01 Major countries involved, the crowd of technology giants into the game

In 2022, China's "Opinions on Further Releasing Consumption Potential to Promote Sustained Recovery of Consumption" calls for promoting pre-research on AR/VR technology standards; the U.S. includes AR/VR technology in the Critical and Emerging Technologies List; Seoul Vision 2030 plans to imagine that citizens can wear VR headsets to meet government officials.

In 2022, Microsoft acquired Activision Blizzard to deeply layout AR/VR content; Tencent set up XR department to create industry benchmark VR products in the experience; Apple continues to make efforts in the AR field and is expected to launch its AR products in 2023.

With the participation of all major countries and the entry of all tech giants, AR/VR ushers in a period of rapid industrial development.

The global best-selling AR/VR market analysis report, based on the sales data of the Top 20 best-selling models, provides a new perspective on the most active, vibrant, and definitely profitable forces in the global AR/VR market.

Although there are considerable differences in several aspects of AR/VR at present, including technical maturity, technical implementation methods, customer portraits, etc., these points of difference are all unified in terms of wearable attributes and metaverse hardware entrance attributes. Therefore, AR/VR is described and reported in this report in a unified manner.

It should also be pointed out that AR/VR technology is not only applied to smart glasses, but also exists in multiple scenarios such as naked eyes and large screens, and this report only counts the AR/VR smart glasses part.

A total of over 40 brands are included in this survey, including Meta, PICO, DPVR, HTC, iQIYI, Rokid, Nolo, MadGaze, Goovis, Microsoft, TCL, Arpara, and Microsoft. TCL, Arpara, PiMax, INMO, FFALCON, ThirdEye, RealMax, OPPO, LLvision, Epson, HUAWEI, Nreal, HPInc. HPInc (Hewlett-Packard), Valve (Wilford Group), ShadowCreator (ShadowCreator Technology), Vuzix (Hongke Electronics), RealWear (ReoWear), Sony (Sony), HiAR (bright wind Taiwan), 3Glasses (virtual reality technology), Lenovo (Lenovo), AcerGroup (Acer Group), Samsung (Samsung), MagicLeap, Fujitsu (Fujitsu), Baofeng (Storm Magic Mirror), Inlife-Handnet (Palm Network Technology), AntVR (Ant Vision Technology), Canon (Canon), Varjo, Goolton (Goolton Technology), etc., in each price range statistics best-selling models TOP20. The best-selling AR/VR Top 20 brands are summarized.

In order to show the advancement and retreat of AR/VR smart glasses brands more dynamically, the global best-selling AR/VR market analysis report will be extended to the brand Top 20.

02 Q2 sales reached 2.87 million units, with Europe and the US accounting for half of the total

Roblox meta-universe first stock listed, META renamed layout meta-universe favorable AR/VR, even the development of digital economy in each major country, each technology giant deepen meta-universe layout is also an important driving force, the key of which is that AR/VR smart glasses is the hardware entrance to the digital world of meta-universe.

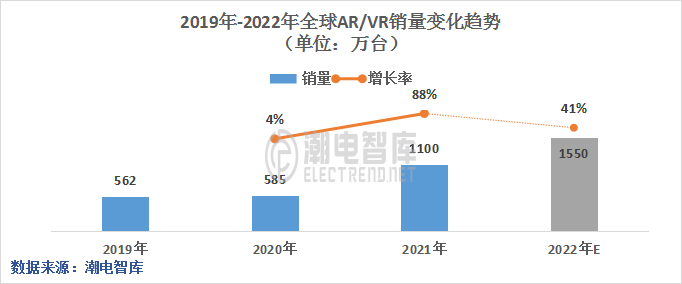

In 2019, global AR/VR sales will be 5.62 million units; in 2020, global AR/VR sales will be 5.85 million units, up 4% year-on-year; in 2021, global AR/VR sales will be 11 million units, up 88% year-on-year.

It can be seen that Roblox meta-universe first stock listed, META renamed layout meta-universe favorable AR/VR, even the development of digital economy in each major country, each technology giant deepen meta-universe layout is also an important driving force, the key of which is that AR/VR smart glasses is the hardware entrance of meta-universe digital world.

