Zhang Hejun, who founded his own business at the age of 17, has spent 52 years turning a small workshop into a billion-dollar listed company, making him a rising star in China's photovoltaic industry and a major player in the dehumidifier market.

In 2021, Zhang Hejun achieved a significant milestone as his company, DeYe, was listed on the Shanghai Stock Exchange with the stock code: 605117.

Following the successful listing, the net worth of Zhang Hejun, the chairman of the company, naturally saw a substantial increase. According to the Hurun Global Rich List 2023, Zhang Hejun is ranked 395th with a fortune of 46 billion yuan.

However, in recent years, DeYe has faced two significant crises, presenting a challenge for Zhang Hejun, who is no longer a young entrepreneur.

Ⅰ Started a business at the age of 17

Born in 1952 in Beilun, Ningbo, Zhang Hejun hails from an ordinary family. Due to his less than stellar academic performance, he entered the workforce at the young age of 17.

Although Zhang Hejun didn't excel academically, he possessed a keen business sense. He and his friends co-founded a small hardware workshop.

In the early stages of his entrepreneurial journey, everything went relatively smoothly as Zhang Hejun was skilled in dealing with people, which helped secure many contracts.

Within two years, thanks to his efforts, the small workshop had grown into a modestly sized factory.

As the factory expanded, Zhang Hejun seized a new opportunity for his business in 1997 when he started producing components for Midea appliances.

At that time, China's air conditioning industry was less developed compared to advanced manufacturing countries like Japan, creating a significant gap.

To address this, Zhang Hejun and his team traveled to Japan to study and understand the manufacturing processes of plastic components for air conditioners. They conducted extensive research and worked diligently to replace imported plastic components with domestic ones.

In 2002, after making significant inroads into the domestic air conditioning market, Zhang Hejun secured a contract for a complete set of domestically produced plastic parts for Great Wall Motors' Haval SUV.

"We caught the golden age of Chinese manufacturing," Zhang Hejun said, emphasizing that DeYe seized the historical opportunity for the localization of the Chinese air conditioning and automotive industries.

Simultaneously, Zhang Hejun expanded into the humidifier and heat exchanger businesses. After entering the heat exchanger field, he became an important supplier for well-known air conditioner brands such as Midea and AUX. His dehumidifier products ranked first in sales on JD.com and Tmall for five consecutive years.

Ⅱ Rising in the Photovoltaic Industry

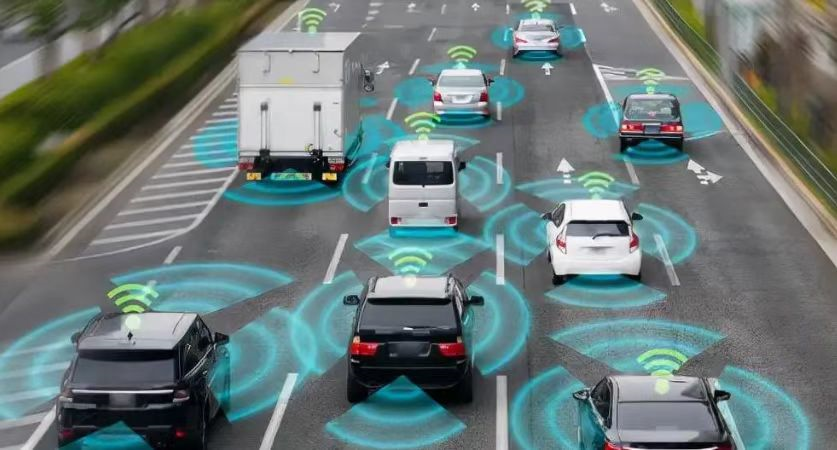

By 2016, DeYe had become a leading player in the heat exchanger and humidifier sectors. At this point, Zhang Hejun set his sights on the new energy industry, making inverters the next strategic target.

Despite being 64 years old at the time, Zhang Hejun decided to enter an entirely new field. The pressure was significant as he had to confront unfamiliar territory.

However, Zhang Hejun believed that new energy was the future trend. DeYe not only wanted to enter the industry but also to become a strong and significant player within it.

In 2017, Zhang Hejun led DeYe to introduce its first-generation energy storage inverter.

As China's "dual carbon" strategy gained momentum, there was an explosive demand for photovoltaics and energy storage. Inverters are an essential component in new energy systems, and their market expanded rapidly.

From 2018 to 2021, DeYe's inverter business revenue increased from 32 million yuan to 1.198 billion yuan, with a high average annual compound growth rate of 234%. In the first half of last year, its inverter business revenue reached 1.149 billion yuan, accounting for 48.3% of total revenue, making it the largest business segment for DeYe.

In the first half of this year, the inverter business generated 3.14 billion yuan in revenue, increasing its share of total revenue to 64.16%. Thanks to the booming inverter business, DeYe achieved total revenue of 4.894 billion yuan in the first half of the year, a year-on-year increase of 106.21%, with a net profit of 1.264 billion yuan, a significant growth of 180.5%.

Although DeYe was a newcomer in the photovoltaic field, its performance in comparison to peers like Ginlong (688348.SH) and HeMai (688032.SH) was commendable.

In reflecting on his success in business, Zhang Hejun highlighted the importance of maintaining a sense of vigilance. He emphasized that there are no permanently profitable businesses, and the key is to continually create and surpass to remain successful.

Ⅲ Faced Two Major Crises

In his entrepreneurial journey, Zhang Hejun, who had previously experienced smooth sailing, encountered two significant credit crises.

First, in 2019, Zhang Hejun led DeYe in a bid to go public, but the company faced challenges related to internal controls and financial issues, leading to scrutiny from the China Securities Regulatory Commission.

The prospectus revealed that Zhang Hejun's family borrowed 253 million yuan from the company in 2016. In 2017, they continued to borrow 28.6982 million yuan.

Furthermore, there were irregularities in the company's waste income and sporadic payments that were transferred directly to Zhang Hejun's wife and son's personal accounts. These funds were used for personal consumption, stock investments, real estate purchases, and financial investments, among other purposes.

Additionally, from 2016 to 2019, DeYe distributed dividends totaling 230 million yuan. Considering that Zhang Hejun owned 86% of the company before it went public, he personally received nearly 200 million yuan.

Surprisingly, some of these substantial dividends were not adequately taxed, as explained in the prospectus.

Zhang Hejun's mother, Mao Juqing, was a shareholder of the company and a Hong Kong resident. According to regulations, dividends from foreign individuals are tax-exempt.

Mao Juqing passed away in 2015, and her shares in DeYe were inherited by Zhang Hejun. However, the change in the company's ownership was only completed in May 2017. The dividend income of 105 million yuan generated during 2016 resulted in underpayment of personal income tax.

The delayed processing of business changes over two years was attributed to "negligence of relevant staff."

Second, in July of this year, DeYe faced a "falsification" controversy after a German blogger discovered that their micro-inverter products did not contain relays, contradicting their claims in VDE4105 certification.

On July 10th, the "falsification" incident significantly impacted DeYe's stock price, causing it to hit the daily limit down.

The incident garnered significant attention from various domestic and international media outlets.

Following active communication with German authorities, distributors, and customers, DeYe proposed an external relay solution and extended the product warranty from 10 to 15 years, helping to alleviate the situation.

In moments of crisis, Zhang Hejun, who is well into his 70s, understands the importance of recognizing the need to act with caution. He has learned that prevention is better

Times new roman