Trendy Electronics Think Tank's analysis brief on China's bestselling smartphones market in Q3 2023 is based on the sales data of the top 20 bestselling smartphone models over the past six quarters. The analysis and sharing revolve around four primary aspects: price segments, regions, brand shares, and model performance, offering a fresh perspective on the most dynamic, active, and profitable forces in the Chinese smartphone market.

Note: Trendy Electronics Think Tank categorizes global smartphones into five price segments based on a product pricing tier of $200. The top 20 models in each price segment (20x5=100 models) form the basis of this report's research.

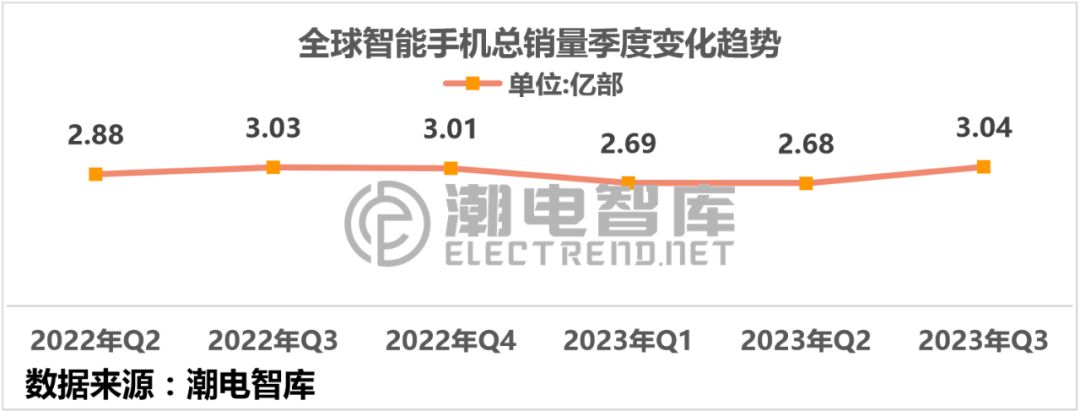

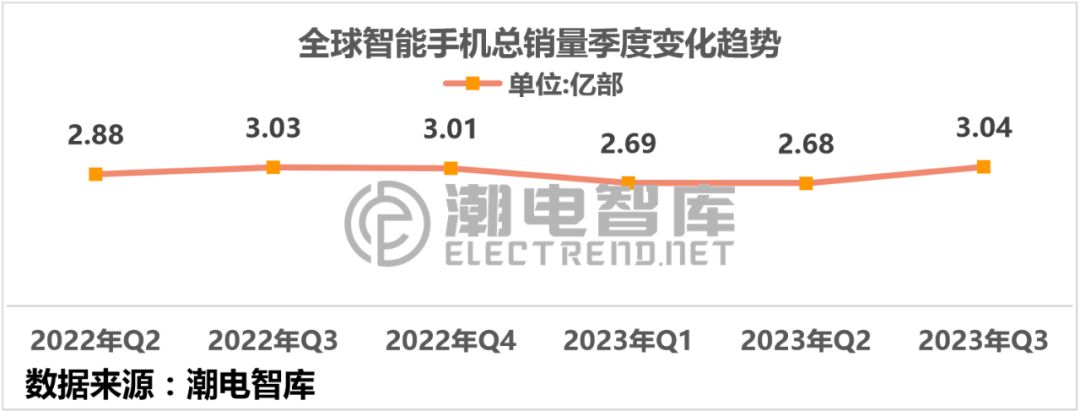

01 Global Smartphone Market Trends

The smartphone market witnessed significant growth in Q3, with a year-over-year increase largely matching the previous year's figures.

Trendy Electronics Think Tank's statistics show a total global smartphone shipment of 304 million units in Q3 2023, marking a 13.5% increase quarter-over-quarter. Looking at the more indicative year-over-year data, the third quarter saw a marginal increase of 0.3%, amounting to just 3 million units more than the same period last year.

02 Distribution of China's Smartphone Sales Across Price Segments

According to Trendy Electronics Think Tank's data, in terms of the total sales of smartphones in China, the top 20 bestselling smartphone models in Q3 2023 continued to be concentrated in the lower-end market. Of the globally sold bestselling smartphones that quarter, 29% were priced below $200, and 62% were priced below $400.

