Thailand energy storage market has dawned, SUNGROW is the first to enter the game!

Europe and the United States, Latin America, Australia's energy storage development is in full swing, Southeast Asia is also strong this year to become the new "wind and water".

July 3-5, Thailand Renewable Energy Expo ASEW 2024 attracted a large number of Chinese light storage enterprises exhibitors, Wo Mai, ReneSolar and other companies have just exhibited in Intersolar Europe 2024 with new products debut.

Thailand is increasing investment in renewable energy projects such as solar and wind power. In order to achieve the 2050 carbon neutral target, Thailand released the 2024 Power Development Plan (PDP) in June this year, one of the main goals of which is to increase the share of renewable energy in total power generation to 51%, and be allowed to participate in the power market to maximize revenue.

While these intermittent energy sources require energy storage systems to balance the grid and ensure a stable power supply, and as Thailand is in the midst of a boom in industrial and commercial development, technology investment, it is also facing a potential power shortage.

Tide believes that the Thai energy storage market has already taken off, given the country's efforts to promote energy independence and reduce its reliance on centralized power generation, and that investment in energy storage projects will quickly follow suit. Perhaps in the near future, Thailand shipment data will appear in the financial reports of major optical storage companies.

As early as March 26 this year, SUNGROW signed a supply agreement with Gulf Energy Thailand to provide PV inverters and liquid-cooled energy storage systems in the next seven years to meet the project demand of 3.5GWp.

Price wars and overseas gold rush are two key words in the energy storage industry last year, and now, the emerging Thai energy storage market is no longer surging, for Chinese companies, household, small industrial and commercial energy storage, there are still a lot of opportunities to quickly enter to seize the market share.

Chao Dian here from the power reform, electric vehicle industry chain two aspects of Thailand's energy storage development to promote the effect.

Electricity reform caused by the immediate need for energy storage

Thailand's energy storage development cannot be separated from its power reform.

Thailand is the largest economy in Southeast Asia and one of the major energy consuming countries, relevant professional organizations based on its medium and long-term GDP, population, per capita electricity consumption, electricity elasticity coefficient forecasts, power demand is expected to grow at an average annual rate of 2.6%.

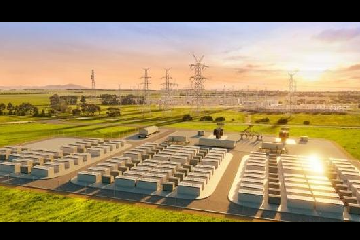

However, as of now, Thailand's electricity is heavily dependent on fossil fuels, and the power infrastructure is still relatively backward, with a large power supply gap. In fact, Thailand's planning for energy storage had begun to take shape the year before.

At the end of 2022, Nuovo Plus, a company controlled by Thailand's state-owned oil and gas company PTT Group, and battery maker Guoxuan Hi-Tech's subsidiary in Singapore set up a manufacturing joint venture, Global Power Synergy Company, with the aim of building a GW-scale factory in Thailand for the production of batteries and PACKs, and venturing into the energy storage system production Business.

It is worth noting that the Thai government is offering tax breaks to households that install solar panels, and the deployment of distributed energy resources such as rooftop solar panels and small wind turbines is increasing.

Meanwhile, demand for portable power sources for camping and self-drive tours is growing in Thailand, and the installed capacity of distributed energy storage systems and portable energy storage is expected to see a growth spurt.

Battery production drives energy storage installations

In recent years, the trend is that Chinese automobile companies have taken Thailand as their production base, and battery manufacturers have also moved in, and the Thai government has introduced a series of preferential policies to attract foreign investors to invest in Thailand and build factories.

So far, battery makers such as Ningde Times, Ruipu Lanjun, Guoxuan Gaoke, Xinwanda, Beehive Energy, YWL, JinkoSolar and others are laying out the energy storage market in Southeast Asia.

On February 28, Beehive Energy announced that its Thailand battery plant will go into operation on the same day, and the products will be delivered in batch, mainly supplying Great Wall Euler, Haval and Tank models as well as new energy vehicles in Thailand.

On July 4, BYD's Thailand plant rolled out the company's 8 millionth new energy vehicle in the world.

Thailand's electric vehicle industry is growing rapidly, with sales of pure electric vehicles increasing nearly 40 times from 2021 to 2023. in 2023, Thailand's annual sales of electric vehicles amounted to 76,314 units, a year-on-year increase of 684 percent.

It can be seen that Thailand is rich in lithium battery production capacity, and hybrid energy storage systems combining lithium-ion batteries with complementary technologies such as liquid current batteries or flywheels can be deduced that a large number of new grid-level energy storage projects using high-capacity batteries will be added in Thailand, and the prospects for long-duration energy storage are promising.