The U.S. energy storage market is recognized as a blue ocean, and from this year onwards, it is difficult to avoid becoming a deep-water area for Chinese enterprises to go to sea.

May 30, New York became the first state to start the home energy rebate program.

The home energy rebate program is part of the U.S. IRA bill, which contains a total of $8.8 billion in federal funds for home energy investment rebate subsidies. Other states have also launched the program.

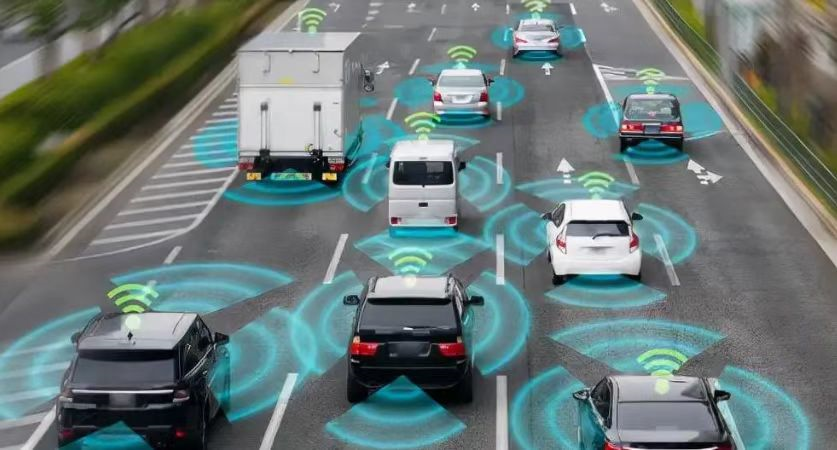

The boom in the U.S. energy storage market has been fueled in part by a significant reduction in upstream system costs. The price of lithium battery cells has plummeted about 50 percent since last summer. In the fourth quarter of last year, battery prices fell rapidly again, and the U.S. installed energy storage in that quarter was strong as a result.

Sunny Power publicly stated in late May that the U.S. market could see increased demand and front-loading before the new tariff policy takes hold.

The U.S. commercial and industrial energy storage market, like its household storage, is a blue ocean.

Generators remain a core part of the U.S. commercial and industrial sector, and energy storage equipment and generators complement each other. When a blackout or power outage is detected, energy storage devices respond much faster than generators, resulting in a rapid transition from grid power to backup power without interrupting any on-site operations in the C&I scenario, minimizing losses.

Meanwhile, U.S. electric vehicle charging demand is growing at a compound annual growth rate of 65 percent, but it is also putting more pressure on state power grids. The U.S. government is investing and cooperating to build charging networks nationwide, deploying more industrial and commercial energy storage systems to provide backup power for car charging stations to ensure continuous and stable charging.

Relevant professionals in the industry summarized to Tide Power Intelligence that the U.S. is transforming existing PV systems to increase energy storage deployment.

Relevant statistics show that this year, the U.S. commercial and industrial energy storage installed capacity is expected to be about 1.2GW, the next five years the cumulative installation of 4GW, a growth rate of 246%, the installed capacity contribution will mainly come from California, New York and Massachusetts.

All indications are that New York has formally gotten serious this year about its goal of achieving 6GW of installed energy storage by 2030, and more and more projects are accelerating to the ground, such as Nala Renewables' 280MW four-battery storage project deployed on Long Island, which is expected to come online and operate this year.

In the sea, at present, most of the energy storage listed Chinese enterprises to Europe shipments, the U.S. market more profitable veteran enterprises such as sunlight power, from its early entry, perennial cultivation of brand influence and customer trust, in order to have the current achievements.

As early as September last year, Sunny Power launched floating solar arrays at the RE+ exhibition, specifically for the North American market. Early in May this year, Sunny Power brought its liquid-cooled battery storage system and string inverter to exhibit at CLEANPOWER 2024, and demonstrated its utility-scale PCS as well as customized solutions for industrial and commercial applications.

In addition, a must-have capability for entering the U.S. market is compliance management.

If energy storage products have high regulatory compliance in the U.S. and are tightly connected to local financial channels, it greatly facilitates the advancement of the energy storage and component business. This representative enterprise is Atlas.

Although Atlas is not superior in the core technology of energy storage, but its U.S. market through Wall Street's strong financial and market channels to expand the energy storage business, but also won the Blackrock Fund 500 million U.S. dollars of investment as a product endorsement, in the U.S. market share is stable, reputation and brand influence are better.

Atlas publicly stated that the fundamental purpose of the expiration of the U.S. anti-circumvention exemption period for Southeast Asia is to foster the local PV industry. The 5GW N-type PV module factory established by the company in Mesquite, Texas, USA was formally put into production last year and started delivering products. In the first quarter of this year, Atlas Energy Storage shipped about 1GWh, and its single-quarter revenue basically reached the full-year level of last year, meaning that its energy storage business has entered the harvest period.

The degree of openness of the U.S. market is greatly affected by the political cycle, especially this year as an election year, the relevant policy changes may increase the restrictions on Chinese enterprises to enter the U.S., and the competition for going abroad continues to be fierce.

Our Authors

We have experienced employees who choose the services we provide, and our services are all professional. If you contact us, we may receive a commission.

Why You Can Trust ELECTREND

15

Years of service experience

580+

Brand Customer Choice

1000+

The choice of corporate customers