From the second half of last year, the lack of innovation, the extreme in-volume TWS industry slowed down the pace of rapid growth, from the brand to the supply chain to open a new round of reshuffling and reshaping.

Among them, especially the main control chip battlefield accounting for nearly 20% of the cost of the whole machine has attracted the most attention.

Tide electricity think tank learned that the market now low-end TWS chip, the price war played an unusually fierce, white label market has fallen by more than 40% year-on-year; high-end market but the resources are limited, with Qualcomm fade out, Loda tight, only a few domestic chip manufacturers such as Heng Xuan and material Qi have the supply strength.

Ltd. is currently recognized as the "dark horse" in the TWS chip industry. According to the tide electricity think tank shipment data show that from the end of last year mass production so far, its TWS Bluetooth audio master chip for the first time to achieve monthly shipments of more than 2KK, and Anker innovation, Harman, magic sound, QCY, Heylo, Noise, singing bar, Wal-Mart, Soundpeats peat and many other brand terminal customers reached a deep cooperative relationship.

"We plan to achieve full coverage of head brands in the next year, and shipments of mid- and high-end products into the top three in the industry." Pang Gonghui, vice president of marketing and sales of Ioqi, revealed the company's strategic development goals, and said it would leverage the policy east wind to fully empower customers with a series of chip products with low power consumption and high performance, and TWS complete solutions.

1. Ample room for mid- to high-end incremental growth

With the release of Apple's AirPods in September 2016 as a landmark event, the consumer market ushered in the golden era of TWS. The earliest gold diggers came from the white-label camp.

Wu, who has been doing white label TWS for many years in Huaqiang North, Shenzhen, said, "At that time, national brand terminals such as Huami OV were too busy expanding their cell phone footprint to take into account the emerging TWS market. If Apple is the leader of TWS, then the white label is the real market educator and promoter."

Overnight, the low-end TWS Bluetooth master chips from CSCL and Jellyfish became the sought-after goods in the white label market. Until the cell phone market hit the ceiling, in order to seek new growth curve and expand the ecological map, the brand turned to TWS.

Due to the weak user stickiness, product innovation and after-sales service and other multiple factors, the brand side of the force, the white label quickly ebb, and last year left more than 100 million TWS inventory.

It is also in this period, the consumer market has been very sensitive to the TWS sound quality, range, signal and other aspects of the needs of the concrete, which forced the brand camp will continue to price the product pro-people down at the same time, but also in the functional configuration of the obvious trend of higher order.

"After six years of growth, TWS in functional innovation, manufacturing processes and other aspects have entered a mature period, so now return to the most core cost competition." Tide Electric Intelligence believes that the battle of brands is, to some extent, the battle of supply chain resources.

TWS main control chip battle, the focus from the low-end to the high-end, and the trend of domestic substitution is obvious.

The main control chip is the most important component of TWS, its Bluetooth technology and audio codec technology determines the headset signal transmission effect and sound quality. Previously, the market share in this field is almost monopolized by overseas manufacturers such as Qualcomm, and now the new forces such as the material Qi, Heng Xuan to catch up with the trend.

2、Monthly production capacity has exceeded 2KK

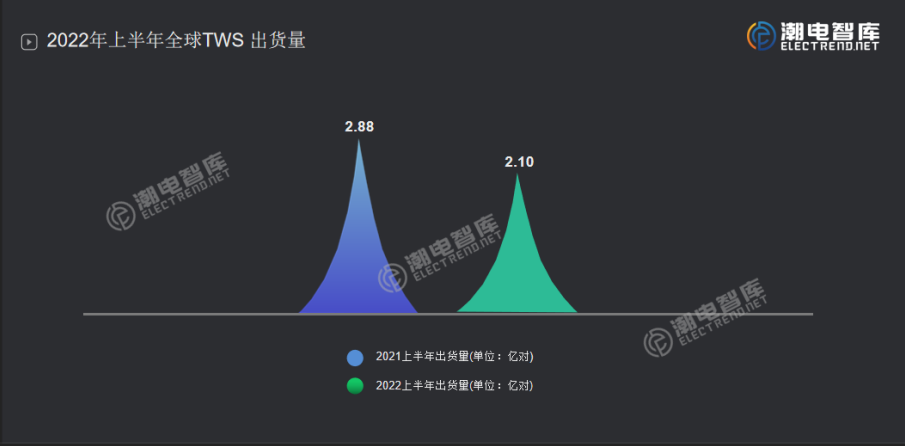

According to Tide Electric Intelligence estimates, global TWS shipments in 2022 will be around 530 million pairs, up 8.16% year-on-year; which includes 100 million pairs of white label inventory not consumed in 2021, which means the real supply chain shipments of 430 million pairs, basically the same as last year.