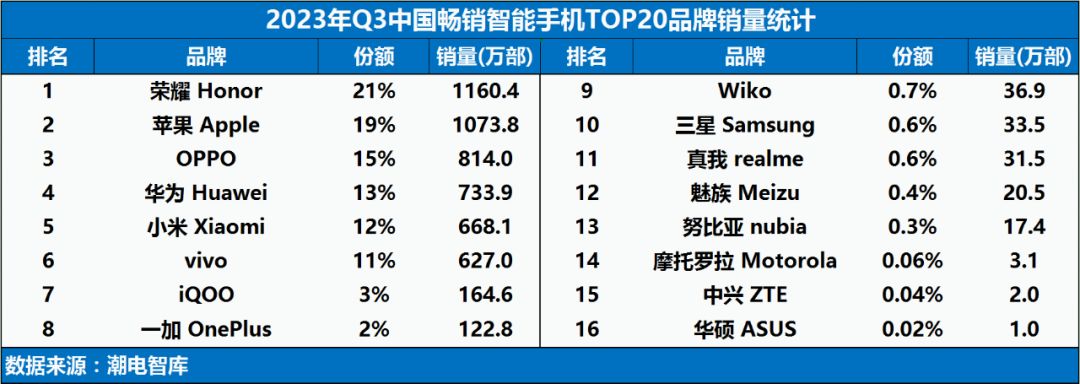

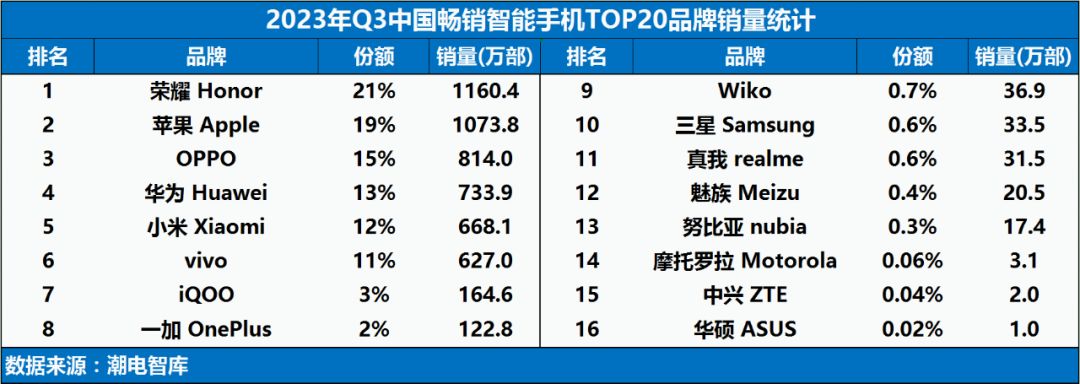

03 Market Landscape of Top 20 Brands

Honor surpasses Apple! Securing a 21% market share. Market concentration intensifies, leaving non-mainstream smartphone brands with limited gains.

In Q3 2023, the total shipments of the top 20 bestselling smartphone brands in China amounted to 55.105 million units, featuring 16 brands. Honor, alongside Apple, accounted for 40% of the market share, followed closely by the quartet of Huawei, Xiaomi, OPPO, and Vivo, capturing 51% of the market share. The CR3 ratio stands at 55%, while CR5 stands at 80%.

04 Top 20 Bestselling Models Priced $800 and Above

Apple dominates the high-end market, with two Xiaomi models making the list.

In Q3 2023, the total shipments of the top 20 bestselling smartphones priced $800 and above amounted to 12.144 million units, featuring six major brands. Apple's 14/15 series swept the market, accounting for 70% of the $800+ market with seven models. Notably, Xiaomi's MI 13 Ultra and foldable model MIX Fold 3 entered the competitive $800+ market.

05 Top 20 Bestselling Models Priced $600-$799

Apple and Huawei take the lead.

In Q3 2023, the total shipments of the top 20 bestselling smartphones priced between $600 and $799 reached 4.713 million units, featuring 11 brands. Apple's iPhone 14 captured 1.609 million units, securing over 10% of this price segment, with only Apple (48%) and Huawei (32%) achieving this feat.

06 Top 20 Bestselling Models Priced $400-$599

OPPO and its subsidiary OnePlus dominate this price range.

In Q3 2023, the total shipments of the top 20 bestselling smartphones priced between $400 and $599 amounted to 4.131 million units, featuring 11 brands. OPPO recorded 1.618 million units, capturing 39% of the market share, while OnePlus shipped 599,000 units, accounting for 15%. Other brands fell below the 10% mark.