In other words, the dividends of the meta-universe and digital economy are still far from being eaten. Based on this, Tide Electric Intelligence expects that global AR/VR sales are expected to reach 15.5 million units in 2022, with a growth rate of 41%, and global AR/VR sales will see significant growth in the next three years from 2022 to 2024.

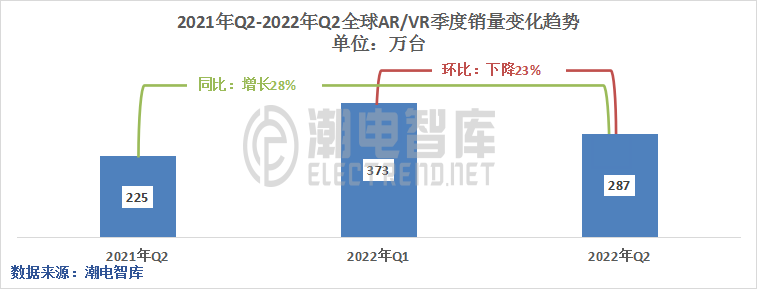

According to TidePower Intelligence, global AR/VR sales reached 2.87 million units in Q2 2022, up 28% from 2.25 million units in Q2 2021; down 23% from 3.73 million units in Q1 2022.

Tide Power Intelligence analyzed that the global AR/VR sales were down in the second quarter of this year for two main reasons: first, the United States is experiencing high inflation, consumers are changing their shopping patterns and demand for consumer electronics products is weak; second, the impact of the war between Russia and Ukraine, rising food prices and energy costs in Europe, increased consumption of daily necessities and further weakened sales of consumer electronics products.

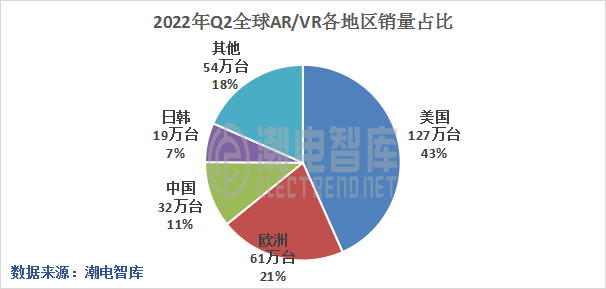

In the second quarter, global AR/VR sales were mainly sold to four major regions, with 1.27 million units sold in the U.S., accounting for 43% of total global sales; 610,000 units sold in Europe, accounting for 21% of total global sales; 320,000 units sold in China, accounting for 11% of total global sales; and 190,000 units sold in Japan and South Korea, accounting for 7% of total global sales.

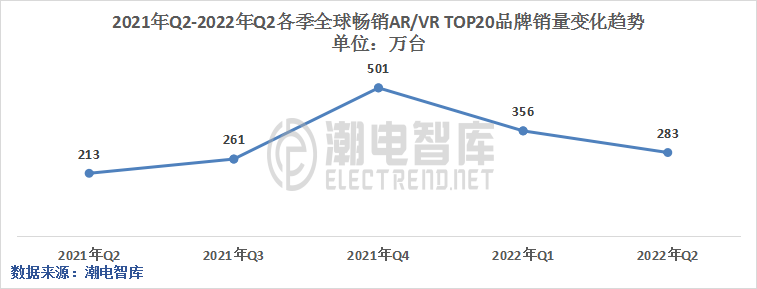

Compared with Q1 and Q2, sales in Europe and the United States dropped rapidly to only 1.88 million units, down 27% from 2.56 million units in the first quarter. In addition, Tide Electric Intelligence statistics show that the global top 20 sales of best-selling AR/VR units in each price segment in Q2 2022 was 2.83 million units, up 8% from 2.61 million units in Q2 2021; down 21% from 3.56 million units in Q1 2022.

Tide Power Intelligence analyzes that the AR/VR smart glasses market needs to be educated and cultivated, and Apple will be the only manufacturer that can quickly educate and cultivate the AR/VR market. Before Apple's AR/VR products are brought to the market, the AR/VR product form standards are not fully set.