Overall, for inventory, this year, TWS main control chip low-end market is a recession, a rapid decline year-on-year; mid- to high-end seemingly stable performance is full of variables, the market power is quietly changing hands.

Around RF, algorithm, protocol stack and SoC integration and other key technologies of short-range communication, IOTC has built three core competencies of international leading ultra-low-power design, high integration and excellent communication performance, making IOTC rise in the field of TWS in the past two years.

Since the end of last year, IOTUS has recently shipped more than 2KK chips per month, and entered the top 10 of "Global TWS main control chip shipment list" by TidePower. Especially in the mid-range and high-end market, IOTC has become an indispensable core supply force.

Pangong will say, there are two main reasons for the increase: First, the overseas head chip companies fade out, leaving a larger takeover space in the mid-to-high-end; Second, combined with industry demand, the material Qi in the technical level to make a lot of innovation, to help users significantly improve the product application experience.

Founded in November 2016, the 22nm ultra-low-power WQ7033 series released in 2021 is mainly for mid- to high-end customers and has become a hit on the market.

It is understood that the WQ7033 series is a high specification Bluetooth audio SoC chip, supporting BT/BLE5.2 dual-mode protocol stack and the new generation of Bluetooth audio technology standard LE Audio. built-in high-performance HiFi 5 DSP and NPU (neural network processing unit) to support complex multi-microphone uplink noise reduction algorithm and keyword wake-up, while taking into account low power consumption. Integrated Hybrid (FF+FB) ANC to support headphone applications with high bandwidth and up to 45dB deep noise cancellation; provides rich interfaces and high integration for advanced TWS noise-canceling headphones and other low-power products that require sophisticated audio processing and voice AI capabilities.

In 2022, Wizards launched and mass-produced the more optimized WQ7036 series chips, further accelerating the speed of mid- to high-end product updates and iterations, solidifying the mid- to high-end market position and maintaining a sustainable competitive advantage.

Head brand enterprise full coverage

With excellent technical innovation ability, backed by head customers, WQ7036 is confident to enter the top three positions of TWS mid-range and high-end main control chips.

"At the latest in the next year, we will achieve full coverage of head brand enterprises." Pangong will say that the development path of TWS is very similar to that of smartphones, after the white label first, the strong market pulling power of the brand side will keep the industry growth curve upward.

According to Tide Electric Intelligence, in the first half of 2022, the global TWS headset market had a total shipment of 210 million pairs, of which the brand and white label ratio was 47% and 53%. Although the white label market is temporarily leading, but over a billion pairs of TWS inventory pressure is huge, shipments may be overtaken by the brand during the year.

In addition to the business market all the way, Thingqi has also been valued and favored by the capital force.

At the end of 2021, IOTC received nearly 700 million RMB in Series C financing from the industry's top industrial capital and well-known investment institutions.

Chip is the cornerstone and heart of the whole information industry, and is also the engine that drives the whole information society forward. Tide Electric Intelligence believes that "in the field of TWS chips, companies such as Hengxuan, Zhongke Lanxun and Torch Core have been successfully listed in just a few years, indicating that the national policy tilt towards the chip industry is very strong." And slightly different from other TWS chip makers is that the thing Qi for many years continue to plow the field of short-range communication, has a rich product areas, in addition to the high-speed growth of TWS chip, but also has annual shipments of ten million PLC broadband carrier chip, and is forming the scale of competitiveness of WiFi chip, etc. Therefore, the thing Qi will be more competitive in the future, with more possibilities, and soon will also be on the capital stage.

Currently on the industry's active noise reduction, range and sound quality and other application pain points, ANC, power consumption and size is the core of the future upgrade iteration of the TWS chip, behind which is the technical dark war of the major chip originals. Represented by the strength of the material Qi, is reshaping the new pattern of TWS chip industry.