxing is this equity transfer before, had planned to expand LED display business in Foshan Nanzhuang or Nanchang.

The LED business of Dongshan Precision and Guoxing Optoelectronics had a high degree of overlap in the market, and the two sides were originally pivotal competitors in the market. The retreat of Dongshan Precision and Guoxing Optoelectronics from one market strategy to another represents two completely opposite voices in the market, one like the conservative attitude of Dongshan Precision, which believes that the market demand is still there, but it takes time to recover; the other is similar to that of Guoxing Optoelectronics, which believes that the market is in the After the end of the epidemic and the completion of the global industry chain adjustment, the world will commonly take economic stimulus policies to activate the market vitality, there will be retaliatory demand growth, at this time to advance the layout of production capacity, will have the opportunity to quickly eat a large share of the market dividend after the market start.

After the annexation of LED business of Yancheng Dongshan, Guoxing will become a veritable giant of new LED packaging and testing in the market of mainland China, and its production capacity and revenue will be on par with those of MUFON.

And Dongshan Precision is turning to the automotive segment, Dongshan Precision believes in rebuilding Dongshan with automotive, which means creating another 30 billion in revenue. The underlying logic is to supply 3 million cars with a value volume of $10,000 per car. Or single car value volume 7-8k for 4 million cars. Disassembled to see the value volume that can be done for a single car, a single car 5,000 by precision structural parts can be achieved, now do already have about 1,000, explosion-proof valve can also increase 1,000, and then count heat dissipation, shell, etc. will have about 4-5k. Soft board now has more than 100 U.S. dollars, the future to consider some other incremental material number, a single car also has about 1000. Hard plate currently see single car about 2,000 can be seen, these add up to about 7-8k, touch display now there is no car revenue, this piece into also can contribute some, so the calculation down, the future supporting 3-4 million cars, single car to do 7-8k, 30 billion revenue target is achievable.

In the field of precision structural parts Dongshan precision does not want to participate in this kind of field has been widely involved in competition, is the so-called similar to the strong and weak class of structural parts, may be involved in very little, at most is some relationship customers to do some supporting. The main hope is that we can do a few products, is likely to be the most advanced products in the industry, and then let customers recognize and promote. Specifically focus on functional structural components, with the traditional advantages of the communications business + consumer electronics flexibility into the new power supply chain. Customer perspective, first service Tesla, at the same time the domestic Ui Xiaoli service, especially T, get its recognition, the future of the new cut customers will be easy.

FPC soft board is mainly Apple's display and Tesla's car two, the largest demand is still in Apple, Apple has been figuring out new technologies, high-frequency high-speed low loss, high-definition easy linkage is the industry trend, high fine lines, to high multi-layer trend evolution, the company has a relatively strong advantage.

BMS soft board is still the most important material number, the current trend is to play more and more pieces, the value of the amount from 30 U.S. dollars to 100 U.S. dollars, the future program and then upgrade may also be enhanced. Tesla is the earliest cooperation, other car manufacturers and battery factories are imitating and following, so with this advantage currently also got more customers' projects.

Dongshan Precision 2022 first half revenue from customers in the automotive industry of about 920 million, an increase of about 104% year-on-year. Among them, the revenue from electronic circuit segment is about 300 million, and the revenue from precision manufacturing segment is about 600 million. The first half of the year due to the epidemic caused the delivery of customer products, the second half of the year will actively ensure the delivery of products and the continued introduction of new products, the automotive business will continue to make efforts.

Translated with www.DeepL.com/Translator (free version)