03 Top 20 brands sell 2.83 million units, PICO takes a big step forward

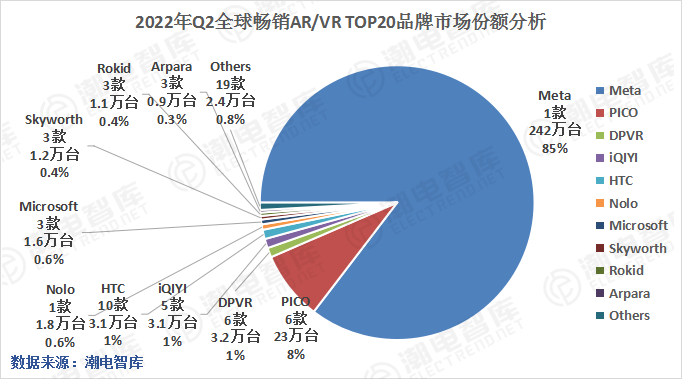

In the global best-selling AR/VR TOP20 brand sales statistics, Meta and Microsoft occupy the first place in VR and AR smart glasses with sales of 2.42 million units and 16,000 units respectively.

Obviously, the market pattern of 'shipping mainly VR smart glasses' in the smart glasses market has not changed, especially the market pattern of 'shipping mainly MetaQuest 2' has not changed.

In addition to Meta far ahead, the five major domestic brands Pico, DPVR, iQIYI, HTC, Nolo are continuing to make efforts, respectively with 230,000 units, 32,000 units, 31,000 units, 31,000 units, 18,000 units wrapped up the second to sixth place.

Compared with the first quarter, the proportion of CR2 is still high at 93%; however, slightly different from the first quarter, PICO doubled its market share from 4% to 8% in the competition of the top two brands in one go.

PICO's performance in the second quarter, although there is still a huge gap with Meta, but also significantly open the gap with the later, the achievement of this achievement, on the one hand, attributed to the comprehensive marketing of PICO in the major platforms; on the other hand, also benefited from PICO to carry out the strategy of going abroad, tide electricity intelligence data show that the second quarter PICO overseas sales reached 30,000 units.

Combined with the layout of PICO's continued expansion in the third quarter and Meta's promotion of cost reduction and efficiency, Tide Electric Intelligence expects that PICO's market share will have a significant expansion in the third quarter of this year.

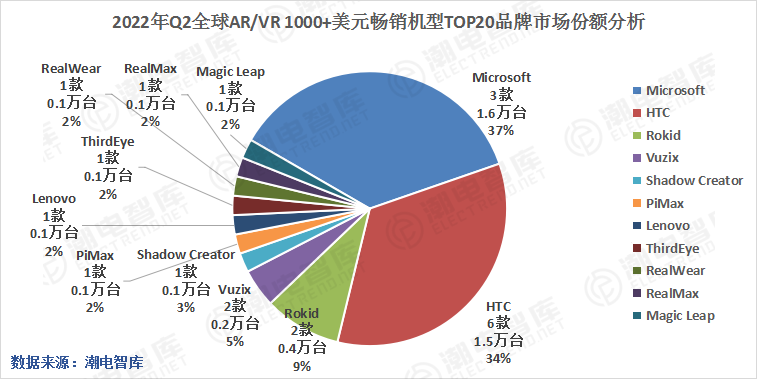

04 Top 20 brands sell 44,000 units in high-end market, Microsoft adjusts strategic layout

Microsoft HoloLens2 always deserves to be the leader in the field of AR development, with 16,000 units sold, it continues to lead the major manufacturers in the AR field.

Even though Microsoft has successively released unfavorable news such as talent loss, executive departures and departmental transfers, Microsoft continues to layout the meta-universe XR field, acquiring Blizzard, cooperating extensively with head companies and delivering military orders smoothly.

In fact, Microsoft remains in a high growth lane, recording revenue of $198.2 billion in fiscal year 2022, with a growth rate of 18%. This is due to Microsoft helmsman Nadella's precise grasp of the market, and Nadella is extremely attached to the meta-universe XR.

Therefore, instead of saying that Microsoft has given up HoloLens and abandoned AR, Microsoft is taking a big leap forward with an all-round layout while the market is clouded with doubts and waiting for the next round of iterative upgrade of the technology.

While continuing to meet the military's $219 order, Microsoft is also looking for ways to break the mold in the enterprise meta-universe. at the MetaConnect 2022 developer conference, Microsoft president Satya Nadella announced that Microsoft will join forces with Meta to create new office scenarios together in the meta-universe.