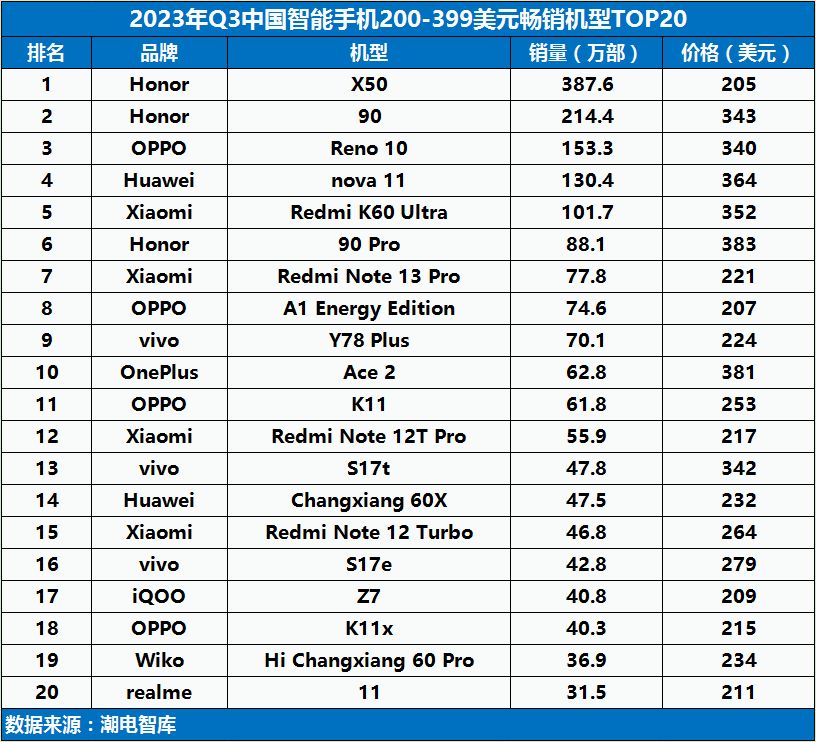

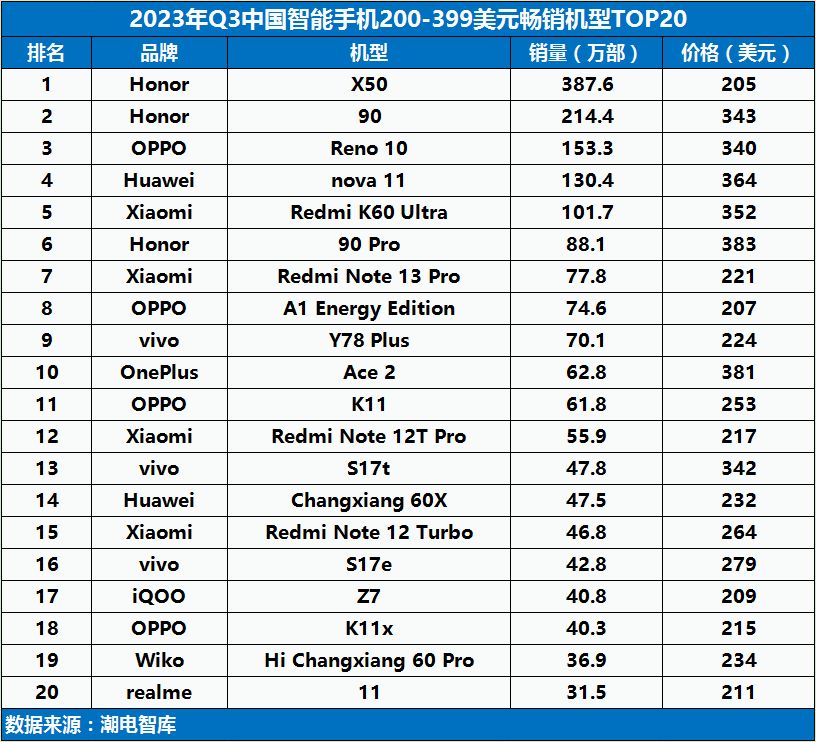

07 Top 20 Bestselling Models Priced $200-$399

"Huawei-OV" evolves into "Honor-O-Mi-Hua."

In Q3 2023, the total shipments of the top 20 bestselling smartphones priced between $200 and $399 reached 18.129 million units, featuring nine brands. Honor from the 'Honor-O-Mi-Hua' group secured the top five positions, with Honor X50 accounting for 6.9 million units, occupying 38% of the shipments, while other brands garnered less than 3% market share in this price segment.

08 Top 20 Bestselling Models Priced $0-$199

In the low-end market, only six major brands dominate, with others having no models featured among the bestselling.

In Q3 2023, the total shipments of the top 20 bestselling smartphones priced below $199 reached 15.986 million units, featuring six brands.

Three tiers emerged: vivo (28%) and Honor (23%) securing over 20% shares each, OPPO (18%) and Xiaomi (18%) close to 20%, while Huawei (7%) and IQOO (6%) sit below the 10% mark.

Our Authors

We have experienced employees who choose the services we provide, and our services are all professional. If you contact us, we may receive a commission.

Why You Can Trust ELECTREND

15

Years of service experience

580+

Brand Customer Choice

1000+

The choice of corporate customers